Temporary postponement or reduction of loan payments granted to borrowers affected by qualifying catastrophic events, such as earthquakes, floods, or hurricanes, is a crucial financial tool. For instance, a homeowner impacted by... Read more »

Loss mitigation options following a declared disaster often include forbearance programs for affected borrowers. When such forbearance periods conclude, lenders implement structured workout arrangements. These arrangements, tailored to individual borrower circumstances, aim... Read more »

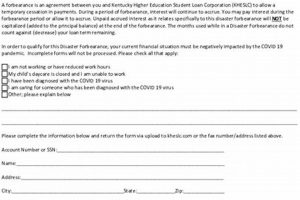

Federally-backed student loan borrowers impacted by declared natural disasters may qualify for temporary suspension of loan payments. This relief, typically granted automatically by loan servicers based on declared disaster areas, provides a... Read more »

Federally-backed mortgage loan workout options available to borrowers impacted by declared disasters typically involve temporary suspensions of mortgage payments (forbearance) followed by a formalized plan to bring the loan current. These workout... Read more »

Temporary suspension of loan payments granted to borrowers affected by declared disasters constitutes a critical form of financial relief. For example, following a hurricane, individuals experiencing property damage or job loss might... Read more »

Temporary postponement of loan payments granted to borrowers affected by declared disasters provides immediate financial relief. For example, following a hurricane, homeowners struggling with property damage and lost income may receive a... Read more »