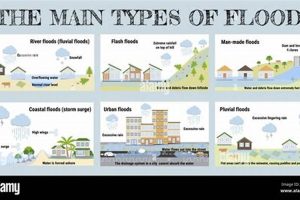

Coverage for losses caused by specific unforeseen environmental events, such as earthquakes, floods, hurricanes, and wildfires, is offered through specialized policies. For example, a homeowner’s policy might cover damage from a falling tree during a windstorm but not flooding from a hurricane’s storm surge, necessitating a separate flood insurance policy.

Financial protection against the devastating economic consequences of these events is crucial for individuals, businesses, and communities. Historically, government assistance and private charitable donations played a larger role in post-disaster recovery. The increasing frequency and severity of such events have highlighted the need for robust, accessible insurance options to facilitate quicker rebuilding and minimize long-term economic disruption. This allows for a more efficient allocation of resources and reduces reliance on post-event funding drives.

The following sections delve deeper into specific policy types, coverage limitations, cost considerations, and the evolving landscape of risk assessment in the face of a changing climate.

Disaster Preparedness and Insurance Tips

Protecting one’s assets and financial well-being requires careful planning and a thorough understanding of available resources. The following tips offer guidance on navigating the complexities of disaster preparedness and insurance.

Tip 1: Conduct a Thorough Risk Assessment: Evaluate the specific risks prevalent in a particular geographic location. Research historical data on events like floods, wildfires, and earthquakes to understand potential vulnerabilities.

Tip 2: Understand Policy Coverage and Exclusions: Carefully review policy documents to identify covered perils and exclusions. Note that standard homeowner’s policies typically exclude flood damage, requiring separate flood insurance.

Tip 3: Document Possessions and Property Value: Create a detailed inventory of belongings, including photographs or videos, to expedite claims processing. Obtain a professional appraisal to accurately assess property value.

Tip 4: Secure Important Documents: Store crucial documents like insurance policies, deeds, and identification in a secure, waterproof, and fire-resistant location or digitally in a secure cloud service.

Tip 5: Consider Mitigation Measures: Implementing preventative measures, such as installing storm shutters, reinforcing roofing, or elevating electrical systems, can reduce risk and potentially lower insurance premiums.

Tip 6: Review and Update Coverage Regularly: As property values fluctuate or life circumstances change, ensuring adequate coverage necessitates periodic policy review and adjustments.

Tip 7: Consult with Insurance Professionals: Seek expert advice from licensed insurance agents to understand policy options and choose appropriate coverage levels tailored to individual needs.

By following these guidelines, individuals can proactively safeguard their investments and enhance their resilience in the face of unforeseen natural events.

This proactive approach to disaster preparedness and insurance selection empowers individuals to minimize financial losses and navigate the recovery process more effectively.

1. Coverage Types

Selecting appropriate coverage within a natural disasters insurance policy is crucial for effective financial protection. Understanding the nuances of different coverage types allows for informed decisions tailored to specific needs and risk profiles. The following facets illustrate the diverse landscape of coverage options.

- Dwelling Coverage:

This fundamental component protects the physical structure of the insured property, including walls, roof, and foundation, against covered perils. For example, dwelling coverage would compensate for repairs to a home damaged by hurricane winds. The extent of coverage depends on the policy’s valuation method, which can be based on replacement cost or actual cash value, impacting the payout amount received.

- Personal Property Coverage:

This facet safeguards belongings within the insured property, such as furniture, appliances, and electronics, against covered perils. In the event of a wildfire, personal property coverage would help replace damaged or destroyed possessions. Coverage limits and specific exclusions for high-value items like jewelry or artwork should be carefully reviewed.

- Additional Living Expenses (ALE):

ALE coverage provides reimbursement for temporary living costs, such as hotel stays and meals, if a home becomes uninhabitable due to a covered peril. If a flood forces evacuation, ALE assists with the expenses incurred during displacement. Understanding ALE limitations and eligibility requirements is essential for effective financial planning during recovery.

- Other Structures Coverage:

This protects structures detached from the main dwelling, like garages, sheds, and fences. Damage to a detached garage caused by a falling tree during a storm would fall under this coverage. Policy limits and specific inclusions or exclusions for different types of outbuildings should be clarified.

Careful consideration of these coverage types, in conjunction with a comprehensive understanding of policy exclusions and limitations, allows for a tailored insurance approach that effectively mitigates the financial risks associated with natural disasters. Evaluating individual needs, property characteristics, and prevalent risks in a specific geographic location informs the selection of appropriate coverage levels and ensures comprehensive protection.

2. Policy Exclusions

Policy exclusions represent crucial limitations within natural disasters insurance contracts, defining circumstances where coverage does not apply. Understanding these exclusions is paramount for informed policy selection and realistic expectations regarding financial protection. A common exclusion is damage resulting from preventable negligence, such as failing to secure property against foreseeable windstorms. For instance, damage to a roof caused by inadequate maintenance might be excluded, even if a hurricane ultimately exacerbates the issue. Another frequent exclusion pertains to specific perils, requiring separate policies. Flood damage, often excluded from standard homeowner’s policies, necessitates dedicated flood insurance. Similarly, earthquake coverage typically requires a distinct policy endorsement or separate policy. Neglecting these exclusions can lead to significant financial vulnerability in the aftermath of a disaster.

The interplay between policy exclusions and covered perils significantly impacts the scope of financial protection. While a policy might cover wind damage from a hurricane, it could exclude resulting water damage if flood insurance is lacking. This distinction underscores the importance of comprehensive risk assessment and tailored coverage selection. Exclusions for earth movement, including landslides and sinkholes, further complicate coverage scenarios. Understanding the specific geological risks in a given location is crucial for determining the necessity of specialized coverage beyond standard policies. Furthermore, exclusions related to gradual damage, such as mold growth or foundation settling, necessitate careful attention to property maintenance and preventative measures. Policyholders bear responsibility for addressing such issues promptly to avoid coverage denial.

Careful scrutiny of policy exclusions is essential for mitigating potential financial hardship following a natural disaster. Reviewing policy documents thoroughly, seeking clarification from insurance professionals, and conducting a comprehensive risk assessment are crucial steps. Understanding the limitations of coverage empowers policyholders to make informed decisions, secure necessary supplemental coverage, and implement appropriate preventative measures to minimize vulnerability and enhance financial resilience. This proactive approach to policy analysis fosters realistic expectations and facilitates a more effective recovery process in the face of unforeseen natural events.

3. Premium Costs

Premium costs for natural disasters insurance represent a significant financial consideration, directly influenced by a confluence of factors related to risk assessment and actuarial calculations. Geographic location plays a pivotal role, with properties situated in high-risk zones, such as coastal areas prone to hurricanes or regions with a history of seismic activity, commanding higher premiums. This reflects the increased likelihood of claims payouts in these areas. Construction materials and building codes also influence premiums. Structures built with reinforced materials and adhering to stringent building codes demonstrate greater resilience against natural forces, often resulting in lower insurance costs. Coverage levels and deductibles further impact premium calculations. Higher coverage limits and lower deductibles offer greater financial protection but come at a higher premium price. Conversely, opting for lower coverage limits and higher deductibles reduces upfront costs but increases out-of-pocket expenses in the event of a claim.

Real-life examples illustrate the practical implications of these factors. A homeowner in a flood-prone coastal region will likely face significantly higher flood insurance premiums than a homeowner in a landlocked area with minimal flood risk. Similarly, a property constructed with earthquake-resistant features may qualify for lower earthquake insurance premiums compared to a similar property lacking such features. The age and condition of a property also play a role. Older structures, especially those with outdated electrical or plumbing systems, may incur higher premiums due to the increased risk of damage and associated claims. Understanding these variables empowers consumers to make informed decisions regarding coverage levels and associated costs, balancing financial protection with budgetary constraints.

Effectively managing premium costs requires careful evaluation of individual risk profiles, property characteristics, and available coverage options. Consulting with insurance professionals can provide valuable insights into risk mitigation strategies and available discounts. Implementing preventative measures, such as installing storm shutters or reinforcing roofing, can demonstrate proactive risk management and potentially lower premiums. Regularly reviewing and updating coverage ensures alignment with current property values and evolving risk assessments. Ultimately, a thorough understanding of the factors influencing premium costs empowers individuals to make sound financial decisions regarding natural disasters insurance, optimizing protection while managing expenses effectively.

4. Claim Processes

Claim processes within natural disasters insurance represent a critical juncture where policyholders transition from the theoretical realm of coverage to the practical application of financial protection. A streamlined and efficient claim process is essential for timely recovery and mitigation of financial hardship following a disaster. The process typically begins with prompt notification to the insurance provider, followed by detailed documentation of the damage. This documentation often includes photographs, videos, and inventories of damaged or destroyed property. A claims adjuster then assesses the extent of the damage, verifying coverage under the policy’s terms and conditions. This assessment considers policy exclusions, deductibles, and coverage limits. The speed and efficiency of this process can significantly impact the policyholder’s ability to rebuild and recover.

Several factors can influence the complexity and duration of a claim process. The scale and severity of the disaster itself can overwhelm resources, leading to delays in processing claims. For instance, widespread devastation following a major hurricane can strain the capacity of insurance companies to respond promptly to a surge in claims. The clarity and completeness of the policyholder’s documentation also play a crucial role. Thorough documentation expedites the assessment process, while inadequate or missing information can lead to delays and disputes. Disagreements regarding the extent of damage or the applicability of coverage can further complicate the process, potentially necessitating appraisals or legal intervention. Real-life examples abound, such as disputes over whether damage resulted from a covered peril like wind or an excluded peril like flooding.

Understanding the nuances of claim processes within natural disasters insurance is crucial for effective preparedness and navigation of the recovery process. Maintaining organized records of policy details, property inventories, and contact information facilitates a smoother claims experience. Promptly reporting damage and meticulously documenting losses are essential steps. Furthermore, open communication with the insurance provider and a clear understanding of policy terms and conditions can help mitigate potential challenges. This proactive approach empowers policyholders to navigate the often complex claims process efficiently, maximizing the benefits of insurance coverage and facilitating a more timely and effective recovery following a natural disaster.

5. Risk Assessment

Risk assessment forms the cornerstone of effective natural disasters insurance, providing the analytical framework for evaluating potential hazards and informing coverage decisions. This process involves identifying potential perils, analyzing their likelihood of occurrence, and quantifying potential financial losses. Cause and effect relationships are central to this assessment. For example, residing in a coastal region increases the risk of hurricane damage, while proximity to fault lines elevates earthquake risk. Understanding these connections allows for tailored insurance solutions, prioritizing coverage for the most probable and impactful threats. Without robust risk assessment, insurance coverage may inadequately address specific vulnerabilities, leaving individuals or businesses exposed to significant financial hardship in the aftermath of a disaster. This underscores risk assessment’s vital role as a fundamental component of comprehensive disaster preparedness.

Real-life examples illustrate the practical significance of risk assessment. A business operating in a flood zone requires a thorough assessment of potential flood-related disruptions, including inventory damage, business interruption, and infrastructure repair costs. This assessment informs decisions regarding flood insurance coverage levels, ensuring adequate financial protection against potential losses. Similarly, homeowners in wildfire-prone areas benefit from risk assessments that consider factors like vegetation density, proximity to firebreaks, and availability of emergency services. This information guides choices regarding wildfire insurance coverage, mitigating the potentially devastating financial consequences of fire damage. These assessments empower individuals and businesses to make informed decisions about insurance coverage, striking a balance between risk mitigation and cost-effectiveness.

Integrating risk assessment into natural disasters insurance fosters a proactive approach to financial protection, shifting the focus from reactive post-disaster recovery to proactive pre-disaster planning. Accurate risk assessment empowers individuals, businesses, and communities to make data-driven decisions regarding insurance coverage and mitigation strategies. This reduces financial vulnerability, facilitates a more efficient recovery process, and enhances overall resilience in the face of natural hazards. While challenges remain in accurately predicting the timing and severity of specific events, a thorough risk assessment provides a crucial framework for navigating the complex landscape of natural disasters insurance, maximizing financial protection and promoting long-term stability.

6. Mitigation Strategies

Mitigation strategies represent a proactive approach to reducing the risk and potential impact of natural disasters, playing a crucial role in the broader context of natural disasters insurance. These strategies encompass a range of actions aimed at minimizing vulnerability to specific hazards, influencing both the likelihood and severity of potential damage. Implementing mitigation measures can create a symbiotic relationship with insurance, often leading to reduced premiums and enhanced overall financial protection. The cause-and-effect relationship between mitigation and insurance cost is significant; demonstrable risk reduction can translate directly into lower insurance premiums. For example, reinforcing a roof to withstand high winds can lessen the potential for damage during a hurricane, reducing the likelihood of a claim and potentially lowering windstorm insurance premiums. This connection underscores the importance of mitigation strategies as a key component of a comprehensive approach to natural disasters insurance, moving beyond simply transferring risk to actively reducing it.

Real-life examples illustrate the practical significance of this connection. A homeowner installing flood vents in a flood-prone area reduces the risk of structural damage during a flood event. This proactive measure not only minimizes potential losses but can also lower flood insurance premiums. Similarly, businesses implementing robust fire suppression systems and creating defensible spaces around their properties demonstrate a commitment to wildfire mitigation, potentially reducing fire insurance costs. Furthermore, communities investing in infrastructure improvements, such as levees or reinforced seawalls, enhance their resilience against natural hazards and may qualify for lower insurance rates overall. These examples demonstrate the tangible benefits of integrating mitigation strategies into disaster preparedness planning, optimizing the effectiveness of insurance coverage.

Understanding the interplay between mitigation strategies and natural disasters insurance fosters a more comprehensive and cost-effective approach to risk management. By proactively reducing vulnerability, individuals, businesses, and communities enhance their resilience against natural hazards, minimize potential financial losses, and optimize insurance investments. While mitigation efforts cannot eliminate all risks, they represent a crucial component of a robust disaster preparedness strategy, fostering a more sustainable and financially secure future in the face of inevitable natural events. This integrated approach underscores the importance of moving beyond reactive insurance coverage toward proactive risk reduction, creating a more resilient and financially secure environment for all.

Frequently Asked Questions about Natural Disasters Insurance

Addressing common inquiries and misconceptions surrounding natural disasters insurance is crucial for informed decision-making and effective risk management. The following FAQs provide clarity on key aspects of this complex topic.

Question 1: Does standard homeowner’s insurance cover flood damage?

Standard homeowner’s insurance typically excludes flood damage. Separate flood insurance, often available through the National Flood Insurance Program (NFIP) or private insurers, is necessary for comprehensive flood protection.

Question 2: How are insurance premiums determined for earthquake coverage?

Earthquake insurance premiums are calculated based on factors such as location, proximity to fault lines, soil type, construction materials, and building age. Properties in high-risk seismic zones generally incur higher premiums.

Question 3: What is the typical waiting period for flood insurance to take effect?

A waiting period, typically 30 days, often applies before flood insurance coverage becomes active. Exceptions may exist for certain circumstances, such as purchasing coverage in conjunction with a mortgage closing.

Question 4: How does a deductible work in natural disasters insurance claims?

A deductible represents the out-of-pocket expense the policyholder must pay before insurance coverage begins. Higher deductibles generally result in lower premiums, but increase the policyholder’s financial responsibility in the event of a claim.

Question 5: What documentation is typically required for filing a claim after a natural disaster?

Documentation requirements often include photographs and videos of the damage, detailed inventories of damaged or destroyed property, proof of ownership, and any relevant supporting documentation, such as repair estimates or receipts.

Question 6: How can individuals and businesses mitigate the financial impact of natural disasters beyond insurance?

Mitigation strategies, such as reinforcing structures, installing storm shutters, creating defensible spaces around properties, and developing emergency preparedness plans, can significantly reduce the risk and potential financial impact of natural disasters.

Understanding these fundamental aspects of natural disasters insurance empowers individuals and businesses to make informed decisions regarding risk management and financial protection. Further research and consultation with insurance professionals are encouraged for comprehensive planning and tailored coverage selection.

This concludes the FAQ section. The following section delves into the specific types of natural disaster insurance policies available.

Natural Disasters Insurance

This exploration of natural disasters insurance has highlighted its multifaceted nature, encompassing coverage types, policy exclusions, premium costs, claim processes, risk assessment, and mitigation strategies. Understanding these components is crucial for informed decision-making, enabling individuals and businesses to secure appropriate financial protection against the potentially devastating consequences of unforeseen natural events. The increasing frequency and severity of such events underscore the importance of comprehensive risk management and proactive preparedness.

Adequate natural disasters insurance represents not merely a financial safeguard but a critical investment in resilience. Proactive planning, informed policy selection, and diligent risk mitigation are essential for navigating the evolving landscape of natural hazards. The future demands a collective commitment to building more resilient communities, adapting to a changing climate, and prioritizing financial security in the face of inevitable natural events. The time for proactive engagement is now.