Withdrawals from retirement accounts under provisions for declared disasters are often subject to specific rules and regulations. These withdrawals, typically permitted following events like hurricanes, floods, wildfires, or other federally declared disasters, allow affected individuals to access funds for recovery expenses. For instance, someone whose home was severely damaged by a hurricane might utilize such a withdrawal to cover repairs or temporary housing. These distributions may have relaxed penalties and offer extended repayment options compared to standard withdrawals.

Access to retirement funds during times of crisis can be a crucial lifeline. It provides individuals with the financial resources to rebuild their lives and communities following devastating events. The ability to rebuild homes, replace essential belongings, and secure temporary housing can significantly reduce the long-term impact of a disaster. Historically, these provisions have been instrumental in helping communities recover after major catastrophic events, allowing for a more rapid return to normalcy and economic stability.

This article will further explore the specific requirements, limitations, and tax implications of qualified disaster distributions. It will also discuss the eligibility criteria related to both the individual and the declared disaster area, and outline the process for taking such a distribution and the potential advantages and disadvantages.

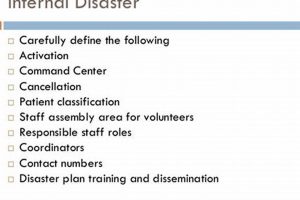

Tips for Utilizing Qualified Disaster Distributions

Accessing retirement funds following a federally declared disaster requires careful consideration. The following tips offer guidance for navigating this complex process.

Tip 1: Verify Eligibility. Confirm that both the individual and the affected area qualify under IRS guidelines for disaster-related distributions. Consult official government resources like the IRS website for the most up-to-date information on designated disaster areas.

Tip 2: Understand the Limits. Be aware of the maximum distributable amount permitted under disaster relief provisions, and avoid exceeding these limitations. Excessive withdrawals may incur penalties.

Tip 3: Explore Repayment Options. Qualified disaster distributions often offer flexible repayment options, including spreading payments over several years or contributing back to the retirement account within a specified timeframe. Investigate which options best align with individual circumstances.

Tip 4: Document Everything. Maintain detailed records of all expenses related to the disaster and any distributions taken. This documentation is crucial for tax reporting and potential audits.

Tip 5: Consult with a Financial Advisor. Seeking professional guidance from a financial advisor can provide personalized strategies for utilizing disaster distributions effectively and minimizing long-term financial impact.

Tip 6: Consider Tax Implications. Disaster-related distributions may have tax consequences. Consult a tax professional to understand the specific tax implications based on individual circumstances.

Tip 7: Evaluate Alternative Resources. Before accessing retirement funds, explore other available resources, such as government assistance programs, insurance claims, or low-interest loans specifically designed for disaster relief.

Careful planning and informed decision-making are essential when considering disaster-related distributions. Understanding the rules, limitations, and repayment options can maximize the benefits of these provisions while mitigating potential drawbacks.

This information provides a general overview. Consulting with financial and tax professionals is recommended to tailor strategies to individual circumstances and ensure compliance with current regulations.

1. Eligibility

Eligibility serves as a cornerstone for determining access to qualified disaster distributions. Specific criteria must be met to qualify for these specialized withdrawals from retirement accounts. These criteria encompass two primary aspects: the individual’s relationship to the declared disaster and the disaster itself. The individual must typically reside or work in a federally declared disaster area. The disaster must qualify under IRS guidelines for this provision. For example, an individual whose primary residence is located within the boundaries of a presidentially declared major disaster area, and who suffered damage to their property, would likely meet the eligibility requirements for a qualified disaster distribution. Conversely, someone residing outside the designated disaster area, even if experiencing hardship, would not qualify based on location. A flood causing significant damage across multiple states, officially declared a disaster by the federal government, would qualify; however, localized flooding impacting a limited area without a federal declaration would not.

Understanding eligibility is paramount. It directly impacts whether an individual can legally access retirement funds under these specific provisions. Failure to meet the eligibility requirements can result in penalties and tax implications as the withdrawal would be considered a standard distribution, subject to regular rules and regulations. Individuals should verify their eligibility through official government resources before taking any distributions. This verification process often involves consulting the IRS website for a list of qualified disasters and designated areas. Confirming residence or work location within the affected area and possessing documentation of the disaster’s impact on personal finances are often necessary steps.

In conclusion, establishing eligibility is a crucial first step in determining access to qualified disaster distributions. Individuals must meet specific criteria related to both the declared disaster and their connection to it. Failure to meet these criteria can result in significant financial repercussions. Therefore, meticulous verification of eligibility through official sources is essential for anyone considering accessing retirement funds under these disaster relief provisions.

2. Qualified Disaster

Determining whether a distribution qualifies as disaster-related hinges critically on the nature of the disaster itself. A “qualified disaster” designates a specific catastrophic event recognized by governing bodies, allowing affected individuals to access retirement funds under favorable conditions. This designation is paramount in determining eligibility for disaster distributions and plays a crucial role in the overall process.

- Federally Declared Disasters

The disaster must be officially declared by the federal government. This declaration typically comes from the President of the United States, following a request from the governor of the affected state. This official declaration triggers the availability of various federal assistance programs, including access to qualified disaster distributions from retirement accounts. Examples include major hurricanes like Katrina and Sandy, wildfires such as the California Camp Fire, and widespread flooding events. This declaration is the foundational requirement for accessing retirement funds under disaster provisions. Without it, withdrawals are subject to standard penalties and tax implications.

- Specific Qualifying Events

The IRS maintains a list of specific events that qualify as federally declared disasters. This list is not exhaustive and is subject to updates as new disasters occur. These events often involve widespread damage and significant impact on communities. Examples include earthquakes, tornadoes, volcanic eruptions, and severe storms. Understanding which events qualify is crucial, as not all natural disasters automatically trigger eligibility. The specific nature of the event, combined with the federal declaration, determines qualification.

- Designated Disaster Areas

Within a federally declared disaster, specific geographic areas are designated as eligible for disaster relief. These designated areas are determined based on the extent and severity of the damage. Individuals must reside or work within these designated areas to qualify for disaster distributions. This geographic limitation ensures that the funds are accessible to those directly impacted by the disaster. For instance, even if a state experiences a widespread disaster, only specific counties or regions may be designated as qualifying areas, impacting individual eligibility.

- Timing of the Disaster and Distribution

The timing of both the disaster and the distribution is crucial. The IRS specifies timeframes within which affected individuals can take distributions related to a qualified disaster. These timeframes are often linked to the date of the presidential declaration. Taking distributions outside these specified windows may disqualify them from disaster-related treatment. This temporal element ensures that the distributions are genuinely related to the disaster recovery process. For example, withdrawals made months or years after a disaster might not qualify for the special provisions, even if related to ongoing recovery efforts.

Understanding the concept of a “qualified disaster” is essential for anyone considering taking a disaster distribution. Meeting these criteria is a prerequisite for accessing retirement funds under these provisions. Failure to meet these requirements can lead to standard penalties and tax liabilities, negating the benefits intended for disaster relief. Careful verification of the disaster’s qualification through official sources is therefore a critical step before initiating any withdrawals.

3. Distribution Amount

The amount distributed from a retirement account under qualified disaster provisions plays a significant role in determining the overall impact on an individual’s financial situation. This amount is subject to limitations set by the IRS and is a key factor in calculating potential tax liabilities and repayment obligations. A clear understanding of distributable limits and their implications is crucial for informed decision-making.

The IRS sets a maximum distributable amount for qualified disaster distributions. Exceeding this limit subjects the excess amount to standard withdrawal penalties and taxation, negating the benefits intended for disaster relief. For example, if the limit is $100,000 and an individual withdraws $120,000, the additional $20,000 will be treated as a regular distribution, potentially incurring a 10% early withdrawal penalty and being taxed as ordinary income. The distributable amount also influences repayment options and strategies. While qualified disaster distributions often allow for repayment over an extended period or a return of funds to the retirement account, these options are typically tied to the initial distributed amount. Larger distributions may require more complex repayment plans. Careful consideration of the amount withdrawn is therefore essential for managing long-term financial recovery.

The distribution amount should align with actual disaster-related expenses. While accessing retirement funds provides crucial support during a crisis, withdrawals should be limited to covering necessary costs like home repairs, temporary housing, or replacement of essential possessions. Taking out more than necessary can jeopardize long-term financial security and retirement goals. Documentation of disaster-related expenses is crucial for substantiating the distribution amount and demonstrating its connection to the qualified disaster. This documentation is essential during tax reporting and may be required in case of audits. Understanding the interplay between the distribution amount, applicable limits, repayment options, and tax implications is vital for navigating the complexities of disaster distributions effectively. Careful planning and consultation with financial professionals can ensure that these distributions are utilized responsibly and contribute positively to the recovery process.

4. Record Keeping

Meticulous record keeping is paramount when utilizing qualified disaster distributions from retirement accounts. Proper documentation substantiates the withdrawal’s purpose, ensures accurate tax reporting, and facilitates compliance with IRS regulations. Maintaining comprehensive records is essential for demonstrating the connection between the distribution and the declared disaster, mitigating potential audits and penalties. This organized approach to documentation provides a clear audit trail and facilitates financial management during a challenging period.

- Proof of Residence/Work Location

Documentation establishing residence or work location within a federally declared disaster area is critical. Utility bills, bank statements, or official government correspondence can serve as proof. This documentation confirms eligibility for disaster-related distributions, linking the individual directly to the affected region. Failure to provide such proof may disqualify the distribution from preferential tax treatment and subject it to standard penalties.

- Disaster-Related Expense Documentation

Detailed records of all expenses incurred due to the disaster are essential. Receipts, invoices, and insurance claim documents substantiate the purpose of the distribution. These records demonstrate that the withdrawn funds were used for legitimate disaster recovery expenses like home repairs, temporary housing, or replacement of essential items. This documentation directly connects the distribution to the disaster’s financial impact.

- Distribution Records

Maintaining records of the distribution itself, including the date, amount, and source of the funds (specific retirement account), is crucial. These records, often provided by the financial institution managing the retirement account, provide a clear record of the transaction. This information is necessary for accurate tax reporting and reconciling the distribution with other financial records. Clear documentation of the distribution facilitates financial planning during the recovery period.

- Tax Forms and Documentation

Copies of relevant tax forms, such as Form 8915, used to report the disaster distribution, must be retained. These forms document the distribution for tax purposes and are essential for compliance with IRS regulations. Retaining these records safeguards against discrepancies and provides necessary documentation during tax audits. This careful record keeping ensures accurate reporting and minimizes potential tax liabilities associated with the distribution.

These record-keeping practices play a vital role in substantiating qualified disaster distributions and protecting individuals from potential penalties and tax complications. Comprehensive documentation provides a clear audit trail, demonstrating the link between the distribution and the declared disaster, ultimately contributing to a smoother recovery process and minimizing financial strain during a challenging time.

5. Repayment Options

Repayment options are a crucial aspect of qualified disaster distributions, offering flexibility and potential financial relief during recovery. Understanding these options is essential for minimizing the long-term impact on retirement savings and managing tax implications effectively. Strategic repayment planning can significantly influence the overall financial outcome following a disaster.

- Repayment Period

Qualified disaster distributions often allow for repayment over an extended period, typically three years. This extended timeframe provides individuals with time to rebuild their finances and manage recovery expenses before needing to repay the withdrawn amount. This flexibility can alleviate financial strain during a challenging period, allowing individuals to prioritize immediate needs while gradually replenishing retirement savings. For instance, someone whose home was destroyed by a hurricane could use this extended period to rebuild before resuming retirement contributions.

- Re-Contribution to Retirement Account

Distributions can often be repaid directly back into a qualified retirement account within the specified repayment period. This re-contribution effectively reverses the withdrawal, restoring the retirement savings to their pre-disaster level and minimizing potential tax liabilities. This option allows individuals to mitigate the long-term impact on retirement savings by replenishing withdrawn funds. Someone who took a distribution to cover temporary housing after a wildfire could re-contribute the funds once insurance claims are settled, minimizing the impact on their retirement nest egg.

- Tax Implications of Repayment

Repaying a qualified disaster distribution can have significant tax advantages. The repaid amount is generally not included in gross income, reducing the tax burden associated with the initial withdrawal. This tax benefit incentivizes repayment and helps preserve the long-term value of retirement savings. If an individual repays the full distribution within the designated timeframe, the amount is typically excluded from taxable income, reducing the overall tax liability for the year of the disaster and subsequent years of repayment.

- Impact on Retirement Savings

Strategic repayment planning minimizes the long-term impact on retirement savings. By understanding the available options and choosing a suitable repayment strategy, individuals can mitigate the effects of the withdrawal and ensure continued growth of their retirement funds. Failing to repay the distribution can significantly reduce retirement savings, impacting long-term financial security. For example, understanding the tax benefits of re-contribution can motivate individuals to prioritize repayment, ultimately preserving their retirement funds.

Careful consideration of repayment options is integral to the effective utilization of qualified disaster distributions. Understanding the available choices, tax implications, and the impact on long-term retirement savings empowers informed decision-making. By utilizing these repayment provisions strategically, individuals can mitigate the financial consequences of a disaster and navigate the recovery process more effectively.

6. Tax Implications

Tax implications are a crucial consideration when determining whether a withdrawal from a retirement account qualifies as a disaster distribution. The tax treatment of these distributions differs significantly from standard withdrawals, and understanding these nuances is essential for accurate tax reporting and financial planning.

- Taxability of Distributions

Qualified disaster distributions are generally included in gross income. However, the tax burden can be spread over three years, mitigating the immediate impact. For instance, a $90,000 distribution could be reported as $30,000 of income each year for three years. Alternatively, taxpayers can choose to include the entire amount in the year of the distribution. This flexibility allows individuals to manage their tax liability strategically during the recovery period.

- Exceptions to the 10% Penalty

Distributions taken due to a qualified disaster are generally exempt from the 10% early withdrawal penalty typically applied to retirement account withdrawals before age 59. This exception provides significant financial relief, particularly for those who rely on these funds for immediate disaster recovery expenses. Eliminating this penalty can significantly reduce the overall financial burden associated with accessing retirement funds during a crisis.

- Repayment and Tax Adjustments

If the distribution is repaid within three years, the repaid amount can be excluded from gross income, either retroactively through amended returns or in the year of repayment. This can result in tax refunds for previously paid taxes on the distribution. This provision incentivizes repayment and mitigates the long-term tax implications of accessing retirement funds during a disaster. For example, repaying a $30,000 distribution may result in a tax refund if the individual’s taxable income is reduced by that amount.

- Tax Form Reporting

Disaster distributions are reported on Form 8915. This form documents the distribution amount, the disaster it relates to, and any repayments made. Accurate completion of this form is crucial for compliance and ensuring proper tax treatment of the distribution. Failure to properly report the distribution can lead to penalties and inaccuracies in tax liability calculations. Using Form 8915 ensures that the IRS recognizes the distribution as disaster-related and applies the appropriate tax rules.

Understanding the tax implications associated with disaster distributions is essential for effective financial planning during recovery. By carefully considering taxability, exceptions to penalties, repayment options, and proper reporting procedures, individuals can minimize their tax burden and maximize the benefits of these provisions. This knowledge allows for informed decisions that contribute to long-term financial well-being following a disaster.

Frequently Asked Questions

This section addresses common inquiries regarding withdrawals from retirement accounts under disaster-related provisions.

Question 1: What constitutes a qualifying disaster for a retirement distribution?

A qualifying disaster is a federally declared disaster, typically announced by the President, that meets specific IRS criteria. These include events like hurricanes, floods, wildfires, earthquakes, and tornadoes.

Question 2: How is eligibility for a disaster distribution determined?

Eligibility typically requires residing or working in a federally declared disaster area and experiencing an adverse financial impact due to the disaster. Specific rules vary depending on the disaster and IRS guidelines.

Question 3: What is the maximum amount that can be withdrawn under disaster provisions?

The IRS sets limits on the distributable amount for qualified disaster distributions. Exceeding this limit subjects the excess to standard withdrawal penalties and taxation.

Question 4: Are disaster distributions subject to the 10% early withdrawal penalty?

Qualified disaster distributions are generally exempt from the 10% early withdrawal penalty typically applied to retirement account withdrawals before age 59.

Question 5: What are the tax implications of a disaster distribution?

While generally included in gross income, the tax burden can be spread over three years. Repaying the distribution within three years can reduce the tax liability.

Question 6: What documentation is needed to substantiate a disaster distribution?

Essential documentation includes proof of residence or work within the disaster area, records of disaster-related expenses, distribution records from the financial institution, and relevant tax forms (Form 8915).

Careful consideration of these frequently asked questions provides a foundational understanding of disaster distributions and their implications. Consulting official IRS resources and financial advisors is recommended for personalized guidance.

This concludes the FAQ section. The following section will provide a detailed checklist for navigating the disaster distribution process.

Determining Disaster Distribution Status

Navigating the complexities of disaster distributions requires careful consideration of eligibility criteria, qualified disaster definitions, distribution amounts, record-keeping requirements, repayment options, and tax implications. Each element plays a crucial role in determining whether a withdrawal qualifies for the specialized treatment afforded under disaster-related provisions. Understanding these factors empowers informed decision-making and facilitates responsible financial recovery following a catastrophic event. Accurate assessment of these elements is essential for compliance and maximizing the benefits intended for disaster relief.

Disaster distributions provide a critical safety net for individuals facing financial hardship due to catastrophic events. Thorough understanding of the rules and regulations surrounding these distributions is paramount for effective utilization and long-term financial well-being. Proactive planning and consultation with financial professionals can ensure compliance and maximize the potential benefits of these provisions, contributing to a more resilient and secure financial future in the face of unforeseen adversity.