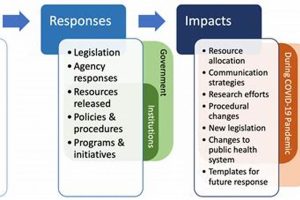

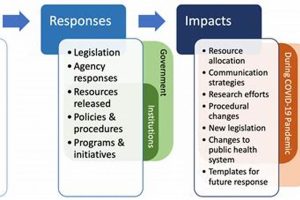

The allocation of resources during the COVID-19 pandemic encompasses the complex logistical processes of delivering essential medical supplies, personnel, and financial aid to affected populations. For example, this involved distributing ventilators to... Read more »

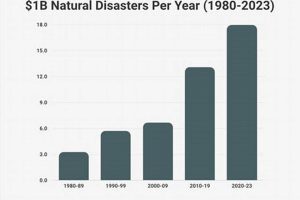

Understanding the geographic and temporal occurrence of catastrophic events during the 2021-2023 period provides crucial insights. This involves analyzing where disasters like earthquakes, floods, wildfires, and storms happened, and how frequently they... Read more »

The process of allocating resources and aid following a catastrophic event involves strategic logistical planning and execution. For example, delivering essential supplies like food, water, medical equipment, and temporary shelter to affected... Read more »

Hardship withdrawals from retirement accounts, specifically permitted under IRS regulations, allow access to funds before retirement age without the usual penalties in specific circumstances. These qualifying events typically encompass sudden, unexpected, and... Read more »

Generally, government-provided financial aid during widespread emergencies falls under specific classifications within tax codes and regulations. For instance, distributions from retirement accounts taken due to a federally declared disaster are often subject... Read more »

Withdrawals from retirement accounts under provisions for declared disasters are often subject to specific rules and regulations. These withdrawals, typically permitted following events like hurricanes, floods, wildfires, or other federally declared disasters,... Read more »

The IRS allows for hardship distributions from retirement plans under specific circumstances, generally involving an immediate and heavy financial need. These distributions may be allowed when the need is due to an... Read more »

The allocation of resources during the COVID-19 pandemic involved complex logistical challenges, encompassing the procurement, storage, and delivery of essential medical supplies, personnel, and financial aid to affected populations. For example, the... Read more »

The allocation of resources during the COVID-19 pandemic presented unprecedented logistical challenges. Effectively delivering essential medical supplies, personnel, and aid to affected populations globally required complex coordination across international borders, varying infrastructures,... Read more »

Understanding the geographic and temporal occurrence of disasters between 2019 and 2022 provides valuable insights. This involves analyzing where disasters happened, when they occurred within that timeframe, and potentially the types of... Read more »