Assessing the economic consequences of disruptive events on businesses requires a thorough evaluation of various factors. These include direct losses due to property damage and business interruption, indirect losses stemming from supply chain disruptions and market volatility, and the costs associated with recovery and mitigation efforts. For example, a natural disaster could lead to physical damage to facilities, halting production and impacting revenue streams. Simultaneously, it might disrupt the supply of essential raw materials, further hindering operations and increasing expenses.

Understanding the financial ramifications of such events is crucial for business continuity and resilience. A comprehensive impact analysis enables organizations to develop informed strategies for risk management, insurance procurement, and post-disaster recovery. Historically, businesses that lacked such foresight have often faced significant financial setbacks, sometimes leading to permanent closure. By proactively evaluating potential vulnerabilities and implementing appropriate mitigation measures, businesses can strengthen their ability to withstand disruptions and safeguard their financial stability.

This understanding lays the groundwork for informed decision-making in areas such as disaster preparedness, insurance coverage, and financial resource allocation. The following sections will delve deeper into specific aspects of assessing and managing the financial consequences of disruptive events.

Assessing Financial Impact After Disruptive Events

Following a disruptive event, a thorough assessment of financial repercussions is essential for effective recovery and future resilience. These tips offer guidance for conducting a comprehensive evaluation.

Tip 1: Document All Losses Meticulously. Comprehensive records of all damages and losses are fundamental to insurance claims and financial recovery strategies. This includes physical damage, lost inventory, interrupted revenue, and increased operational expenses.

Tip 2: Analyze Supply Chain Vulnerabilities. Evaluate the event’s impact on suppliers, distributors, and other critical partners. Disruptions in the supply chain can lead to significant delays and increased costs.

Tip 3: Quantify Business Interruption Costs. Accurately estimate the financial impact of operational downtime. This includes lost profits, fixed expenses incurred during closure, and the costs associated with restarting operations.

Tip 4: Review Insurance Policies Thoroughly. Understand the scope of existing insurance coverage for various types of losses. Identify any gaps in coverage and explore options for supplemental protection.

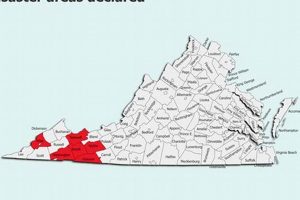

Tip 5: Explore Government Assistance Programs. Research available disaster relief programs and other forms of government aid that may provide financial support for recovery efforts.

Tip 6: Develop a Financial Recovery Plan. Outline a detailed plan for managing finances during the recovery period. This includes securing necessary funding, managing cash flow, and prioritizing essential expenditures.

Tip 7: Implement Mitigation Strategies for Future Events. Identify vulnerabilities exposed by the event and implement preventative measures to mitigate future risks. This may include diversifying supply chains, strengthening infrastructure, or implementing robust backup systems.

By implementing these strategies, organizations can gain a clearer understanding of their financial position after a disruptive event and develop a robust recovery plan. This proactive approach strengthens long-term resilience and protects against future financial setbacks.

With a comprehensive understanding of the financial impact, organizations can transition to the crucial next step: developing and implementing a comprehensive recovery and mitigation plan.

1. Revenue Loss

Revenue loss is a critical component of understanding how disasters financially impact business operations. Disruptions can significantly impair a business’s ability to generate income, leading to immediate and long-term financial challenges. Examining the various facets of revenue loss provides a clearer picture of its overall impact.

- Sales Disruption

Disasters can halt sales activities through physical damage to retail spaces, factory closures, or disruptions to distribution networks. For example, a hurricane forcing a store to close for repairs leads to lost sales during that period. The duration of the closure directly correlates with the magnitude of the revenue loss. Even after reopening, sales may remain below pre-disaster levels due to lingering market disruption or damaged reputation.

- Decreased Customer Demand

Disasters can also indirectly impact revenue by reducing customer demand. Economic downturns following a disaster can decrease consumer spending. For example, following a major earthquake, consumer confidence may decline, leading to reduced spending on non-essential goods and services, impacting businesses even outside the directly affected area.

- Contract Cancellations

Businesses may experience revenue loss through contract cancellations if they are unable to fulfill obligations due to disaster-related disruptions. For instance, a manufacturing plant damaged by a flood may be unable to deliver products on time, leading to contract cancellations by clients and a subsequent loss of anticipated revenue.

- Inability to Access Markets

Disasters can restrict access to target markets. Road closures, port damage, or communication outages can prevent businesses from reaching customers and completing transactions. A logistics company unable to transport goods due to damaged highways loses revenue from delayed or cancelled shipments. This can have cascading effects throughout the supply chain, impacting multiple businesses.

Understanding these various facets of revenue loss provides a more comprehensive insight into the overall financial impact of a disaster on business operations. Analyzing these individual contributors to lost revenue is crucial for developing effective mitigation strategies and financial recovery plans. These insights can help businesses prioritize recovery efforts, secure necessary funding, and implement long-term measures to enhance resilience against future disruptions.

2. Property Damage

Property damage represents a significant factor in the financial impact of disasters on business operations. Direct damage to physical assets, including buildings, equipment, inventory, and infrastructure, leads to immediate costs. These costs encompass repairs, replacements, and potential write-offs of unsalvageable assets. For example, a factory damaged by fire incurs costs to repair the building, replace damaged machinery, and dispose of destroyed inventory. The extent of the damage directly correlates with the financial burden on the business. Beyond direct costs, property damage often triggers a cascade of financial consequences.

Operational downtime resulting from property damage contributes significantly to financial losses. A damaged retail store cannot generate revenue while undergoing repairs. Similarly, a damaged manufacturing plant experiences production halts, leading to lost output and potential contract penalties. The duration of the downtime directly impacts the magnitude of lost revenue and increased operational expenses. Furthermore, property damage can disrupt supply chains. Damage to warehouses or transportation infrastructure can delay or prevent the delivery of essential materials and finished goods, impacting both production and sales. This can lead to increased costs for expedited shipping or alternative sourcing, as well as lost revenue due to delays.

Understanding the financial ramifications of property damage is crucial for disaster preparedness and recovery planning. Accurate assessments of potential property damage inform insurance decisions, enabling businesses to secure adequate coverage for various disaster scenarios. This understanding also highlights the importance of preventative measures, such as robust building codes and disaster-resistant infrastructure, to minimize potential damage and financial losses. Effective post-disaster recovery strategies should prioritize swift damage assessment and repairs to minimize operational downtime and mitigate further financial strain. By recognizing property damage as a key component of disaster impact, businesses can develop comprehensive strategies to protect their assets and ensure financial stability in the face of disruptive events.

3. Operational Disruption

Operational disruption represents a critical link between a disaster and its financial impact on business operations. Disasters can trigger a cascade of disruptions, affecting various operational aspects, from production and logistics to sales and customer service. These disruptions translate directly into financial consequences. Production halts due to damaged equipment or inaccessible facilities result in lost output and unmet customer demand. Disrupted logistics networks delay deliveries, increase transportation costs, and potentially lead to contract penalties. Impaired customer service due to communication outages or staff displacement can erode customer relationships and damage brand reputation, impacting future sales. Understanding the ripple effect of operational disruption is essential for assessing the full financial impact of a disaster.

For example, a manufacturer experiencing a flood in its primary warehouse faces several operational disruptions. Damaged inventory leads to production delays, resulting in lost revenue and potentially contractual penalties for missed delivery deadlines. The flood may also damage critical infrastructure, such as power systems or IT servers, further hindering operations and increasing recovery costs. Disruptions to transportation networks complicate the sourcing of raw materials and the distribution of finished goods, adding to operational expenses and impacting customer satisfaction. These combined disruptions significantly impact the manufacturer’s financial performance. Another example is a retail business forced to close due to a hurricane. The closure represents a complete halt in sales activity, leading to immediate revenue loss. Damage to the retail space necessitates repairs and replacements, incurring additional costs. Disruptions to supply chains prevent the replenishment of inventory, further impacting sales once the business reopens. The hurricane’s impact on the retail business extends beyond physical damage, demonstrating the substantial financial consequences of operational disruption.

Analyzing operational disruption provides crucial insights for developing effective disaster preparedness and recovery strategies. Identifying potential vulnerabilities within operations allows businesses to implement preventative measures, such as backup systems, diversified supply chains, and robust communication protocols. These measures can mitigate the impact of future disruptions and minimize financial losses. Post-disaster recovery plans should prioritize restoring critical operations to minimize downtime and accelerate financial recovery. Recognizing the link between operational disruption and financial impact allows businesses to develop more effective strategies to navigate the challenges posed by disasters and ensure long-term resilience. Focusing on minimizing operational downtime and implementing robust contingency plans are key to mitigating the financial repercussions of disaster-related disruptions.

4. Recovery Costs

Recovery costs represent a significant aspect of the financial impact of disasters on business operations. These costs encompass a range of expenditures necessary to restore business functionality following a disruptive event. Understanding the various components of recovery costs is crucial for accurate financial assessment and effective recovery planning. Failure to adequately account for these costs can impede a business’s ability to regain stability and long-term viability. Analyzing these costs provides valuable insights into the overall financial impact of disasters and informs strategies for mitigating future risks.

- Repairs and Reconstruction

This facet includes costs associated with repairing or rebuilding damaged physical assets, such as buildings, equipment, and infrastructure. For example, a business might need to repair a damaged roof after a hurricane or rebuild an entire warehouse destroyed by fire. These costs can be substantial, particularly if specialized equipment or contractors are required. The extent of the damage directly influences the magnitude of repair and reconstruction costs, significantly impacting the overall financial recovery process. Delays in repairs can further exacerbate financial losses due to extended operational downtime.

- Inventory Replacement

Disasters can damage or destroy inventory, requiring businesses to replace lost stock. A retailer experiencing a flood might lose a significant portion of its merchandise, requiring substantial investment to replenish inventory. These costs depend on the type and quantity of lost inventory. Furthermore, disruptions to supply chains can complicate and increase the cost of replacing inventory post-disaster. Businesses heavily reliant on readily available inventory may face significant financial challenges if replacement is delayed or unavailable.

- Technology Restoration

Restoring damaged technology systems is a crucial recovery cost often overlooked. Disasters can damage computer hardware, software, and data storage systems, disrupting essential business functions. A company whose servers are damaged by a power surge incurs costs to replace hardware, restore data, and implement cybersecurity measures. These costs can be substantial, especially if specialized IT expertise is required. Furthermore, downtime due to technology disruptions can hinder operational recovery and prolong financial losses.

- Employee-Related Expenses

Recovery costs also include expenses related to employees. Businesses may need to provide temporary housing, transportation, or financial assistance to employees displaced by a disaster. A company relocating employees from a hurricane-affected area incurs costs for temporary housing and relocation expenses. These employee-related costs are essential for maintaining workforce stability and ensuring business continuity during the recovery period. Failure to support employees during a disaster can negatively impact morale, productivity, and long-term retention.

These various recovery costs contribute significantly to the overall financial impact of a disaster on business operations. Accurately assessing and managing these costs is crucial for effective financial recovery and long-term business viability. By understanding the different components of recovery costs, businesses can develop more comprehensive disaster preparedness plans, secure adequate insurance coverage, and implement robust financial recovery strategies. Ignoring these costs can lead to underestimated financial impact, hindering a business’s ability to effectively navigate the challenges of post-disaster recovery and potentially jeopardizing long-term sustainability. Understanding the interconnectedness of these recovery costs and their impact on various aspects of business operations provides a holistic view of the financial ramifications of disasters.

5. Supply Chain Breakdown

Supply chain breakdowns represent a significant contributor to the financial impact of disasters on businesses. Disruptions to the intricate network of suppliers, manufacturers, distributors, and retailers can have cascading effects, impacting all aspects of business operations and resulting in substantial financial consequences. Examining the facets of supply chain breakdowns provides a comprehensive understanding of their role in disaster-related financial impact.

- Disrupted Material Flow

Disasters can disrupt the flow of raw materials, components, and finished goods, impacting production, sales, and overall business continuity. For example, a port closure due to a hurricane can prevent a manufacturer from receiving necessary components, halting production and leading to lost revenue. Similarly, damaged transportation infrastructure can delay the delivery of finished goods to retailers, impacting sales and customer satisfaction. The severity and duration of the disruption directly correlate with the magnitude of financial losses.

- Increased Procurement Costs

Supply chain disruptions often necessitate sourcing materials or goods from alternative suppliers, potentially at higher costs. A business reliant on a supplier located in a disaster-affected area may need to procure materials from a more distant or less cost-effective supplier. Increased transportation costs, expedited shipping fees, and premium prices for scarce resources contribute to escalating procurement expenses, impacting profitability and financial stability. This can be particularly challenging for businesses operating on tight margins.

- Production Delays and Bottlenecks

Disruptions in the supply chain create production delays and bottlenecks. Manufacturers unable to receive timely deliveries of essential components experience production slowdowns or complete halts. This leads to lost output, unmet customer demand, and potential contract penalties. Delays in one part of the supply chain can create cascading effects, impacting downstream operations and amplifying financial losses. Businesses with complex, multi-tiered supply chains are particularly vulnerable to these cascading effects.

- Inventory Shortages and Lost Sales

Supply chain breakdowns often result in inventory shortages, impacting retailers and other businesses reliant on readily available goods. A retailer unable to replenish stock due to disrupted distribution networks experiences lost sales opportunities and decreased customer satisfaction. Inventory shortages can also lead to price increases, potentially further impacting sales and customer loyalty. The duration and severity of the shortage directly correlate with the financial impact on the business.

These facets of supply chain breakdown illustrate the significant financial repercussions of disasters on businesses. Understanding these vulnerabilities enables organizations to develop robust supply chain management strategies to mitigate future risks. Diversification of suppliers, strategic inventory management, and robust logistics planning are essential components of building supply chain resilience. By recognizing and addressing these vulnerabilities, businesses can minimize the financial impact of disasters and ensure long-term stability.

6. Market Volatility

Market volatility, often exacerbated by disasters, represents a crucial factor influencing the financial impact on business operations. Disasters can trigger significant fluctuations in market conditions, impacting supply and demand dynamics, commodity prices, and investor confidence. These fluctuations create an unpredictable environment that poses substantial financial risks to businesses. Understanding the connection between market volatility and disaster impact is essential for developing effective mitigation strategies and ensuring financial resilience.

Disasters can disrupt supply chains, leading to shortages of essential goods and driving up prices. For example, a hurricane damaging agricultural regions can cause a spike in food prices, impacting businesses reliant on these commodities. Conversely, decreased consumer spending following a disaster can lead to a decline in demand for non-essential goods and services, impacting businesses across various sectors. Furthermore, disasters can trigger uncertainty in financial markets, impacting investor confidence and potentially leading to decreased investment or divestment. This can particularly affect businesses reliant on external funding or operating in volatile industries. For instance, a major earthquake impacting a significant industrial zone could lead to a decline in stock prices for companies operating in that region, affecting their ability to raise capital and potentially impacting long-term growth.

Navigating market volatility induced by disasters requires proactive risk management strategies. Businesses must develop flexible supply chains, diversify their customer base, and implement robust financial planning to mitigate potential losses. Understanding market trends and anticipating potential disruptions enables businesses to adapt quickly to changing conditions and minimize financial exposure. For example, a company anticipating supply chain disruptions due to a hurricane season can secure alternative suppliers in advance or increase inventory levels to buffer against potential shortages. Similarly, businesses operating in disaster-prone areas can develop financial reserves to navigate periods of decreased revenue or increased expenses. By acknowledging market volatility as a key component of disaster impact, businesses can develop more resilient operational and financial strategies, ensuring long-term stability and minimizing the negative financial consequences of disruptive events.

Frequently Asked Questions

This section addresses common inquiries regarding the financial ramifications of disasters on businesses, providing clarity and guidance for navigating these complex challenges.

Question 1: How can one quantify the indirect costs of a disaster, such as reputational damage or lost market share?

Quantifying indirect costs can be challenging. Methodologies include estimating the cost of regaining lost customers, calculating the impact of negative publicity on sales, and assessing the financial implications of market share erosion. Consulting with industry experts or financial analysts can provide further guidance on quantifying these less tangible losses.

Question 2: What insurance coverage is typically recommended to mitigate the financial impact of disasters?

Recommended coverage includes property insurance for physical damage, business interruption insurance for lost income, and contingent business interruption insurance for losses due to disruptions in the supply chain. Specific coverage needs vary depending on the industry, location, and specific vulnerabilities of the business. A thorough risk assessment is crucial for determining appropriate coverage levels.

Question 3: How can businesses ensure sufficient cash flow to cover expenses during prolonged operational downtime?

Maintaining adequate cash reserves, establishing lines of credit, and exploring disaster relief loans are strategies to ensure financial stability during extended disruptions. Developing a detailed financial recovery plan that outlines projected expenses and identifies potential funding sources is essential for navigating prolonged downtime.

Question 4: What are the key steps in developing a robust financial recovery plan following a disaster?

Key steps include conducting a thorough damage assessment, quantifying all losses, reviewing insurance policies, exploring available financial resources, developing a detailed budget for recovery activities, and establishing clear timelines for recovery milestones. Prioritizing essential operations and focusing on revenue-generating activities are crucial for a swift and effective financial recovery.

Question 5: How can businesses mitigate the risk of supply chain disruptions in disaster-prone areas?

Diversifying suppliers, establishing backup supply arrangements, strategically positioning inventory, and implementing robust logistics management systems are key mitigation strategies. Regularly reviewing and updating supply chain protocols is essential for adapting to changing risk landscapes and ensuring supply chain resilience.

Question 6: How can a business assess its overall vulnerability to the financial impacts of various types of disasters?

Conducting a comprehensive risk assessment that considers potential hazards, operational vulnerabilities, and financial exposures is essential. This assessment should identify potential disaster scenarios, quantify potential losses, and inform mitigation strategies to minimize financial impact. Regularly reviewing and updating the risk assessment ensures preparedness for evolving threats.

Understanding the potential financial ramifications of disasters and proactively implementing mitigation measures are essential for business continuity and long-term resilience. Thorough planning and preparation can significantly reduce financial losses and facilitate a swift and effective recovery.

Moving forward, businesses should focus on developing comprehensive disaster preparedness and recovery plans that incorporate the insights gained from these FAQs.

Conclusion

Understanding the financial ramifications of disasters requires a comprehensive evaluation encompassing various factors. This exploration has highlighted key areas impacted by disruptive events: revenue loss, property damage, operational disruption, recovery costs, supply chain breakdowns, and market volatility. Each area presents unique financial challenges, and their interconnectedness amplifies the overall impact. Revenue losses stem from sales disruptions, decreased customer demand, and contract cancellations. Property damage leads to repair costs and operational downtime. Operational disruptions hinder production, logistics, and customer service. Recovery costs include repairs, inventory replacement, technology restoration, and employee-related expenses. Supply chain breakdowns disrupt material flow, increase procurement costs, and cause production delays. Market volatility introduces uncertainty in pricing, demand, and investment. Addressing these challenges requires a multifaceted approach.

Organizations must prioritize disaster preparedness and develop robust mitigation strategies. Thorough risk assessments, comprehensive recovery plans, and proactive supply chain management are essential for minimizing financial losses and ensuring business continuity. Diversification of suppliers, strategic inventory management, and robust insurance coverage are crucial components of building resilience against future disruptions. Investing in disaster-resistant infrastructure, employee training, and robust communication systems further strengthens an organization’s ability to withstand and recover from disruptive events. The financial impact of disasters extends beyond immediate losses, potentially impacting long-term growth and sustainability. Therefore, a proactive and comprehensive approach to disaster preparedness and mitigation is not merely a prudent business practice but a critical investment in long-term organizational resilience and financial stability.