Federally declared disasters, whether natural or human-caused, can devastate communities and cripple local economies. Businesses, particularly smaller enterprises, are often acutely vulnerable to these events. The U.S. government recognizes this vulnerability and offers financial assistance programs to help affected businesses recover. These programs provide low-interest loans to cover physical damage, economic injury, and mitigation efforts, enabling businesses to rebuild, rehire, and resume operations. For example, a restaurant damaged by a hurricane could access funds to repair the building, replace equipment, and cover operating expenses while closed.

Access to such recovery resources is vital for community resilience. By helping businesses survive and rebuild following a catastrophe, these programs contribute to stabilizing local economies, preserving jobs, and facilitating a faster return to normalcy. Historically, government-backed assistance has played a significant role in post-disaster recovery, demonstrating its effectiveness in mitigating long-term economic consequences and supporting impacted communities.

Further exploration of this topic will cover the specific types of assistance available, eligibility requirements, application procedures, and successful recovery strategies. Understanding these aspects can be critical for businesses seeking to prepare for and navigate the challenges posed by unforeseen events.

Disaster Preparedness and Recovery Tips for Small Businesses

Preparedness and swift action are crucial for business survival following a disaster. These tips offer guidance for navigating challenging circumstances and accessing available resources.

Tip 1: Develop a comprehensive business continuity plan. This plan should outline procedures for various disaster scenarios, including communication strategies, data backup and recovery processes, and alternate operating locations. For example, a plan might identify a cloud-based system for storing critical data, ensuring accessibility even if physical infrastructure is damaged.

Tip 2: Maintain thorough records and documentation. Accurate records of inventory, finances, and insurance policies are essential for supporting loan applications and insurance claims. Regularly backing up these records electronically and storing them securely offsite is highly recommended.

Tip 3: Understand available assistance programs. Familiarize the business with federal, state, and local resources offered during disaster recovery. This knowledge allows for quicker access to necessary funds and support services.

Tip 4: Contact insurers immediately after an incident. Prompt communication with insurance providers initiates the claims process and ensures timely assessment of damages.

Tip 5: Document all losses meticulously. Thorough documentation, including photographs and videos of damage, strengthens claims and supports requests for financial assistance.

Tip 6: Secure disaster assistance loans promptly. Applications for government-backed loans should be submitted as quickly as possible, as funds may be limited. Prepare necessary documentation in advance to expedite the process.

Tip 7: Seek guidance from relevant agencies. Organizations like the Small Business Administration and local chambers of commerce provide valuable resources and support throughout the recovery process.

Proactive planning and informed action can significantly mitigate the impact of disasters. By implementing these tips, businesses can enhance their resilience and increase their chances of successful recovery.

These strategies offer a foundation for navigating the complexities of disaster recovery. Further sections will delve into specific program details and offer additional resources for long-term recovery and future preparedness.

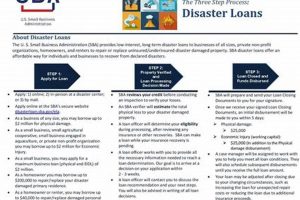

1. Disaster Declaration

A disaster declaration is the crucial first step that unlocks access to federal disaster assistance, including vital programs administered by the Small Business Administration (SBA). This declaration, typically issued by the President of the United States at the request of a governor or tribal leader, signifies that an area has experienced a disaster of such severity that it warrants federal intervention. The declaration formally recognizes the need for supplementary federal resources to support state, local, and tribal recovery efforts. Without a presidential disaster declaration, SBA disaster assistance programs remain unavailable to affected businesses. For example, following Hurricane Sandy in 2012, the presidential disaster declaration allowed businesses in impacted areas to apply for SBA loans to rebuild and recover.

The declaration specifies the types of assistance available, which may include individual assistance for homeowners and renters, public assistance for infrastructure repair, and hazard mitigation assistance for preventative measures. Critically, it also activates the SBA’s disaster loan programs, offering low-interest loans to businesses of all sizes, private non-profit organizations, homeowners, and renters to repair or replace disaster-damaged property. These loans provide a lifeline to businesses struggling to recover from the economic impacts of a declared disaster. Following the severe flooding in Louisiana in 2016, affected businesses utilized SBA disaster loans to rebuild damaged facilities, replace lost inventory, and cover operating expenses while recovering.

Understanding the pivotal role of the disaster declaration process is essential for businesses seeking post-disaster assistance. Awareness of the declaration process, including how requests are initiated and the criteria for approval, empowers businesses to proactively prepare for potential disasters. This understanding also highlights the importance of timely application submission once assistance becomes available, maximizing the opportunity for recovery and rebuilding.

2. Loan Programs

The Small Business Administration (SBA) administers several loan programs specifically designed to aid businesses impacted by declared disasters. These programs serve as a crucial component of disaster recovery efforts, providing access to capital for rebuilding, replacing lost inventory, and covering operational expenses during business interruption. The availability of these loan programs is directly tied to a presidential disaster declaration. This declaration triggers the activation of the SBA’s disaster assistance portfolio, making low-interest loans accessible to eligible businesses in designated areas. For instance, following Hurricane Katrina in 2005, businesses in affected regions utilized SBA disaster loans to rebuild their operations and contribute to the economic recovery of the Gulf Coast.

Several distinct loan programs address various recovery needs. Business Physical Disaster Loans cover the repair or replacement of damaged property, including real estate, equipment, and inventory. Economic Injury Disaster Loans (EIDLs) provide working capital to businesses experiencing substantial economic injury due to a disaster, even if they did not suffer physical damage. Home Disaster Loans assist homeowners and renters with repairing or replacing damaged residences. These programs offer favorable terms, including low interest rates and extended repayment periods, designed to make recovery financially feasible. After the 2011 Joplin, Missouri tornado, many businesses relied on EIDLs to maintain payroll and cover operating costs while rebuilding, preventing further economic hardship within the community.

Understanding the types of SBA disaster loan programs, eligibility requirements, and application procedures is essential for businesses seeking post-disaster financial assistance. Proactive familiarity with these programs allows businesses to act quickly and efficiently when disaster strikes, maximizing their chances of securing necessary funding. This knowledge also underscores the importance of maintaining accurate financial records, which are crucial for supporting loan applications. By understanding the role and function of SBA disaster loan programs, businesses can effectively leverage these resources to navigate challenging circumstances and contribute to a more resilient recovery process.

3. Eligibility Criteria

Eligibility criteria determine which businesses qualify for Small Business Administration (SBA) disaster assistance following a declared disaster. These criteria function as gatekeeping mechanisms, ensuring that limited resources are directed towards businesses genuinely impacted by the event and demonstrating a capacity for recovery. The criteria consider factors such as the physical location of the business, the type and extent of disaster-related damage, and the business’s financial soundness prior to the disaster. For instance, a business located outside the designated disaster area would not be eligible for assistance, even if indirectly affected. Similarly, a business already experiencing significant financial distress before the disaster might not qualify, as its long-term viability would be questionable.

Understanding these criteria is crucial for businesses seeking post-disaster assistance. Meeting the eligibility requirements does not guarantee loan approval, but failure to meet them disqualifies a business outright. The SBA assesses each application individually, considering the specific circumstances of the disaster and the applicant’s situation. Clear documentation of the business’s pre-disaster financial health, the extent of disaster-related damage, and the potential for recovery significantly strengthens the application. For example, a business demonstrating strong financial performance before the disaster and a well-defined recovery plan stands a better chance of approval. Conversely, a business lacking proper documentation or demonstrating questionable pre-disaster financial stability may face challenges in securing assistance.

Careful consideration of eligibility criteria before applying for SBA disaster assistance is critical. This proactive approach allows businesses to assess their likelihood of qualification and gather necessary documentation in advance. This preparation can expedite the application process and increase the chances of receiving timely assistance. Furthermore, understanding these criteria underscores the importance of sound business practices and financial management, which contribute to long-term resilience and enhance the ability to navigate unforeseen challenges.

4. Application Process

The application process for Small Business Administration (SBA) disaster assistance is a critical step for businesses seeking financial recovery following a declared disaster. This process, while designed to be accessible, requires careful attention to detail and thorough documentation. A successful application hinges on providing accurate and comprehensive information about the business, the extent of disaster-related damage, and the intended use of loan proceeds. The timely submission of a complete application is essential, as delays can hinder access to much-needed funds. For example, following Hurricane Harvey in 2017, businesses that submitted complete applications promptly were often able to access funds more quickly, facilitating a faster recovery.

Several key components comprise the application process. Applicants must complete required forms, providing detailed information about the business’s financial history, ownership structure, and insurance coverage. Supporting documentation, such as tax returns, financial statements, and insurance policies, must accompany the application. Clear and concise documentation of disaster-related damage, including photographs, appraisals, and repair estimates, is crucial for substantiating the request for assistance. In cases of economic injury, businesses must demonstrate a substantial decrease in revenue directly attributable to the disaster. Following the 2018 California wildfires, businesses seeking EIDL assistance needed to provide detailed financial records demonstrating the impact of the fires on their revenue streams.

Navigating the application process effectively requires careful planning and preparation. Gathering necessary documentation in advance streamlines the application process. Seeking guidance from SBA resource partners, such as Small Business Development Centers (SBDCs) and local chambers of commerce, can provide valuable assistance. Understanding the specific requirements and deadlines associated with each disaster declaration is crucial. By proactively preparing and understanding the nuances of the application process, businesses can maximize their chances of securing timely financial assistance and contribute to a more efficient and effective recovery.

5. Mitigation Assistance

Mitigation assistance plays a crucial role in the context of small business administration disaster recovery. It represents a proactive approach to minimizing the impact of future disasters, reducing the need for extensive post-disaster recovery efforts. By investing in mitigation measures, businesses can strengthen their resilience and protect their assets from future hazards. This proactive strategy complements the reactive nature of traditional disaster assistance, fostering a more comprehensive approach to disaster preparedness and recovery.

- Pre-Disaster Planning and Risk Assessment

Thorough pre-disaster planning and comprehensive risk assessments form the foundation of effective mitigation. Identifying potential hazards, evaluating vulnerabilities, and developing strategies to reduce risk are essential steps. For example, a business located in a flood-prone area might elevate critical equipment or relocate inventory to higher ground. These proactive measures can significantly reduce the impact of future flooding, minimizing damage and downtime.

- Structural Improvements and Retrofitting

Structural improvements and retrofits represent tangible investments in disaster resilience. Strengthening building structures, installing storm shutters, and elevating foundations can significantly enhance a building’s ability to withstand high winds, flooding, and seismic activity. For instance, businesses in earthquake-prone regions might retrofit their buildings with seismic bracing to minimize structural damage during an earthquake. These structural enhancements can prevent significant losses and contribute to faster recovery.

- Hazard-Resistant Landscaping and Site Development

Strategic landscaping and site development can play a significant role in mitigating disaster risks. Proper drainage systems, retaining walls, and vegetation management can help control water flow and prevent erosion, reducing the impact of flooding and landslides. For example, a business might install a rain garden to absorb excess rainwater and reduce runoff, mitigating the risk of localized flooding. These landscape-based mitigation measures offer cost-effective solutions for enhancing disaster resilience.

- Emergency Preparedness and Business Continuity Planning

Developing comprehensive emergency preparedness and business continuity plans is a critical aspect of mitigation. These plans outline procedures for various disaster scenarios, including communication protocols, evacuation routes, and data backup and recovery processes. For instance, a business might establish a cloud-based system for storing critical data, ensuring accessibility even if physical infrastructure is damaged. These plans provide a roadmap for navigating disruptions and minimizing downtime, contributing to a more resilient and sustainable operation.

These mitigation measures, while requiring upfront investment, offer significant long-term benefits. By reducing the impact of future disasters, businesses can minimize financial losses, protect their employees, and contribute to a faster community recovery. Integrating mitigation strategies into overall disaster preparedness planning complements traditional disaster assistance programs, fostering a more proactive and comprehensive approach to disaster resilience.

6. Economic Injury

Economic injury, in the context of small business administration disaster assistance, refers to the substantial negative financial impact experienced by businesses due to a declared disaster. This impact can occur even without direct physical damage to the business property. Understanding the nuances of economic injury is crucial for accessing appropriate assistance programs, such as the SBA’s Economic Injury Disaster Loan (EIDL) program. These programs aim to bridge the financial gap caused by disasters, enabling businesses to maintain operations and contribute to community recovery.

- Revenue Loss

A significant decline in revenue is a primary indicator of economic injury. Disasters can disrupt supply chains, reduce customer demand, and force temporary closures, all contributing to revenue loss. For example, a restaurant forced to close due to a hurricane experiences a direct loss of revenue due to the inability to serve customers. Documenting this revenue loss is essential for supporting EIDL applications and demonstrating the need for financial assistance.

- Increased Operating Costs

Disasters can also lead to increased operating costs. Businesses may incur expenses related to temporary relocation, repairs, or securing alternative supplies. For instance, a manufacturer might need to lease temporary warehouse space after a flood damages its primary facility, leading to increased operating costs. These additional expenses further strain a business’s financial resources and underscore the importance of economic injury assistance.

- Working Capital Disruption

Disasters can disrupt a business’s working capital cycle, hindering its ability to meet ongoing financial obligations. Delayed payments from customers, increased inventory costs, and difficulty accessing credit can create working capital challenges. For example, a retailer experiencing delayed shipments due to a port closure after an earthquake may struggle to maintain adequate inventory levels, impacting sales and cash flow. EIDL assistance can help bridge this working capital gap and maintain essential business operations.

- Fixed Debt Obligations

Existing fixed debt obligations, such as mortgage payments or lease agreements, continue even when a business experiences disaster-related economic hardship. These fixed costs can become a significant burden during periods of reduced revenue and increased operating expenses. For example, a small business owner with a mortgage on their business property still faces monthly payments even if the business is forced to close temporarily due to a wildfire. EIDL assistance can help cover these fixed debt obligations, preventing default and contributing to long-term recovery.

Understanding these facets of economic injury is crucial for businesses seeking SBA disaster assistance. Demonstrating the specific ways in which a declared disaster has negatively impacted a business’s financial health is essential for securing EIDL support. These loans play a vital role in bridging the financial gap caused by disasters, enabling businesses to maintain operations, retain employees, and contribute to the overall economic recovery of their communities.

Frequently Asked Questions about SBA Disaster Assistance

This FAQ section addresses common inquiries regarding disaster assistance programs administered by the Small Business Administration (SBA). Clear understanding of these programs is crucial for businesses seeking financial recovery following a declared disaster.

Question 1: What types of disasters qualify for SBA assistance?

SBA assistance is available following disasters declared by the President of the United States. These declarations typically cover major natural disasters such as hurricanes, floods, earthquakes, wildfires, and tornadoes. Declarations can also be issued for other events, including certain types of technological disasters and civil unrest, if they cause significant physical damage or economic injury.

Question 2: How does a business apply for SBA disaster assistance?

Applications are submitted directly to the SBA through its online portal, dedicated disaster recovery centers, or by mail. Required documentation typically includes tax returns, financial statements, and documentation of disaster-related damage. Guidance and assistance are available from SBA resource partners, such as Small Business Development Centers (SBDCs).

Question 3: What is the difference between a Business Physical Disaster Loan and an Economic Injury Disaster Loan (EIDL)?

Business Physical Disaster Loans cover the repair or replacement of physical property damaged or destroyed in a declared disaster. EIDLs, however, address economic injury caused by the disaster, even without direct physical damage, providing working capital to help businesses meet financial obligations during recovery.

Question 4: What are the typical interest rates and repayment terms for SBA disaster loans?

Interest rates are determined by the SBA and are typically lower than market rates for comparable loans. Repayment terms can extend up to 30 years, depending on the applicant’s ability to repay. Specific terms vary based on the individual circumstances of each loan and the type of disaster.

Question 5: What if a business has insurance coverage? Does that affect eligibility for SBA assistance?

Insurance proceeds are considered when determining the amount of SBA loan assistance. Applicants are expected to utilize insurance to cover losses before applying for SBA loans. However, SBA assistance may be available to cover uninsured or underinsured losses.

Question 6: How can a business prepare for potential future disasters?

Developing a comprehensive business continuity plan, maintaining accurate financial records, and understanding available disaster assistance programs are essential preparedness steps. Implementing mitigation measures, such as structural improvements and hazard-resistant landscaping, can reduce the impact of future disasters. Regularly reviewing and updating preparedness strategies is crucial.

Understanding these key aspects of SBA disaster assistance programs empowers businesses to effectively navigate the recovery process. Proactive planning and preparation significantly enhance a business’s resilience and its ability to withstand future challenges.

Further information and resources are available on the SBA website and through local SBA district offices. Consulting with these resources can provide valuable personalized guidance.

Conclusion

Government-backed assistance programs offer crucial support to businesses impacted by declared disasters. These programs provide access to low-interest loans, enabling businesses to rebuild, rehire, and resume operations. Understanding program specifics, eligibility requirements, and application procedures is essential for effective recovery. Mitigation efforts play a vital role in minimizing future losses and enhancing long-term resilience. The interplay of disaster preparedness, access to appropriate financial resources, and proactive mitigation strategies forms the cornerstone of successful recovery.

Building resilient businesses and communities requires ongoing engagement with disaster preparedness and recovery resources. Proactive planning, informed decision-making, and access to appropriate support services pave the way for a stronger, more sustainable future. Continued exploration of these resources and a commitment to preparedness strengthens the ability of businesses and communities to withstand and recover from unforeseen challenges.