The cancellation of debt obligations incurred through government-backed programs designed to provide financial relief following declared disasters, such as hurricanes, floods, or earthquakes, represents a crucial safety net for individuals and businesses.... Read more »

A numerical representation of a borrower’s creditworthiness is a key factor in determining eligibility for assistance from the Small Business Administration (SBA) following a declared disaster. This three-digit number, ranging from 300... Read more »

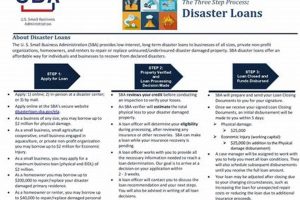

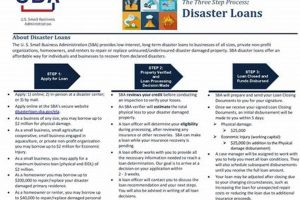

Low-interest, long-term financing is available to businesses, most private nonprofits, homeowners, and renters located in declared disaster areas through a specific program administered by the U.S. Small Business Administration. These funds can... Read more »

Businesses impacted by declared disasters often seek financial relief through government programs. Legal counsel specializing in Small Business Administration (SBA) disaster loan applications can provide guidance through the complex process, from initial... Read more »

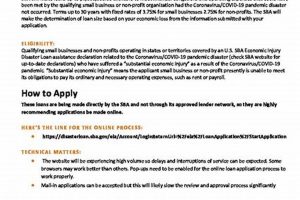

Low-interest, fixed-rate financing is available to small businesses, small agricultural cooperatives, and most private, non-profit organizations located in declared disaster areas. This assistance covers working capital necessary to help small businesses meet... Read more »

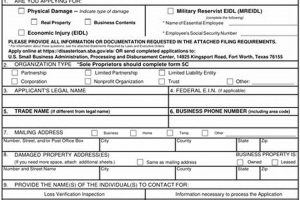

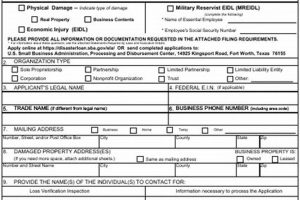

A request for financial assistance designed specifically for businesses impacted by unforeseen calamitous events, such as natural disasters or widespread emergencies, typically involves providing documentation of damages, losses, and operational impact. For... Read more »

Federally subsidized financial aid provides a crucial lifeline for businesses impacted by declared disasters. These programs offer low-interest, long-term loans to cover physical damage and economic injury not fully covered by insurance... Read more »

Personal loans offered by Navy Federal Credit Union during declared natural disasters provide eligible members financial assistance for recovery. These loans typically feature lower interest rates and more flexible repayment terms than... Read more »

A tool designed to estimate potential loan amounts, repayment schedules, and associated costs for businesses and homeowners affected by declared disasters provides crucial financial planning insights. For instance, a business owner assessing... Read more »

Online forums, particularly the social media platform Reddit, serve as vital resources for individuals and businesses seeking information and support regarding Economic Injury Disaster Loans (EIDLs) and other disaster assistance programs offered... Read more »