The concept of profiting from misfortune, whether personal or widespread, is a complex and often controversial phenomenon. Consider the surge in demand for construction materials following a natural disaster, driving up prices and benefiting suppliers. This dynamic, while potentially exploitative, illustrates how economic opportunities can arise from calamitous events.

This principle, though ethically challenging, has been a driving force in markets throughout history. From post-war reconstruction to the development of new technologies in response to crises, the ability to identify and address emergent needs in times of hardship often leads to significant economic activity. Understanding this dynamic is crucial for analyzing market trends and societal responses to adversity. It also highlights the need for ethical considerations and regulatory frameworks to prevent exploitation and ensure equitable distribution of resources.

This exploration provides a foundation for examining related themes such as disaster capitalism, crisis management, and the ethics of profit in times of widespread suffering. It encourages a deeper understanding of the interplay between economic forces and societal vulnerability.

Capitalizing on Disruptive Events

This section offers guidance for navigating the complex ethical landscape of profiting from disruptive events. Careful consideration of these points can facilitate responsible and sustainable practices.

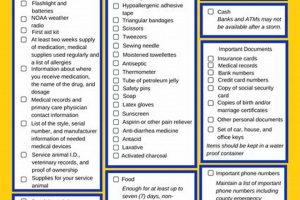

Tip 1: Prioritize Ethical Sourcing: Ensure that materials and resources are acquired through legitimate and ethical channels, avoiding exploitation of vulnerable populations or environmentally damaging practices. For example, when sourcing lumber after a hurricane, ensure it comes from sustainable forestry operations and not illegally harvested timber.

Tip 2: Transparency in Pricing: Maintain fair and transparent pricing models, avoiding price gouging or other exploitative practices. Publicly disclosing pricing structures and justifying any increases due to increased demand fosters trust and accountability.

Tip 3: Focus on Long-Term Value Creation: Prioritize investments and initiatives that contribute to long-term community recovery and resilience. This may involve supporting local businesses, investing in infrastructure improvements, or providing job training programs.

Tip 4: Engage with Stakeholders: Communicate openly and honestly with all stakeholders, including affected communities, government agencies, and non-profit organizations. This collaborative approach fosters understanding and ensures that initiatives align with community needs.

Tip 5: Assess Environmental Impact: Carefully evaluate the environmental impact of any venture, minimizing negative consequences and prioritizing sustainable practices. This may include utilizing renewable energy sources, reducing waste, and promoting environmentally friendly building materials.

Tip 6: Regulatory Compliance: Adhere to all applicable regulations and legal frameworks related to disaster relief and economic activity. This includes compliance with pricing regulations, building codes, and environmental protection laws.

By adhering to these guidelines, organizations and individuals can navigate the challenges of profiting from disruptive events while upholding ethical principles and contributing to sustainable recovery.

These considerations pave the way for a more in-depth examination of the broader implications of profit in times of crisis.

1. Economic Opportunism

Economic opportunism, the practice of capitalizing on misfortune for personal gain, forms the core of the “fortune for your disaster” concept. While often viewed negatively, its implications are multifaceted and warrant careful examination. Understanding its various facets provides crucial insights into market dynamics and ethical considerations in times of crisis.

- Disaster Capitalism:

This facet refers to the exploitation of disasters, both natural and man-made, for profit. Examples include purchasing distressed properties at significantly reduced prices following a natural disaster or privatizing essential services in the wake of economic collapse. While potentially generating substantial wealth, disaster capitalism raises serious ethical concerns regarding exploitation of vulnerable populations and exacerbation of existing inequalities.

- Supply and Demand Fluctuations:

Disasters often disrupt supply chains and create sudden surges in demand for specific goods and services. This dynamic allows opportunistic businesses to increase prices, potentially leading to price gouging. For instance, the price of bottled water or gasoline might rise dramatically after a hurricane. While basic economic principles explain such fluctuations, ethical considerations mandate regulatory oversight to prevent exploitation.

- Innovation and Reconstruction:

Disasters can create opportunities for innovation and economic growth through reconstruction efforts and development of new technologies. The demand for resilient building materials after an earthquake, for example, can spur innovation in construction techniques. While this presents a positive aspect of economic opportunism, it’s crucial to ensure equitable access to these innovations and prevent them from becoming exclusive to the wealthy.

- Regulatory Loopholes and Legal Frameworks:

Existing legal frameworks and regulations often struggle to keep pace with rapidly evolving disaster-related market dynamics. This creates loopholes that opportunistic individuals or corporations can exploit. For example, ambiguous contract clauses related to insurance payouts can lead to protracted legal battles and deny victims fair compensation. Strengthening regulatory frameworks is crucial to mitigating this risk and ensuring ethical conduct.

These facets of economic opportunism highlight the complex interplay of market forces, ethical considerations, and regulatory frameworks in the aftermath of disasters. Understanding these dynamics is essential for navigating the ethical dilemmas inherent in profiting from misfortune and for developing policies that promote equitable recovery and long-term resilience. This nuanced perspective provides a framework for analyzing “a fortune for your disaster,” moving beyond simplistic condemnation to explore the intricate web of factors that shape this phenomenon.

2. Ethical Considerations

Ethical considerations form a crucial counterpoint to the potential for profit in the wake of disaster. The pursuit of “a fortune” during times of widespread suffering necessitates careful examination of moral implications. This involves scrutinizing the balance between legitimate business activity and exploitative practices, ensuring that the pursuit of profit does not exacerbate existing vulnerabilities or compromise equitable access to essential resources. For instance, pharmaceutical companies increasing drug prices during a pandemic demonstrates a potential conflict between profit maximization and public health needs. Similarly, inflated pricing for essential goods and services following a natural disaster, while potentially explained by supply and demand dynamics, raises ethical concerns regarding fairness and accessibility for affected populations.

The tension between profit and ethical conduct during crises necessitates a nuanced approach. While generating profit through addressing emergent needs can drive innovation and contribute to recovery efforts, ethical frameworks must guide these endeavors. Transparency in pricing, equitable resource allocation, and avoidance of exploitative practices are essential components of an ethical response. Real-life examples, such as post-disaster price gouging or manipulation of insurance claims, demonstrate the potential for unethical conduct in these contexts. A robust understanding of ethical considerations enables stakeholders, including businesses, policymakers, and individuals, to navigate these complex situations responsibly.

In conclusion, ethical considerations are integral to navigating the complex landscape of profit in the wake of disaster. Balancing the pursuit of financial gain with societal well-being presents a significant challenge. Addressing this challenge requires a commitment to ethical principles, robust regulatory frameworks, and ongoing dialogue between stakeholders. Understanding this interplay is crucial for fostering responsible practices and ensuring that the pursuit of “a fortune” does not come at the expense of those most affected by disaster.

3. Market Manipulation

Market manipulation represents a critical dimension of the “fortune for your disaster” concept, highlighting how opportunistic actors can exploit crises for personal gain. By artificially influencing markets, these actors create scenarios that generate substantial profits while often exacerbating the suffering of those affected by the disaster. Understanding the mechanics of market manipulation is crucial for developing effective regulatory measures and promoting ethical conduct during times of crisis.

- Price Gouging:

This tactic involves drastically increasing prices for essential goods and services during emergencies. Exploiting the surge in demand following a natural disaster, vendors of necessities like bottled water, gasoline, or building materials can inflate prices, generating exorbitant profits at the expense of vulnerable populations struggling to recover. This practice, while sometimes rationalized by supply chain disruptions, often crosses the line into unethical profiteering.

- Insider Trading:

Exploiting non-public information for personal gain, insider trading can manifest in disaster scenarios. Individuals with advance knowledge of impending disasters, government aid packages, or corporate responses can leverage this information to manipulate stock prices or acquire assets at undervalued prices. This undermines market integrity and exacerbates the financial losses suffered by those lacking such privileged access.

- Misinformation and Rumor Mongering:

Spreading false information or rumors can significantly impact market stability during times of crisis. By disseminating misleading reports about the severity of a disaster, the availability of resources, or the efficacy of government responses, manipulators can create artificial market volatility and exploit resulting price fluctuations for profit. This manipulation further undermines public trust and hinders recovery efforts.

- Exploitation of Regulatory Loopholes:

Opportunistic actors often exploit gaps or ambiguities in existing regulations to their advantage. This can involve circumventing price controls, manipulating insurance claims processes, or engaging in other illicit activities shielded by inadequate legal frameworks. The complexity and rapidly evolving nature of disaster scenarios make it challenging for regulations to keep pace, creating opportunities for exploitation.

These facets of market manipulation demonstrate how the pursuit of “a fortune” can intersect with unethical and exploitative practices during times of disaster. Understanding these tactics is crucial for developing robust regulatory frameworks, promoting ethical conduct within markets, and safeguarding vulnerable populations from opportunistic actors seeking to profit from their misfortune.

4. Resource Allocation

Resource allocation during and after disasters becomes a critical factor influencing who benefits and who suffers in the aftermath. The pursuit of “a fortune for your disaster” often hinges on manipulating or exploiting resource distribution, creating winners and losers in the struggle for essential goods and services. Understanding how resource allocation intersects with profit-seeking during crises is essential for developing equitable and effective disaster response strategies.

- Prioritization and Triage:

Disasters necessitate difficult choices regarding which needs are addressed first and who receives limited resources. While established triage protocols aim to maximize lives saved and suffering alleviated, economic opportunism can distort these priorities. For example, private companies offering premium disaster relief services might divert resources away from public efforts, prioritizing paying clients over the most vulnerable populations.

- Supply Chain Disruptions and Bottlenecks:

Disasters often disrupt supply chains, creating bottlenecks in the distribution of essential goods. These disruptions create opportunities for exploitation, as actors with access to limited resources can leverage their position for profit. For instance, hoarding essential supplies and subsequently selling them at inflated prices exemplifies how supply chain vulnerabilities can be exploited for personal gain during emergencies.

- Government Intervention and Aid Distribution:

Government agencies play a crucial role in resource allocation during disasters, distributing aid and coordinating relief efforts. However, these processes can be susceptible to corruption and inefficiency, creating opportunities for misappropriation of funds and resources. Cases of disaster relief funds being diverted for personal gain or political purposes highlight the risks associated with government involvement in resource allocation.

- Long-Term Recovery and Reconstruction:

Resource allocation decisions in the aftermath of a disaster significantly impact long-term recovery and reconstruction efforts. Favoritism towards certain industries or communities can exacerbate existing inequalities and create disparities in the pace and effectiveness of rebuilding. For example, directing reconstruction funds towards large corporations rather than supporting local businesses can hinder community recovery and create long-term economic hardship.

These facets of resource allocation demonstrate how the pursuit of profit can influence, and often distort, the distribution of essential goods and services during and after disasters. Understanding these dynamics is critical for developing equitable and effective disaster response strategies, ensuring that resources are allocated based on need rather than the potential for profit. This underscores the complex relationship between “a fortune for your disaster” and the ethical imperative of equitable resource allocation in times of crisis.

5. Long-Term Consequences

Exploiting disasters for financial gain generates long-term consequences that extend far beyond the immediate aftermath of the event. While the pursuit of “a fortune for your disaster” may yield short-term profits, it often creates systemic issues that exacerbate existing inequalities, hinder sustainable recovery, and erode public trust. Examining these long-term consequences is crucial for understanding the true cost of profiting from misfortune.

- Economic Disparity:

Disaster-related profiteering frequently exacerbates existing economic disparities. Price gouging and exploitative lending practices disproportionately impact low-income communities, widening the gap between the rich and the poor. The ability of wealthier individuals and corporations to capitalize on disaster-created opportunities further concentrates wealth, leaving vulnerable populations struggling to rebuild their lives.

- Erosion of Public Trust:

Exploitative practices during times of crisis erode public trust in institutions and markets. Instances of price gouging, insurance fraud, and misallocation of relief funds damage public confidence in businesses, government agencies, and even charitable organizations. This erosion of trust can hinder recovery efforts and create long-term cynicism towards societal structures.

- Inhibited Recovery and Development:

Focusing on short-term profit maximization can impede long-term recovery and sustainable development. Decisions driven by the pursuit of a quick return often neglect the underlying needs of affected communities, leading to inadequate infrastructure development, insufficient social support systems, and heightened vulnerability to future disasters. This short-sighted approach undermines community resilience and creates a cycle of vulnerability.

- Environmental Degradation:

Exploiting natural disasters for profit can exacerbate environmental degradation. Unregulated logging in areas devastated by storms, for instance, can lead to deforestation and increased risk of landslides. Similarly, prioritizing rapid reconstruction over environmentally sustainable practices can contribute to climate change and increase vulnerability to future environmental disasters.

These long-term consequences underscore the interconnectedness of economic opportunism and societal well-being. The pursuit of “a fortune for your disaster” creates ripple effects that extend far beyond the immediate crisis, impacting economic equality, social cohesion, and environmental sustainability. Recognizing these long-term implications is crucial for developing ethical frameworks, robust regulations, and responsible business practices that prioritize community resilience and equitable recovery over short-term profit maximization.

Frequently Asked Questions

This section addresses common inquiries regarding the complex issue of profiting from disaster, offering concise and informative responses.

Question 1: Is profiting from disaster inherently unethical?

While the concept may evoke negative connotations, the ethical implications depend heavily on the specific context. Providing essential goods and services after a disaster, even at a profit, can be a crucial component of recovery. However, exploitative practices like price gouging are clearly unethical. The key lies in distinguishing between legitimate business activity and exploitation of vulnerable populations.

Question 2: How can market manipulation be prevented during disasters?

Robust regulatory frameworks and vigilant enforcement are essential. Clear laws prohibiting price gouging, insider trading, and other manipulative practices, coupled with effective monitoring and penalties, can deter unethical behavior and promote market stability during times of crisis. Transparency in pricing and resource allocation is also crucial.

Question 3: What role does government play in mitigating the negative consequences of disaster profiteering?

Government plays a vital role in disaster response, including resource allocation, regulation of markets, and provision of aid. Effective oversight of relief funds, transparent procurement processes, and stringent enforcement of anti-gouging laws are critical government responsibilities. Furthermore, promoting ethical business practices through incentives and public awareness campaigns can foster a culture of responsible conduct during emergencies.

Question 4: How can individuals contribute to ethical conduct in disaster scenarios?

Informed consumer choices play a significant role. Supporting businesses that demonstrate ethical pricing and resource allocation practices, while avoiding those engaging in exploitative behavior, can incentivize responsible conduct. Reporting instances of price gouging or other unethical activities to relevant authorities also contributes to accountability.

Question 5: What are the long-term societal impacts of unchecked disaster profiteering?

Unchecked exploitation can exacerbate existing inequalities, erode public trust, and hinder long-term recovery. Concentrated wealth in the hands of a few, coupled with increased vulnerability of marginalized communities, can create lasting societal divisions and impede sustainable development.

Question 6: How can businesses balance profit generation with ethical considerations during disasters?

Businesses can adopt ethical frameworks that prioritize fairness, transparency, and community well-being alongside profit objectives. This includes implementing fair pricing policies, engaging in responsible resource allocation, and supporting community recovery efforts. Focusing on long-term value creation rather than short-term profit maximization can align business interests with societal needs during times of crisis.

Understanding the ethical dimensions of profiting from disaster is crucial for building resilient communities and fostering a more equitable and sustainable future.

Further exploration of related topics, such as disaster capitalism and the ethics of resource allocation, can provide deeper insights into this complex issue.

A Fortune for Your Disaster

The exploration of profiting from disaster reveals a complex interplay of economic forces, ethical considerations, and societal impact. From the immediate aftermath of a crisis to long-term recovery efforts, the pursuit of gain in the face of widespread suffering presents profound moral dilemmas. Market manipulation, resource allocation, and the potential for exacerbating existing inequalities underscore the need for careful examination of this phenomenon. Understanding the mechanisms through which individuals and organizations capitalize on disaster is crucial for developing effective regulatory frameworks and promoting ethical conduct during times of vulnerability.

The pursuit of “a fortune for your disaster” presents a stark challenge to societal values. Balancing the imperative for economic recovery with the ethical obligation to protect vulnerable populations requires ongoing dialogue, robust regulatory oversight, and a commitment to equitable resource allocation. Ultimately, building a more resilient and just future necessitates recognizing the long-term consequences of disaster profiteering and prioritizing sustainable practices that benefit all members of society, not just those positioned to profit from misfortune.