Conditions that, if present, significantly increase the likelihood of negative consequences constitute preconditions for failure. For example, insufficient testing combined with tight deadlines and inadequate communication within a development team creates an... Read more »

Personal loans offered by Navy Federal Credit Union during declared natural disasters provide eligible members financial assistance for recovery. These loans typically feature lower interest rates and more flexible repayment terms than... Read more »

Within Old School RuneScape (OSRS), progression through the extensive quest “Recipe for Disaster” hinges on fulfilling specific criteria for each of its subquests. These prerequisites often involve achieving particular skill levels, completing... Read more »

Low-interest, long-term federal loans are available to businesses, private non-profit organizations, homeowners, and renters located in regions declared disaster areas by the U.S. Small Business Administration, covering physical damage and economic injury.... Read more »

Low-interest, long-term loans are available through the Small Business Administration (SBA) to homeowners, renters, and personal property owners impacted by declared disasters. These loans offer financial assistance to repair or replace disaster-damaged... Read more »

The Small Business Administration (SBA) offers disaster assistance loans to businesses and homeowners affected by declared disasters. Eligibility for these loans is not solely based on creditworthiness, but a minimum acceptable credit... Read more »

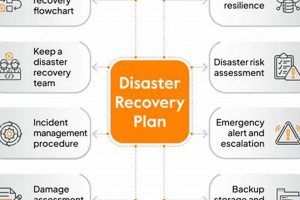

Specifications for restoring data, applications, and infrastructure after an unforeseen disruptive eventnatural or human-madeare crucial for business continuity. These specifications outline the necessary steps, resources, and timelines for resuming operations. For example,... Read more »

When a presidentially declared disaster impacts a Federal Housing Administration (FHA)-insured property, specific evaluations are often necessary to assess the extent of damage and determine eligibility for various forms of assistance. These... Read more »