Federal assistance for small businesses impacted by declared disasters provides crucial financial support for recovery. These funds can cover physical damage to property, economic injury caused by the disaster, and mitigation measures to protect against future events. For example, a restaurant damaged by a hurricane could receive funds to repair the building, replace lost inventory, and implement floodproofing measures.

This aid is vital for community resilience, enabling businesses to reopen, rehire employees, and contribute to the local economy’s recovery. Historically, such programs have been instrumental in helping communities rebuild after significant events, recognizing that small businesses are often the backbone of local economies and the most vulnerable to disaster impacts. These programs offer a lifeline, facilitating a quicker return to normalcy and mitigating long-term economic hardship.

Further exploration will cover eligibility requirements, application procedures, available funding amounts, and other essential aspects of disaster assistance for affected enterprises.

Tips for Disaster Assistance Applicants

Securing disaster assistance requires careful preparation and a thorough understanding of the application process. The following tips offer guidance for businesses seeking federal aid following a declared disaster.

Tip 1: Document Everything. Maintain meticulous records of all disaster-related damages and losses. Detailed photographs, videos, receipts, and insurance documents are crucial for substantiating claims.

Tip 2: Contact Insurance Providers Immediately. File insurance claims promptly and provide all necessary documentation to expedite the process. Federal assistance may supplement insurance coverage, but it’s essential to maximize insurance payouts first.

Tip 3: Understand Eligibility Requirements. Carefully review all eligibility criteria before applying. Requirements may vary depending on the specific disaster and type of assistance requested.

Tip 4: Gather Required Documentation. Assemble all necessary documentation, including proof of business ownership, tax returns, and financial statements, well in advance of applying. This will streamline the application process.

Tip 5: Apply as Soon as Possible. Application deadlines are strictly enforced. Submitting a complete application as quickly as possible is critical for receiving timely assistance.

Tip 6: Keep Records of Communication. Maintain thorough records of all communications with relevant agencies, including application confirmation numbers, caseworker contact information, and dates of correspondence.

Tip 7: Seek Professional Assistance if Needed. Consider consulting with a disaster recovery specialist or accountant for complex situations or if assistance is needed navigating the application process.

By following these guidelines, applicants can significantly increase their chances of securing necessary disaster assistance, facilitating a more efficient and less stressful recovery process.

This guidance provides essential preparation steps for navigating the disaster assistance application process, setting the stage for a successful recovery.

1. Eligibility Requirements

Eligibility requirements serve as a critical gateway for accessing federal disaster assistance allocated to small businesses. These stipulations ensure that limited funds are distributed equitably and efficiently to those truly in need. A clear understanding of these requirements is paramount for a successful application. Criteria typically encompass several factors, including the physical location of the business within a declared disaster area, verifiable disaster-related damage, and demonstrated financial need. For instance, a business operating outside the designated disaster zone, even if indirectly impacted, might not qualify for assistance. Similarly, pre-existing financial difficulties, unrelated to the disaster, could complicate eligibility.

Understanding the nuances of eligibility requirements can be complex. For example, a business might have insurance coverage for some damages but not others. In such cases, applicants must demonstrate that insurance proceeds are insufficient to cover essential recovery costs. Another common scenario involves businesses operating from multiple locations. Eligibility may be determined on a location-by-location basis, depending on the specific disaster declaration and the extent of damage at each site. Navigating these complexities often necessitates careful documentation and potentially professional guidance.

Meeting eligibility criteria is not merely a procedural hurdle but a fundamental step in the recovery process. A thorough understanding of these requirements allows businesses to assess their eligibility accurately, gather necessary documentation, and present a compelling case for assistance. Ultimately, adhering to these requirements ensures the effective allocation of resources to those most in need, fostering a more resilient and equitable recovery for affected communities.

2. Application Process

The application process for federal disaster assistance designed for small businesses represents a critical juncture in the recovery journey. A well-navigated application can be the difference between accessing crucial funds and facing prolonged financial hardship. This process serves as the conduit through which eligible businesses articulate their needs and demonstrate their eligibility. Understanding the intricacies of this process is therefore essential for successful recovery. For instance, a business failing to provide adequate documentation of disaster-related losses risks application rejection, regardless of the legitimate need. Conversely, a meticulously prepared application, complete with supporting evidence, significantly improves the likelihood of approval and expedites the distribution of funds.

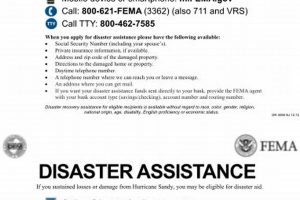

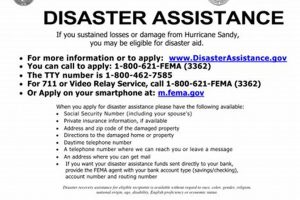

Several key elements typically comprise the application process. Applicants must first register with the appropriate agency, often FEMA, to initiate the process. This registration generally involves providing essential business information and verifying disaster-related impact. Subsequently, applicants complete a comprehensive application form, detailing the extent of damages, estimated losses, and requested assistance. Supporting documentation, such as insurance claims, photographs, and financial records, must accompany the application. Failure to submit required documentation can lead to delays or rejection. Furthermore, applicants should anticipate potential follow-up inquiries from the agency, requiring further clarification or documentation. For example, an applicant seeking assistance for damaged equipment might be asked to provide purchase receipts or repair estimates.

Navigating the application process effectively requires meticulous attention to detail, thorough documentation, and proactive communication with the relevant agencies. Challenges may arise throughout the process, such as navigating complex forms, gathering required documentation, or addressing follow-up inquiries. However, understanding the process’s intricacies and maintaining clear communication can mitigate these challenges and increase the likelihood of a successful outcome. A successful application process directly translates to timely access to vital financial resources, enabling businesses to rebuild, rehire, and contribute to the overall community recovery.

3. Funding Limits

Funding limits constitute a critical aspect of federal disaster grant programs for small businesses. These limits determine the maximum amount of financial assistance a business can receive for disaster-related losses. Understanding these limits is crucial for applicants to develop realistic recovery plans and explore supplemental funding options if necessary. Funding limits are not arbitrary but reflect the program’s overall budget constraints and the need to distribute limited resources equitably among affected businesses. For instance, a business with extensive damage exceeding the established funding limit must consider alternative financing mechanisms, such as low-interest loans or private insurance, to cover the remaining recovery costs. Conversely, understanding the limits allows businesses with less extensive damage to maximize available grant funding within established parameters. This understanding facilitates informed decision-making and efficient resource allocation during the recovery process.

Several factors influence funding limits, including the specific program, the nature of the disaster, and the demonstrated need of the applicant. For example, grants for physical damage might have different limits than grants for economic injury. Furthermore, the severity of the disaster can impact available funding, with larger-scale disasters potentially leading to adjustments in funding limits. Critically, the applicant’s demonstrated need plays a significant role in determining the final grant amount, even within established limits. A business demonstrating a clear and compelling need for the maximum allowable grant is more likely to receive full funding than a business with less substantial justification. This emphasizes the importance of meticulous documentation and a clear articulation of need during the application process. Consider a business seeking assistance to repair a damaged building. Providing detailed repair estimates from licensed contractors strengthens the application and justifies the requested funding within established limits.

Recognizing the implications of funding limits enables businesses to develop comprehensive recovery strategies. While grant funding serves as a crucial resource, it may not cover all recovery costs. Therefore, understanding the limits empowers businesses to explore alternative funding options proactively, such as Small Business Administration (SBA) loans, private insurance payouts, or lines of credit. This proactive approach ensures a smoother transition to recovery and minimizes potential financial strain. Ultimately, a clear understanding of funding limits within the context of federal disaster grants enables informed decision-making, realistic budgeting, and a more resilient recovery for impacted businesses.

4. Eligible Uses

Eligible uses of federal small business disaster grants define the permissible purposes for which awarded funds can be allocated. This specificity ensures that financial assistance directly addresses disaster-related needs, promoting efficient resource allocation and maximizing community recovery. A clear understanding of eligible uses is essential for applicants to align recovery plans with program guidelines, preventing misuse of funds and ensuring compliance. This understanding fosters transparency and accountability in the distribution and utilization of disaster relief resources. For example, while grants may cover repairing damaged equipment, they typically do not cover expansion projects or unrelated business expenses. A business attempting to use grant funds for ineligible purposes risks penalties and repayment obligations.

Eligible uses often encompass a range of recovery needs, including physical damage repairs, inventory replacement, operating expense coverage, and mitigation measures. Physical damage repairs might include restoring a damaged storefront or replacing essential equipment. Inventory replacement allows businesses to replenish stock lost or damaged due to the disaster. Operating expense coverage can provide temporary support for payroll, rent, or utilities while the business recovers. Mitigation measures, such as floodproofing or reinforcing structures, aim to reduce future disaster vulnerability. A restaurant damaged by a hurricane could use grant funds to repair the building, replace spoiled food, cover employee wages during closure, and elevate electrical systems to mitigate future flood risk. However, purchasing new kitchen appliances unrelated to the hurricane damage would be an ineligible use.

Understanding eligible uses is crucial for both applicants and granting agencies. Applicants can develop targeted recovery plans, ensuring alignment with program guidelines and maximizing the impact of received funds. Granting agencies can effectively monitor fund utilization, ensuring compliance and promoting transparency. This shared understanding fosters responsible resource management, strengthens accountability, and contributes to a more effective and equitable disaster recovery process. Challenges can arise when the line between eligible and ineligible uses becomes blurred, such as determining whether specific equipment replacements are directly related to the disaster. Careful documentation and clear communication with the granting agency can mitigate these challenges and ensure compliance.

5. Loan Options

Loan options often complement federal grant programs for small businesses impacted by disasters. While grants provide crucial upfront funding for immediate recovery needs, loans offer supplemental financial support to address longer-term recovery and bridge financial gaps. This combination of grants and loans provides a more comprehensive approach to disaster recovery, recognizing that recovery needs often extend beyond the scope of immediate repairs and replacements.

- SBA Disaster Loans

Small Business Administration (SBA) disaster loans are a primary resource for businesses seeking supplemental funding after a declared disaster. These loans offer favorable terms, including lower interest rates and longer repayment periods, making them more accessible to businesses facing financial strain. For example, a business might secure an SBA loan to cover operating expenses while rebuilding after a fire, supplementing any grant funding received for physical repairs. These loans play a critical role in bridging the gap between immediate recovery needs and long-term business viability.

- Economic Injury Disaster Loans (EIDLs)

EIDLs specifically address economic hardship resulting from a disaster, even if the business did not experience direct physical damage. These loans can cover operating expenses, payroll, and debts incurred due to the disaster’s economic impact. A business forced to close temporarily due to a hurricane, even without physical damage to the premises, might secure an EIDL to cover ongoing expenses and avoid layoffs during the closure. This targeted assistance helps maintain business continuity and mitigate long-term economic consequences.

- Bridge Loans

Bridge loans provide short-term financing to cover immediate cash flow needs while waiting for disaster assistance or insurance payouts. These loans offer a temporary lifeline, allowing businesses to address urgent expenses and maintain operations during the initial recovery phase. A business awaiting insurance proceeds for damaged inventory might utilize a bridge loan to purchase replacement stock, ensuring continued operations and mitigating revenue loss. This short-term financing bridges the gap between immediate needs and anticipated funding.

- Lines of Credit

Lines of credit offer flexible access to funds, allowing businesses to draw on credit as needed during the recovery process. This provides businesses with greater control over their finances, enabling them to address unforeseen expenses and adjust to evolving recovery needs. A business rebuilding after a flood might utilize a line of credit to cover unexpected repair costs or address fluctuating supply chain disruptions. This flexibility allows for adaptive financial management during a dynamic recovery period.

Understanding available loan options is essential for developing a comprehensive disaster recovery plan. While grant funding may address immediate needs, loan options provide the necessary flexibility and supplemental resources to navigate longer-term recovery challenges and ensure sustained business viability. The strategic combination of grants and loans can significantly enhance a business’s resilience and contribute to a more robust and sustainable community recovery following a disaster.

6. Mitigation Assistance

Mitigation assistance, a key component of federal disaster grant programs for small businesses, focuses on preemptive measures to reduce future disaster impacts. Funding allocated for mitigation recognizes that investing in preventative measures can significantly reduce long-term recovery costs and enhance community resilience. This proactive approach complements post-disaster recovery efforts by addressing underlying vulnerabilities and promoting sustainable rebuilding practices.

- Property Protection

Mitigation grants can fund structural improvements to protect business properties from future hazards. Elevating critical equipment, reinforcing roofs, and installing floodproofing measures are examples of eligible mitigation activities. A business located in a flood-prone area might elevate electrical panels and HVAC systems to prevent damage during future floods. These proactive measures minimize disruptions, reduce repair costs, and expedite recovery following a disaster.

- Hazard Resistance

Strengthening building codes and implementing hazard-resistant construction techniques enhance a community’s overall resilience to disasters. Mitigation funding can support the adoption of these enhanced building practices, ensuring that reconstructed structures are better equipped to withstand future events. A business rebuilding after an earthquake might utilize mitigation funds to incorporate seismic retrofits, reducing the risk of structural damage in future earthquakes. This strengthens both individual businesses and the broader community’s ability to withstand future shocks.

- Business Continuity Planning

Developing comprehensive business continuity plans helps businesses prepare for disruptions and maintain essential operations during and after a disaster. Mitigation assistance can support the development and implementation of these plans, ensuring businesses have strategies in place to address supply chain disruptions, communication outages, and other potential challenges. A business reliant on online sales might develop a backup communication system to maintain customer contact during internet outages, minimizing disruption and ensuring continued operations.

- Community-Wide Mitigation Projects

Mitigation efforts often extend beyond individual businesses to encompass community-wide projects. Improving drainage systems, constructing levees, and restoring wetlands are examples of community-level mitigation activities that benefit multiple businesses and enhance overall community resilience. A coastal community might utilize mitigation funding to restore coastal wetlands, providing natural flood protection for multiple businesses in the area. This collaborative approach amplifies the impact of mitigation investments, creating a more resilient and sustainable community.

Integrating mitigation assistance within federal disaster grant programs demonstrates a forward-thinking approach to disaster recovery. By investing in preventative measures, these programs not only address immediate recovery needs but also reduce future risks, minimizing the long-term economic and social costs of disasters. This proactive approach fosters more resilient communities, better prepared to withstand and recover from future events, ultimately contributing to a more sustainable and secure future.

Frequently Asked Questions

This section addresses common inquiries regarding federal disaster assistance for small businesses, providing clarity on eligibility, application procedures, and available resources.

Question 1: What types of disasters qualify for federal assistance?

Federally declared disasters, including hurricanes, floods, earthquakes, wildfires, and other major events, typically qualify for assistance. Declarations are made by the President, triggering the availability of federal resources.

Question 2: How does one determine eligibility for assistance?

Eligibility requirements vary depending on the specific program and the nature of the disaster. Generally, businesses must be located within a declared disaster area, demonstrate verifiable disaster-related damage, and meet specific size and industry criteria. Consulting official resources provides detailed eligibility information.

Question 3: What types of assistance are available?

Assistance may include grants, low-interest loans, and mitigation funding. Grants can cover physical damage repairs, inventory replacement, and some operating expenses. Loans offer supplemental financial support for longer-term recovery. Mitigation assistance funds preventative measures to reduce future disaster impacts.

Question 4: What is the typical application process?

The application process typically involves registering with the appropriate agency (often FEMA), completing a detailed application form, and providing supporting documentation. Maintaining thorough records and responding promptly to agency inquiries is essential.

Question 5: What are common misconceptions about disaster assistance?

A common misconception is that all disaster-affected businesses automatically qualify for assistance. Eligibility requirements exist, and applications are reviewed based on demonstrated need and adherence to program guidelines. Another misconception is that federal assistance covers all losses. Assistance often complements insurance coverage and other funding sources, but may not cover the full extent of losses.

Question 6: Where can additional information and resources be found?

The official websites of FEMA, the Small Business Administration (SBA), and other relevant government agencies provide comprehensive information on disaster assistance programs, eligibility requirements, application procedures, and available resources.

Understanding these key aspects of disaster assistance programs is crucial for successful application and recovery. Thorough research and preparation significantly increase the likelihood of accessing necessary resources and navigating the recovery process effectively.

For further guidance on specific recovery strategies and resources, consult the following sections.

Conclusion

Federal disaster assistance for small businesses, encompassing grants, loans, and mitigation support, provides a crucial safety net for disaster-affected communities. Understanding eligibility requirements, navigating the application process effectively, and exploring all available resources are essential steps for successful recovery. These programs recognize the vital role small businesses play in local economies and aim to facilitate their recovery, contributing to broader community resilience.

Preparedness and proactive planning remain paramount. While disaster assistance offers vital support, mitigating future risks through preventative measures strengthens long-term resilience. Investing in mitigation strategies, developing robust business continuity plans, and maintaining awareness of available resources contribute to a more secure and sustainable future for small businesses and the communities they serve.