Determining whether an event like Hurricane Ian qualifies as a disaster loss involves assessing the extent and nature of the damage against specific criteria established by governmental and non-governmental organizations. These criteria... Read more »

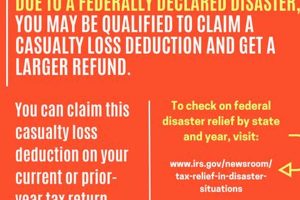

A loss arising from a sudden, unexpected, or unusual event caused by a federally declared disaster qualifies for specific tax treatment. Such events could include natural disasters like hurricanes, earthquakes, floods, wildfires,... Read more »

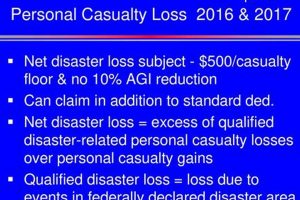

Losses incurred due to federally declared disasters, such as hurricanes, floods, wildfires, and earthquakes, may be eligible for a reduction in taxable income. This includes losses to personal property like homes, vehicles,... Read more »

Protecting an organization from the potentially devastating effects of unforeseen events involves a two-pronged approach. The first, preemptive aspect focuses on minimizing the impact of such events, encompassing strategies like robust data... Read more »

A casualty loss stemming from a federally declared disaster allows affected individuals to reduce their taxable income. This reduction reflects the decline in value of their property resulting from events like hurricanes,... Read more »