Individuals and households impacted by presidentially declared disasters might be eligible for federal assistance. Generally, eligibility hinges on sustaining damage to one’s primary residence in a designated disaster area and demonstrating a need for financial support to recover. For instance, those whose homes are uninhabitable due to flooding or fire may qualify for grants to cover temporary housing, essential home repairs, or replacement of personal property. Eligibility is not automatic and requires an application process with supporting documentation.

Access to such aid is often crucial for individuals and communities struggling to rebuild after catastrophic events. This assistance can provide a critical lifeline, enabling families to secure safe shelter, replace essential belongings, and begin the long process of recovery. Historically, federal disaster relief programs have evolved to address the increasing frequency and severity of natural disasters, aiming to mitigate the devastating financial impacts on survivors and bolster community resilience.

The following sections will explore the specific eligibility criteria, application procedures, available aid programs, and common misconceptions related to receiving disaster assistance. Additional topics covered include navigating the appeals process and resources for further support.

Tips for Disaster Assistance Applicants

Applying for disaster assistance can be a complex process. These tips are designed to streamline the application and improve the likelihood of receiving aid.

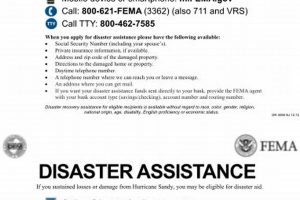

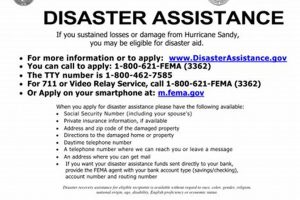

Tip 1: Register with FEMA as soon as possible. Disaster assistance has limited availability. Early registration expedites the process.

Tip 2: Document all damage thoroughly. Photographic and video evidence of damage to property and belongings are critical for substantiating claims. Detailed records of repair or replacement costs are also recommended.

Tip 3: Maintain accurate records of all communication with FEMA. Keep copies of application numbers, correspondence, and any other relevant documentation.

Tip 4: Understand the specific eligibility requirements for each aid program. Requirements vary depending on the specific program and the nature of the disaster. Researching these details beforehand can prevent delays.

Tip 5: Be prepared to provide necessary documentation. Proof of identity, residency, and ownership or occupancy of the damaged property are typically required. Gather these documents in advance to expedite the application process.

Tip 6: Don’t hesitate to seek clarification or assistance. FEMA helplines and Disaster Recovery Centers offer support to applicants navigating the process. Consult these resources for any questions or concerns.

Following these tips can significantly improve the efficiency and success of the disaster assistance application process. Preparedness and accurate documentation are essential for receiving timely and appropriate aid.

The subsequent section provides further details on specific aid programs, eligibility criteria, and the appeals process.

1. Declared Disaster Area

A “Declared Disaster Area” designation is the foundational requirement for accessing FEMA disaster relief. This declaration, issued by the President of the United States, officially recognizes the severity of an event’s impact on a specific geographic area, triggering the availability of federal assistance. Without this declaration, individuals and communities affected by the disaster are ineligible for most forms of FEMA aid.

- Types of Disasters Covered

Presidential disaster declarations encompass a range of events, including natural disasters like hurricanes, floods, wildfires, earthquakes, and tornadoes, as well as human-caused disasters such as terrorist attacks and hazardous material spills. The specific type of disaster declared influences the types of assistance available. For example, a flood-related declaration might trigger individual assistance for housing repairs and temporary shelter, while a fire-related declaration could emphasize debris removal and mitigation assistance.

- Geographic Specificity

Declarations delineate specific geographic areas eligible for assistance, often defined by county or zip code. Residents outside the designated area, even if affected by the same event, generally do not qualify for FEMA assistance. For instance, if a hurricane impacts multiple counties but the declaration only covers a specific few, only residents within those designated counties are eligible for aid. This emphasizes the importance of verifying inclusion within the official declared area.

- Individual Assistance vs. Public Assistance

Disaster declarations often specify whether they authorize Individual Assistance, Public Assistance, or both. Individual Assistance programs focus on direct aid to individuals and households for housing repairs, temporary shelter, and other essential needs. Public Assistance programs, on the other hand, support community infrastructure repair and restoration efforts by providing funds to state and local governments. The specific programs available under a declaration depend on the declared disaster type and its assessed impact.

- Duration of Declaration

The declaration period establishes the timeframe within which individuals can register for assistance and access available programs. Missing the registration deadline can significantly hinder access to much-needed support. Therefore, understanding the declaration’s duration and registering promptly are critical. The length of the declaration period varies depending on the severity and complexity of the disaster.

The “Declared Disaster Area” designation is not merely a formality but a critical gateway to federal disaster relief. Understanding its nuances, including the types of disasters covered, geographic specificity, and available assistance programs, is paramount for those seeking aid after a catastrophic event. This designation, coupled with individual eligibility factors, ultimately determines access to crucial resources for recovery and rebuilding.

2. Verified Damages

Verified damages constitute a cornerstone of FEMA disaster relief eligibility. A direct causal link must exist between the declared disaster and the claimed damages. Damage verification ensures that federal funds are allocated appropriately to those directly impacted by the disaster. This process involves meticulous documentation and, often, on-site inspections by FEMA personnel. For instance, damage resulting from a flood in a declared flood disaster area would be considered, while pre-existing damage or damage caused by unrelated events would not. Without verifiable damage directly attributable to the declared disaster, eligibility for assistance is unlikely.

The verification process typically requires applicants to provide substantial evidence of damage. This might include photographs, videos, insurance reports, contractor estimates, and receipts for repairs. The more comprehensive the documentation, the stronger the claim. Consider a scenario where a home sustains wind damage during a hurricane. Clear photographs of the damaged roof, accompanied by a contractor’s estimate for repairs, would serve as robust verification. Conversely, vague descriptions or insufficient evidence could lead to claim denial. Therefore, meticulous documentation of all disaster-related damage is paramount for a successful application.

Accurate damage verification serves multiple crucial functions within the disaster relief framework. It ensures equitable distribution of limited resources, prevents fraudulent claims, and facilitates the efficient processing of legitimate applications. Furthermore, the verification process provides valuable data for disaster impact assessments, informing future mitigation and preparedness strategies. Challenges can arise when damage is difficult to access or document, such as in heavily impacted or remote areas. However, FEMA provides resources and guidance to address such challenges, emphasizing the importance of thorough documentation in all cases.

3. Uninsured or Underinsured Losses

Uninsured or underinsured losses represent a critical factor in determining eligibility for FEMA disaster relief. Federal assistance aims to bridge the gap between available insurance coverage and the actual cost of disaster-related damages. A causal relationship must exist between the declared disaster and the uninsured or underinsured loss. For instance, if a homeowner’s flood insurance policy does not fully cover the cost of repairing flood damage caused by a declared flood disaster, they may qualify for FEMA assistance to address the shortfall. Conversely, losses covered by existing insurance policies are typically ineligible for FEMA aid. This principle underscores the program’s role as a safety net for those lacking sufficient insurance coverage to recover from a disaster.

The extent of uninsured or underinsured losses directly impacts the amount of assistance an individual or household may receive. A comprehensive assessment of these losses is crucial during the application process. Supporting documentation, such as insurance policy details, claim settlements, and estimates for uncovered repairs, is essential for substantiating the need for federal assistance. Consider a scenario where a homeowner’s fire insurance policy covers structural damage but not the replacement of personal belongings lost in a declared fire disaster. In this case, FEMA assistance might be available to help replace essential personal property. The ability to demonstrate the extent of uninsured losses is paramount for maximizing potential aid.

Understanding the role of uninsured and underinsured losses in FEMA disaster relief eligibility is crucial for individuals and communities preparing for and recovering from disasters. Adequate insurance coverage serves as the first line of defense against financial hardship following a disaster. However, when insurance falls short, FEMA assistance can provide a critical lifeline. Recognizing this interplay encourages proactive disaster preparedness, including evaluating insurance needs and understanding the limitations of coverage. While FEMA assistance is designed to mitigate the impact of uninsured or underinsured losses, it’s essential to remember that these programs have limitations. Therefore, maintaining comprehensive insurance coverage remains the most effective strategy for financial protection in the face of disaster.

4. Primary Residence Affected

The “primary residence affected” requirement plays a significant role in determining eligibility for FEMA disaster relief. Assistance programs primarily focus on restoring habitability to the dwelling where individuals reside permanently. Damage to secondary residences, vacation homes, or investment properties generally does not qualify for FEMA individual assistance. This stipulation ensures that limited resources are directed towards those facing the most immediate and critical housing needs following a disaster. For instance, if an individual owns both a primary residence and a vacation home in a declared disaster area, and both properties sustain damage, FEMA assistance would typically apply only to the primary residence. Damage to the vacation home, while unfortunate, would not meet the primary residence criterion for individual assistance.

Establishing primary residency involves demonstrating a consistent and demonstrable pattern of living at the affected address. Proof of residency may include utility bills, driver’s license, voter registration, or other official documentation linking the individual to the property. Cases involving recent relocation or temporary displacement can present challenges. However, FEMA provides guidance on addressing these situations during the application process. The emphasis remains on ensuring that assistance reaches those whose primary living space has been compromised by the disaster. Consider a scenario where a family recently moved to a new state and a disaster strikes shortly after their arrival. Providing documentation of the move, lease agreement, or other evidence establishing the new address as their primary residence becomes crucial for accessing FEMA aid. The practical significance of this understanding underscores the importance of maintaining accurate and up-to-date residency documentation.

The primary residence stipulation serves as a critical filter in allocating disaster relief resources efficiently and equitably. While acknowledging the impact disasters can have on various property types, the focus remains on restoring essential housing needs. Understanding this aspect of eligibility empowers individuals to prepare adequately and navigate the application process effectively. Furthermore, it clarifies the scope of FEMA assistance, managing expectations and ensuring that resources reach those facing the most pressing housing challenges in the aftermath of a disaster.

5. US Citizenship or Qualified Alien Status

Eligibility for FEMA disaster relief is generally tied to U.S. citizenship or possessing qualified alien status. This requirement stems from the fundamental principle that federal disaster assistance programs primarily serve U.S. citizens and those with legal residency. Qualified alien status encompasses specific immigration categories recognized by federal law, granting individuals certain rights and benefits, including potential access to disaster relief. This stipulation ensures that federal resources are directed towards those legally residing within the United States and its territories. For instance, a lawful permanent resident (Green Card holder) affected by a hurricane would likely meet the qualified alien status requirement, while an undocumented individual, even if residing in the affected area, would not. Understanding the distinction between these statuses is critical for navigating disaster relief eligibility.

The practical implication of this requirement manifests in the documentation necessary to establish eligibility during the FEMA application process. Applicants typically need to provide proof of citizenship or qualified alien status, such as a U.S. passport, birth certificate, or Green Card. Failure to provide satisfactory documentation can lead to delays or denial of assistance. Consider a scenario where a family affected by a wildfire includes both U.S. citizens and non-citizen family members. While citizen family members may be eligible for direct assistance, non-citizen members might only qualify for limited aid or require a U.S. citizen or qualified alien to apply on their behalf for certain benefits. Navigating these nuances requires a thorough understanding of the documentation requirements and available resources.

The “U.S. citizenship or qualified alien status” criterion serves as a fundamental component of FEMA’s eligibility framework. While exceptions exist for certain limited forms of assistance, such as crisis counseling and mass care services, access to the full range of disaster relief programs typically necessitates meeting this requirement. This policy underscores the focus on supporting those with legal residency within the United States during times of crisis. Addressing these complexities requires clear communication, accessible resources, and a commitment to equitable aid distribution. Recognizing the intersection of immigration status and disaster relief eligibility remains crucial for ensuring that vulnerable populations receive necessary support in the aftermath of disasters.

6. Social Security Number

A Social Security number (SSN) serves as a crucial identifying factor within the FEMA disaster relief application process. Its primary function lies in verifying identity and preventing fraud, ensuring that federal assistance reaches legitimate recipients. This requirement aligns with broader federal program standards, where the SSN acts as a unique identifier for accessing benefits and services. The SSN’s role becomes particularly significant in disaster scenarios, where efficient and accurate aid distribution is paramount. For instance, an individual applying for assistance following a hurricane must provide their SSN as part of the registration process. This allows FEMA to verify their identity against existing records, preventing duplicate applications and ensuring that aid is directed appropriately. Without a valid SSN, navigating the application process and accessing aid becomes significantly more challenging.

The connection between SSN and disaster relief eligibility extends beyond mere identification. It facilitates the integration of disaster assistance with other federal programs, enabling a more holistic approach to recovery. By utilizing the SSN, FEMA can coordinate aid distribution with other agencies, preventing overlaps and maximizing the impact of available resources. Consider a scenario where a family displaced by a flood requires both FEMA housing assistance and SNAP benefits. The SSN serves as a common identifier, allowing seamless coordination between FEMA and the administering agency for SNAP, streamlining the application process and ensuring the family receives the necessary support from both programs. This interconnectedness underscores the practical significance of the SSN within the broader disaster recovery framework.

In summary, the SSN plays a pivotal role in FEMA disaster relief, serving as a linchpin for identity verification, fraud prevention, and interagency coordination. While challenges can arise for individuals without an SSN or those facing complex documentation issues, understanding its importance is crucial for navigating the application process successfully. This requirement underscores the broader significance of accurate personal identification within federal programs, particularly in times of crisis, where efficient and equitable aid distribution becomes paramount. Recognizing the multifaceted role of the SSN empowers individuals to prepare adequately and access necessary assistance during disaster recovery.

7. Meet financial need requirements

Meeting financial need requirements constitutes a critical component of FEMA disaster relief eligibility. This criterion ensures that federal assistance is directed towards those whose financial resources are insufficient to cover essential disaster-related expenses. A demonstrated inability to meet basic needs like housing, food, or medical care due to disaster-caused losses forms the basis of this assessment. For instance, an individual whose home was destroyed by a hurricane and who lacks the financial means to secure alternative housing would likely meet the financial need requirement, while an individual with significant personal assets capable of covering similar expenses might not. This distinction underscores FEMA’s role as a safety net for those facing significant financial hardship due to disasters.

Demonstrating financial need typically involves providing documentation of income, assets, and disaster-related expenses. Applicants may need to submit pay stubs, bank statements, tax returns, insurance settlements, and receipts for repair or replacement costs. The greater the disparity between available resources and disaster-related expenses, the stronger the case for financial need. Consider a scenario where a low-income family loses their home and all possessions in a wildfire. Their limited income and lack of savings would likely demonstrate a clear financial need for FEMA assistance to cover temporary housing, essential household items, and other recovery costs. Conversely, a high-income family with substantial savings might be expected to utilize personal resources before qualifying for federal aid. The practical implication underscores the importance of maintaining accurate financial records and understanding the documentation required to demonstrate need effectively.

In summary, “meeting financial need requirements” serves as a crucial filter in allocating limited disaster relief resources to those most in need. While all disaster survivors face challenges, FEMA prioritizes assistance for those lacking the financial capacity to recover independently. Understanding this criterion empowers individuals to prepare adequately for potential disasters, gather necessary documentation, and navigate the application process effectively. This requirement also highlights the broader societal implications of disaster recovery, emphasizing the need for robust social safety nets to support vulnerable populations in times of crisis. Recognizing the interplay between financial need and disaster relief eligibility is essential for ensuring equitable aid distribution and fostering community resilience in the face of future disasters.

Frequently Asked Questions

This section addresses common inquiries regarding eligibility for federal disaster assistance.

Question 1: Does homeownership affect eligibility for assistance?

Renters can also qualify for assistance. Eligibility is not limited to homeowners. Occupants of damaged primary residences may qualify for aid, regardless of ownership status.

Question 2: What if the damage is minor?

The severity of damage influences the type and amount of assistance available. Even minor damage may qualify for certain programs, particularly if it impacts the habitability of the primary residence.

Question 3: Is assistance available for secondary residences or vacation homes?

Generally, assistance focuses on primary residences. Damage to secondary residences typically does not qualify for individual assistance programs.

Question 4: What documentation is required to prove occupancy of a damaged residence?

Various documents can serve as proof of occupancy, including utility bills, lease agreements, driver’s license with the affected address, or official correspondence addressed to the applicant at the damaged residence.

Question 5: How does FEMA verify the reported damages?

Damage verification may involve inspections, review of submitted documentation such as photographs and repair estimates, and comparison with available data from other sources.

Question 6: What if an applicant disagrees with FEMA’s determination of eligibility or assistance amount?

An appeals process exists for applicants who disagree with FEMA’s decisions. Specific procedures and deadlines apply to the appeals process.

Understanding these common questions clarifies eligibility requirements and facilitates a smoother application process. Consulting official FEMA resources provides further clarification and addresses specific circumstances.

The following section provides further details on the application process and available aid programs.

Conclusion

Eligibility for FEMA disaster relief hinges on a confluence of factors. A presidentially declared disaster area designation is the foundational requirement, establishing the geographic scope of federal assistance. Within this designated area, individuals and households must demonstrate verifiable damage to their primary residence directly caused by the declared disaster. Uninsured or underinsured losses resulting from the disaster further contribute to eligibility, with federal aid designed to bridge the gap between available insurance coverage and actual recovery costs. Applicants must also meet specific criteria related to U.S. citizenship or qualified alien status, provide a Social Security number for identification and verification purposes, and demonstrate financial need based on an assessment of income, assets, and disaster-related expenses. These interwoven factors collectively determine access to vital resources for individuals and communities striving to rebuild their lives after a catastrophic event.

Understanding these multifaceted eligibility requirements is paramount for navigating the often-complex application process successfully. Preparedness, thorough documentation, and timely application submission are crucial for maximizing access to available aid. While FEMA disaster relief represents a critical lifeline for those impacted by disasters, proactive measures, such as maintaining adequate insurance coverage and developing comprehensive disaster preparedness plans, remain essential for mitigating the devastating financial impacts of future catastrophic events. The collective responsibility of individuals, communities, and government agencies in preparing for and responding to disasters underscores the importance of a holistic and informed approach to disaster resilience.