Policies specifically designed to protect against financial losses arising from natural disasters exist. These policies typically cover a range of perils, including earthquakes, floods, hurricanes, wildfires, and other similar events. For example,... Read more »

Protection against unforeseen events during trips is crucial. Policies may offer coverage for trip cancellations, interruptions, or delays caused by events like earthquakes, hurricanes, or volcanic eruptions, as well as reimbursement for... Read more »

Policies covering losses caused by events such as earthquakes, floods, hurricanes, and wildfires typically use specific designations for these occurrences. For instance, “Acts of God” is a commonly used phrase, though increasingly,... Read more »

Protection against financial losses stemming from events such as earthquakes, floods, hurricanes, and wildfires is typically available through various insurance policies. For example, homeowners insurance may cover damage from fire sparked by... Read more »

Protection against financial loss due to unforeseen calamities such as earthquakes, floods, hurricanes, and wildfires is typically obtained through specialized policies. For example, a homeowner might purchase a separate policy to supplement... Read more »

Standard homeowners insurance policies typically do not cover all natural events. While damage from fire and wind is generally included, coverage for floods, earthquakes, and other specific perils is often excluded from... Read more »

Auto insurance policies typically cover vehicle damage resulting from certain natural events. Comprehensive coverage, an optional addition to standard liability insurance, is the key to this protection. For example, damage caused by... Read more »

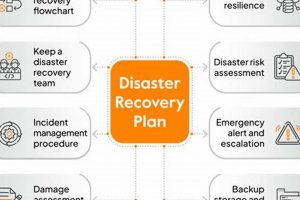

Protection for business continuity expenses incurred when activating a documented strategy to restore operations after unforeseen events, like natural disasters or cyberattacks, is a critical aspect of risk management. For instance, this... Read more »

Financial protection from calamities such as earthquakes, floods, hurricanes, and wildfires is a critical aspect of risk management for homeowners and businesses. Different policies offer varying levels of coverage for specific perils,... Read more »

Coverage for losses caused by specific unforeseen environmental events, such as earthquakes, floods, hurricanes, and wildfires, is offered through specialized policies. For example, a homeowner’s policy might cover damage from a falling... Read more »