Federally-backed student loan borrowers impacted by declared natural disasters may qualify for temporary suspension of loan payments. This relief, typically granted automatically by loan servicers based on declared disaster areas, provides a period during which payments are not required and interest may not accrue, depending on the specific disaster and associated relief programs. For example, borrowers residing in a county declared a disaster area due to a hurricane might receive automatic administrative forbearance on their student loans.

Temporary postponement of loan obligations offers crucial financial flexibility to individuals facing immediate recovery costs and lost income following a devastating event. This safety net allows borrowers to focus on essential needs like housing, food, and repairs without the added burden of student loan payments. Historically, such provisions have been implemented in response to various natural disasters, recognizing the significant financial strain these events impose on affected communities.

The following sections will further explore eligibility criteria, application processes, the duration of relief periods, potential impacts on loan terms, and other available resources for borrowers affected by natural disasters.

Preparing for and navigating the aftermath of a natural disaster requires careful consideration of various financial obligations, including student loans. These tips offer guidance on effectively utilizing available resources and managing student loan repayment during such challenging times.

Tip 1: Maintain accurate contact information with loan servicers. Updated contact details ensure timely notifications regarding forbearance options and other disaster relief programs. This allows borrowers to access crucial information and benefits quickly.

Tip 2: Familiarize oneself with available resources in advance. Understanding forbearance qualifications and application procedures before a disaster strikes can streamline the process and minimize stress during an already difficult period. Resources include the Federal Student Aid website and individual loan servicer contact information.

Tip 3: Document all disaster-related damage and expenses. Thorough documentation may be required for forbearance applications or other forms of financial assistance. Retain records of communication with relief agencies, insurance companies, and other relevant entities.

Tip 4: Contact loan servicers immediately following a declared disaster. Prompt communication allows servicers to initiate forbearance or other applicable relief measures quickly, providing immediate financial relief. Delays may complicate or prolong the process.

Tip 5: Explore additional disaster relief programs beyond loan forbearance. Other programs may offer grants, low-interest loans, or other forms of financial aid specifically designed for disaster recovery. Seek information from FEMA, the Small Business Administration, and other relevant agencies.

Tip 6: Develop a post-forbearance repayment strategy. While forbearance provides temporary relief, borrowers should plan for the resumption of loan payments. This might involve adjusting repayment plans or exploring alternative repayment options to align with post-disaster financial circumstances.

Proactive planning and informed decision-making can significantly mitigate the financial impact of natural disasters. Leveraging available resources and understanding forbearance options empower borrowers to navigate these challenges effectively and maintain financial stability during recovery.

By understanding these tips and taking appropriate action, individuals can better manage their student loan obligations and focus on rebuilding their lives after a natural disaster. The concluding section will summarize key takeaways and offer further guidance on financial recovery.

1. Eligibility Requirements

Eligibility requirements form the cornerstone of access to natural disaster forbearance for student loans. These criteria determine which borrowers qualify for temporary relief from loan payments following a declared natural disaster. A primary requirement often involves residing or working in a location designated as a disaster area by the federal government. This geographic stipulation ensures that relief efforts target those directly impacted by the event. For instance, a borrower living in a county declared a disaster zone due to flooding would likely meet this initial requirement, while someone residing in a neighboring unaffected county would not. The causal link between the disaster declaration and the borrower’s location establishes the basis for potential eligibility.

Beyond geographic location, further eligibility criteria may exist depending on the specific disaster and associated relief programs. Some programs may require borrowers to demonstrate financial hardship directly resulting from the disaster, such as loss of income or significant property damage. Providing documentation, like insurance claims or employer verification of lost wages, may be necessary to substantiate the impact. For example, a borrower whose place of employment was destroyed by a hurricane could provide documentation from their employer to demonstrate income loss and strengthen their eligibility claim. Understanding these specific requirements is essential for borrowers seeking to access available relief.

Navigating eligibility requirements accurately is paramount for borrowers seeking temporary financial relief through natural disaster forbearance. A clear understanding of these criteria allows affected individuals to determine their qualification status and pursue necessary application procedures promptly. Failure to meet eligibility requirements can preclude access to crucial relief programs, hindering financial recovery during a challenging period. Therefore, borrowers are encouraged to consult official resources, such as the Federal Student Aid website or their loan servicer, for precise and up-to-date information regarding eligibility criteria specific to declared disaster events.

2. Application Process

Initiating natural disaster forbearance for student loans typically involves a straightforward application process designed to provide timely relief to affected borrowers. While specific procedures may vary depending on the loan servicer and the nature of the disaster, the process generally begins with contacting the loan servicer directly. This initial contact serves as notification of the borrower’s situation and initiates the forbearance request. Providing necessary documentation, such as proof of residency in a declared disaster area or evidence of disaster-related financial hardship, may be required. For example, borrowers affected by a hurricane might submit insurance claim documents or FEMA assistance verification to support their request. Prompt communication with the loan servicer is crucial for expediting the process and ensuring timely access to relief.

In some cases, forbearance may be granted automatically based on federal disaster declarations. Loan servicers often cross-reference borrower addresses with declared disaster areas and proactively apply forbearance to eligible accounts. This automated approach streamlines the process, minimizing the burden on borrowers during challenging circumstances. However, even with automatic forbearance, borrowers are encouraged to contact their loan servicer to confirm enrollment and understand specific terms and conditions. Direct communication allows for clarification of forbearance duration, interest accrual, and any necessary steps for resuming repayment after the forbearance period concludes. This proactive approach ensures borrowers remain informed and prepared for managing their loans effectively throughout the recovery process.

Understanding the application process for natural disaster forbearance empowers borrowers to access necessary financial relief efficiently. Whether initiated by the borrower or applied automatically, prompt communication with loan servicers remains essential. This communication facilitates accurate application processing, clarifies forbearance terms, and enables borrowers to focus on immediate recovery needs without the added stress of loan repayment. Accurate knowledge of the application process ultimately contributes to a smoother and more effective recovery journey for individuals facing the financial challenges of a natural disaster.

3. Forbearance Duration

The duration of forbearance for student loans following a natural disaster plays a crucial role in borrowers’ financial recovery. This period, during which loan payments are temporarily suspended, provides essential breathing room for individuals facing immediate recovery costs and potential income loss. Understanding the factors influencing forbearance duration and its implications is paramount for effective financial planning during challenging times. The following facets explore key aspects of forbearance duration within the context of natural disaster relief.

- Disaster Severity and Scope

The magnitude and extent of the natural disaster significantly influence the length of forbearance granted. Larger-scale disasters, such as widespread hurricanes or earthquakes, often necessitate longer forbearance periods compared to more localized events. For example, a major hurricane impacting multiple states might result in a longer forbearance duration than a localized flood affecting a single county. The severity and scope directly impact the time required for individuals and communities to recover and regain financial stability.

- Government Declarations and Programs

Federal and state government declarations and associated disaster relief programs directly impact forbearance duration. Specific programs implemented following a disaster often dictate the length of available forbearance. For instance, a presidential disaster declaration might trigger automatic forbearance for a specific timeframe, while other programs may offer varying durations based on individual circumstances. The alignment between government programs and forbearance policies ensures consistency and provides a framework for relief efforts.

- Individual Borrower Circumstances

While general forbearance periods are often established based on disaster characteristics and government programs, individual borrower circumstances can sometimes influence the duration. Borrowers experiencing prolonged hardship directly related to the disaster might qualify for extended forbearance periods. For example, a borrower whose home was destroyed and requires extensive rebuilding might request an extension beyond the standard forbearance period. Consideration of individual circumstances allows for flexibility and tailored support during recovery.

- Loan Servicer Policies

While guided by federal regulations and disaster declarations, individual loan servicers may have specific policies influencing forbearance duration. These policies, while generally aligned with broader relief efforts, might introduce slight variations in the length of forbearance granted. Borrowers should consult their loan servicer directly to understand specific policies and potential variations in forbearance duration. This direct communication ensures clarity and allows for proactive planning regarding loan repayment resumption.

The interplay of these factors determines the ultimate duration of forbearance granted to borrowers affected by natural disasters. Understanding these elements allows individuals to anticipate the length of relief, plan for eventual repayment resumption, and navigate the financial challenges of recovery effectively. A comprehensive understanding of forbearance duration empowers borrowers to make informed decisions and regain financial stability following a natural disaster.

4. Interest Accrual

Interest accrual represents a critical aspect of natural disaster forbearance for student loans, significantly impacting a borrower’s overall loan balance and repayment trajectory. While forbearance provides temporary relief from monthly payments, the accrual or non-accrual of interest during this period depends on specific loan types and disaster-related programs. Understanding how interest accrual functions during forbearance is crucial for informed financial decision-making during challenging recovery periods. The following facets delve into key components of interest accrual within the context of natural disaster forbearance.

- Subsidized Loans

For subsidized federal student loans, the government typically covers interest accrual during forbearance periods related to natural disasters. This means borrowers do not see their loan balance increase due to interest during the designated forbearance. This provision offers significant financial relief, allowing borrowers to focus on immediate recovery needs without the added burden of accumulating interest.

- Unsubsidized Loans

Unsubsidized federal student loans, including PLUS loans, generally continue to accrue interest during forbearance, regardless of the cause. This means the loan balance will grow during the forbearance period, even though payments are temporarily suspended. Upon resumption of payments, accrued interest may be capitalized, meaning it is added to the principal loan balance, resulting in a larger overall loan amount and potentially higher monthly payments. For example, a borrower with a $10,000 unsubsidized loan and a 5% interest rate experiencing a six-month forbearance could see their loan balance increase by approximately $250 due to accrued interest.

- Private Loans

Interest accrual on private student loans during natural disaster forbearance varies significantly depending on the lender and specific loan terms. Some lenders may offer forbearance programs that suspend both payments and interest accrual, while others may continue to accrue interest. Borrowers with private loans must contact their lender directly to understand specific terms and conditions regarding interest accrual during forbearance. This direct communication is essential for accurate financial planning and avoiding unexpected increases in loan balances.

- Capitalization of Interest

A critical consideration for borrowers with unsubsidized or certain private loans is the potential capitalization of accrued interest upon exiting forbearance. Capitalization adds the accumulated interest to the principal loan balance, resulting in a larger overall loan amount. This increase in principal can lead to higher monthly payments and a greater total cost over the life of the loan. Understanding the potential for capitalization allows borrowers to anticipate its impact and explore options for minimizing its effect on long-term repayment.

The nuances of interest accrual during natural disaster forbearance underscore the importance of understanding individual loan types, specific disaster relief programs, and lender policies. By recognizing the potential for interest accrual and its implications, borrowers can make informed decisions regarding loan management during challenging circumstances and develop effective strategies for navigating the financial aspects of recovery following a natural disaster. This proactive approach empowers borrowers to minimize the long-term financial impact of forbearance and maintain progress toward their repayment goals.

5. Credit Reporting

Credit reporting plays a crucial role in the broader context of natural disaster forbearance for student loans. Understanding how forbearance affects credit reports and scores is essential for borrowers seeking to maintain healthy credit profiles during challenging times. This section explores the intersection of credit reporting and natural disaster forbearance, providing insights into its implications for borrowers navigating financial recovery.

- Forbearance Status and Credit Reports

Natural disaster forbearance typically does not negatively impact credit reports. Loan servicers generally report loans in forbearance as current, preventing any negative marks or derogatory entries related to missed payments during the forbearance period. This protective measure ensures that borrowers utilizing necessary relief programs do not experience adverse credit consequences due to circumstances beyond their control. This accurate reporting of forbearance status safeguards credit profiles during periods of financial hardship.

- Credit Score Impact

While forbearance itself typically does not lower credit scores directly, other factors related to disaster-induced financial hardship can potentially affect credit. For instance, missed payments on other debts or increased credit utilization due to reliance on credit cards for essential expenses during recovery could negatively impact credit scores. These indirect effects underscore the importance of managing overall finances carefully during and after a natural disaster. Maintaining open communication with creditors and exploring available relief options for all debts can mitigate potential negative impacts on credit scores.

- Post-Forbearance Credit Management

Upon exiting forbearance, resuming timely loan payments is crucial for maintaining a positive credit trajectory. Missed payments after the forbearance period ends will be reported to credit bureaus and can negatively impact credit scores. Developing a clear repayment strategy before forbearance concludes and exploring alternative repayment options if necessary can help ensure a smooth transition back to regular loan payments. Proactive planning for post-forbearance repayment contributes to sustained healthy credit management.

- Credit Monitoring and Dispute Resolution

Regularly monitoring credit reports during and after natural disaster forbearance allows borrowers to identify any inaccuracies or discrepancies promptly. In the event of errors, such as incorrect reporting of forbearance status or missed payments, initiating dispute resolution processes with credit bureaus is essential for correcting inaccuracies and maintaining accurate credit profiles. Active credit monitoring empowers borrowers to protect their credit standing and address any reporting errors effectively.

Understanding the interplay between credit reporting and natural disaster forbearance provides borrowers with essential knowledge for protecting their credit health during challenging times. By understanding the nuances of forbearance reporting, potential indirect impacts on credit scores, and the importance of post-forbearance credit management, borrowers can navigate the financial complexities of disaster recovery while safeguarding their credit standing. This proactive approach to credit management empowers individuals to maintain financial stability and build a strong credit foundation for the future.

6. Repayment Resumption

Repayment resumption represents a critical phase following natural disaster forbearance for student loans. This transition, marking the end of the temporary suspension of payments, requires careful planning and understanding to ensure a successful return to regular loan management. The timing of repayment resumption typically coincides with the conclusion of the designated forbearance period, which varies depending on the specific disaster, government declarations, and individual circumstances. Factors such as the extent of damage, recovery progress, and individual financial stability influence the readiness of borrowers to resume payments. For example, borrowers significantly impacted by a major hurricane might require a longer forbearance period and, consequently, experience a later repayment resumption date compared to those affected by a less severe event. This variability underscores the importance of individualized forbearance periods tailored to specific needs.

Navigating repayment resumption effectively involves several key considerations. Borrowers should contact their loan servicers well in advance of the anticipated resumption date to confirm the exact date, review current loan details, and explore available repayment options. Financial circumstances may have changed significantly during the forbearance period, necessitating adjustments to existing repayment plans. Options such as income-driven repayment plans or extended repayment plans can help align monthly payments with post-disaster financial realities. For instance, a borrower who experienced job loss due to a natural disaster might explore an income-driven repayment plan to lower monthly payments based on reduced income. Such proactive engagement with loan servicers allows for informed decision-making and a smoother transition back into regular repayment.

Successful repayment resumption contributes significantly to long-term financial stability following a natural disaster. It allows borrowers to re-establish positive repayment habits, avoid delinquencies and defaults, and maintain healthy credit profiles. Furthermore, understanding the process and planning accordingly minimizes the potential for financial strain during the recovery period. This proactive approach to repayment resumption empowers borrowers to regain control of their student loan obligations and rebuild their financial well-being after a natural disaster. By integrating these considerations into their financial recovery plan, individuals can effectively navigate the transition from forbearance back to regular repayment and pave the way for long-term financial health.

7. Available Resources

Navigating the complexities of natural disaster forbearance for student loans often requires accessing and utilizing various available resources. These resources provide crucial support, guidance, and financial assistance to borrowers facing the challenges of disaster recovery. Understanding the types of resources available and how they connect to forbearance can significantly impact a borrower’s ability to effectively manage student loan obligations during difficult times. The availability of these resources plays a crucial role in mitigating the financial strain associated with natural disasters and facilitating a smoother recovery process. A strong connection exists between access to resources and successful navigation of forbearance, creating a critical link for borrowers seeking financial relief.

Several key resources play a pivotal role in supporting borrowers impacted by natural disasters. The Federal Student Aid (FSA) website offers comprehensive information on disaster-related forbearance, eligibility requirements, application procedures, and other relevant programs. Loan servicers provide individualized guidance, process forbearance applications, and offer repayment options tailored to specific borrower circumstances. FEMA and other government agencies offer disaster relief programs that may provide financial assistance for housing, repairs, and other essential needs, indirectly supporting student loan management by alleviating other financial burdens. Non-profit organizations and community resources often provide additional support, such as financial counseling, legal aid, and access to essential supplies. For example, a borrower whose home was damaged by a hurricane might access FEMA assistance for temporary housing, freeing up financial resources to address student loan obligations when forbearance ends. The synergy between these resources creates a comprehensive support network for borrowers during challenging recovery periods.

Access to and effective utilization of available resources are essential components of successful natural disaster forbearance management. These resources empower borrowers to understand their rights and responsibilities, navigate application processes efficiently, and make informed decisions regarding loan repayment. Challenges in accessing resources, such as limited internet access or language barriers, can hinder effective utilization and underscore the importance of accessible and inclusive resource delivery. The overarching goal remains to provide comprehensive support to borrowers, enabling them to navigate the financial complexities of disaster recovery and maintain progress toward their long-term financial goals. By recognizing the crucial connection between available resources and natural disaster forbearance, borrowers can leverage these resources effectively to mitigate financial strain and navigate the path to recovery successfully.

Frequently Asked Questions

This FAQ section addresses common inquiries regarding student loan forbearance related to natural disasters, providing clarity on eligibility, application procedures, and other relevant aspects.

Question 1: What constitutes a qualifying natural disaster for student loan forbearance?

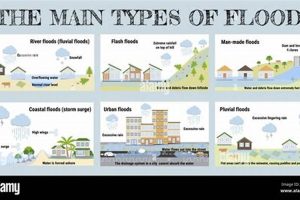

Qualifying natural disasters are typically those declared as major disasters by the federal government. These declarations often follow events like hurricanes, earthquakes, floods, wildfires, and other significant natural occurrences causing widespread damage and requiring federal assistance.

Question 2: How does one apply for natural disaster forbearance?

Contacting one’s loan servicer directly initiates the application process. Documentation verifying residency in a federally declared disaster area may be required. In some cases, forbearance may be applied automatically based on federal disaster declarations and borrower location data.

Question 3: Does interest continue to accrue on student loans during forbearance?

Interest accrual depends on the type of loan. Subsidized federal loans generally do not accrue interest during disaster-related forbearance. Unsubsidized and private loans may continue to accrue interest, potentially leading to capitalization upon repayment resumption.

Question 4: How does natural disaster forbearance affect credit reports and scores?

Forbearance related to natural disasters generally does not negatively impact credit reports. Loans in forbearance are typically reported as current. However, other disaster-related financial difficulties could indirectly affect credit if not managed carefully.

Question 5: What happens when the forbearance period ends?

Borrowers must resume regular loan payments once the forbearance period concludes. Contacting the loan servicer before the end of forbearance is crucial to confirm the resumption date, understand updated loan details, and discuss potential adjustments to repayment plans.

Question 6: What additional resources are available to borrowers affected by natural disasters?

Beyond loan servicers, resources like the Federal Student Aid (FSA) website, FEMA, other government agencies, and non-profit organizations offer various forms of financial assistance, guidance, and support tailored to disaster recovery needs.

Understanding these key aspects of natural disaster forbearance empowers borrowers to navigate the financial challenges of recovery effectively. Proactive planning, timely communication with loan servicers, and utilization of available resources are crucial for successful management of student loan obligations during and after a natural disaster.

For further information and specific guidance, consult the resources mentioned above and contact your loan servicer directly.

Natural Disaster Forbearance

Navigating the financial complexities of natural disasters presents significant challenges, particularly for individuals managing student loan obligations. This exploration of natural disaster forbearance for student loans has highlighted key aspects, including eligibility criteria, application procedures, impacts on interest accrual and credit reporting, and strategies for successful repayment resumption. Access to accurate information and available resources remains paramount for informed decision-making during these difficult periods. Understanding the interplay between disaster relief programs, loan servicer policies, and individual borrower circumstances empowers informed choices regarding loan management.

Proactive planning and open communication with loan servicers are essential for minimizing the long-term financial impact of natural disasters. Leveraging available resources, understanding forbearance provisions, and developing effective repayment strategies contribute significantly to financial stability during recovery. The ability to access crucial relief programs, such as natural disaster forbearance, empowers borrowers to focus on immediate needs and rebuild their lives without the added burden of student loan payments during challenging times. This underscores the significance of these programs in fostering financial resilience within communities impacted by natural disasters.