Low-interest, fixed-rate financing from the Small Business Administration (SBA) is available to homeowners, renters, and businesses located in declared disaster areas. These funds are designed to cover uninsured or underinsured losses to... Read more »

Standardized emergency preparedness classifications are crucial for home healthcare agencies. These classifications categorize various emergency situations, such as natural disasters (hurricanes, earthquakes, floods), public health emergencies (pandemics, bioterrorism), and technological incidents (power... Read more »

Catastrophic events affecting manufactured housing encompass a range of hazards, from natural events like hurricanes, tornadoes, and floods to human-induced incidents such as fires and explosions. These situations often lead to significant... Read more »

The company’s program of providing aid and resources following natural disasters and other emergencies involves partnerships with organizations like the American Red Cross and Team Rubicon, enabling rapid response and distribution of... Read more »

Specific alphanumeric designations are used to categorize emergencies and disasters impacting patients receiving care in their residences. These classifications facilitate efficient communication and resource allocation among healthcare providers, emergency response teams, and... Read more »

Protection against financial loss due to events like earthquakes, floods, wildfires, and hurricanes is typically achieved through specialized policies or endorsements added to standard homeowner’s insurance. For example, a homeowner living in... Read more »

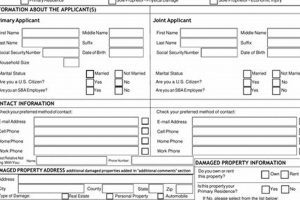

Homeowners affected by declared disasters often face significant financial challenges in repairing or rebuilding their properties. The U.S. Small Business Administration (SBA) offers disaster assistance loans specifically designed to aid in this... Read more »

Protection against financial loss due to unforeseen events like earthquakes, floods, wildfires, and hurricanes is a critical aspect of property ownership. For example, a comprehensive policy can cover the cost of rebuilding... Read more »

Financing for rebuilding or repairing homes damaged by natural calamities, such as floods, earthquakes, or hurricanes, is available through specific programs. These programs typically offer low-interest rates, flexible terms, and sometimes grants,... Read more »

Low-interest, long-term federal assistance is available to homeowners, renters, and businesses located in declared disaster areas through the U.S. Small Business Administration. This aid is designed to repair or replace damaged or... Read more »