Hardship withdrawals from retirement accounts, specifically permitted under IRS regulations, allow access to funds before retirement age without the usual penalties in specific circumstances. These qualifying events typically encompass sudden, unexpected, and costly situations. For example, unreimbursed medical expenses exceeding a percentage of adjusted gross income, substantial home repairs necessitated by a federally declared disaster, and funeral expenses are common qualifying events.

Such provisions offer crucial financial relief when individuals face overwhelming and unforeseen expenses, preventing further financial hardship during already challenging times. Historically, these regulations have evolved to address a broader range of qualifying events, reflecting a growing understanding of the diverse financial emergencies individuals may encounter. This access provides a safety net, protecting individuals from depleting other essential resources or incurring significant debt.

Understanding the specific requirements and procedures for these withdrawals is essential. The following sections will explore eligible circumstances in greater detail, outline the application process, and explain potential tax implications.

Careful planning and consideration are essential when determining whether a hardship withdrawal is the appropriate course of action. The following tips provide guidance for navigating this process effectively.

Tip 1: Verify Eligibility Carefully: Regulations governing eligible hardship withdrawals are specific. Confirm the event qualifies before applying, consulting official IRS publications or a qualified financial advisor.

Tip 2: Explore Alternatives: Exhaust all other financial avenues, such as insurance claims, emergency savings, or low-interest loans, before resorting to a hardship withdrawal.

Tip 3: Understand Tax Implications: Hardship withdrawals are generally subject to income tax and may incur an additional 10% penalty if taken before age 59 1/2. Consult a tax professional to understand potential liabilities.

Tip 4: Gather Required Documentation: Assemble all necessary documentation supporting the hardship claim, such as medical bills, repair estimates, or other relevant evidence. Incomplete applications may delay processing.

Tip 5: Maintain Accurate Records: Retain copies of all documentation submitted for the hardship withdrawal, along with any correspondence received from the plan administrator or the IRS.

Tip 6: Consider Long-Term Impact: Withdrawing retirement savings early reduces the funds available for future growth, impacting long-term financial security. Carefully weigh the immediate need against future consequences.

Tip 7: Consult with a Financial Advisor: A financial advisor can provide personalized guidance based on individual circumstances, helping assess the long-term implications of a hardship withdrawal and explore alternative strategies.

By adhering to these guidelines, individuals can make informed decisions regarding hardship withdrawals and mitigate potential negative impacts on long-term financial well-being.

This information is for educational purposes and should not be considered financial advice. Consult with a qualified professional for personalized guidance tailored to specific circumstances.

1. Qualified Disasters

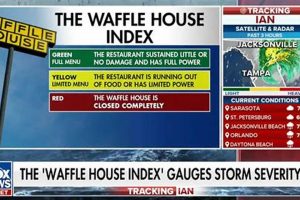

The concept of “qualified disasters” forms a cornerstone of disaster distributions from retirement accounts. A causal link exists: only a federally declared disaster, specifically recognized by the IRS, triggers eligibility for these distributions. This declaration signifies that the event’s severity warrants exceptional access to retirement funds, differentiating it from other hardships. For instance, widespread flooding resulting in a presidential disaster declaration would likely qualify, whereas localized property damage without such a declaration generally would not.

The importance of the “qualified disaster” designation lies in its objective criteria, providing a standardized framework for determining eligibility. This framework prevents arbitrary access to retirement savings while ensuring relief is available during genuine emergencies. A practical example is the difference between a homeowner experiencing basement flooding due to a burst pipe (generally not qualifying) versus widespread flooding from a hurricane declared a federal disaster (likely qualifying). This distinction clarifies the link between the event’s scale and access to disaster distributions. Furthermore, the IRS often specifies eligible disaster-related expenses, such as home repairs, temporary housing, or funeral expenses, further refining the scope of permissible withdrawals.

Understanding the “qualified disaster” requirement is crucial for those considering accessing retirement funds during emergencies. It provides a clear roadmap for navigating the complexities of disaster distributions, highlighting the necessity of official declarations and specified eligible expenses. Failing to meet these criteria can lead to denied applications and potential penalties. This framework safeguards retirement savings while providing crucial financial relief during truly catastrophic events, reflecting a balance between individual needs and long-term financial security.

2. IRS Declaration

An IRS declaration of a disaster is the pivotal factor determining eligibility for disaster distributions from retirement accounts. This declaration establishes a direct causal link: without official recognition of a disaster by the IRS, access to these funds remains unavailable. This requirement underscores the significance of the IRS declaration as a gatekeeping mechanism, ensuring that withdrawals are limited to genuine emergencies of significant scale.

The IRS declaration serves as an objective criterion, differentiating between localized incidents and widespread catastrophes warranting exceptional access to retirement savings. For instance, a house fire affecting a single dwelling, while devastating, would not typically qualify for a disaster distribution. However, widespread wildfires declared a disaster by the IRS would likely trigger eligibility for affected residents within the designated area. This distinction highlights the importance of scale and official recognition in determining eligibility. The declaration itself often specifies eligible disaster-related expenses, such as temporary housing or rebuilding costs, further refining the scope of permissible withdrawals.

Understanding the crucial role of the IRS declaration is essential for those considering accessing retirement funds in the wake of a disaster. It provides a clear framework for navigating the complexities of disaster distributions and highlights the necessity of official recognition for eligibility. This requirement safeguards retirement savings while providing essential financial relief during truly catastrophic events. By consulting official IRS publications or seeking professional financial advice, individuals can ensure they meet the specific criteria for disaster distributions, avoiding potential complications and accessing necessary funds effectively.

3. Affected Individuals

Eligibility for disaster distributions hinges on the individual’s status as “affected.” This status connects the individual directly to a qualified disaster, establishing a necessary link between the hardship experienced and access to retirement funds. Understanding the criteria defining an “affected individual” is crucial for determining eligibility and accessing available resources.

- Residency Requirement

Typically, residing within a federally declared disaster area is a primary qualifier. This establishes a direct geographical link between the individual and the disaster. For example, individuals living within the boundaries of a county declared a disaster area due to flooding would likely meet this requirement. Proof of residency, such as utility bills or official identification, may be required for verification.

- Employment Location

In some cases, working within a declared disaster area, even if residing elsewhere, may qualify an individual. This recognizes that economic hardship can result from workplace damage or closure. For example, employees of a business destroyed by a tornado in a declared disaster area might qualify, even if they live outside the designated zone. Documentation from the employer might be necessary to substantiate this connection.

- Relationship to Deceased

Disaster-related distributions may also cover funeral expenses for a deceased relative whose death resulted directly from the disaster. This extends eligibility beyond direct victims to those facing financial burdens due to loss of life. For instance, covering funeral costs for a family member who perished in a hurricane-related incident might qualify for a distribution, even if the individual making the claim resides outside the affected area. Death certificates and proof of relationship would typically be required.

- Substantiated Financial Need

While residing or working in a disaster area forms the basis of eligibility, demonstrating a legitimate financial need directly related to the disaster is often essential. This might involve providing documentation of unreimbursed expenses, such as home repair estimates, medical bills, or temporary housing costs. This requirement ensures funds are used for their intended purpose, addressing genuine hardship resulting from the disaster.

These facets of “affected individuals” clarify the link between personal circumstances and access to disaster distributions. Meeting these criteria establishes the necessary connection between the individual and the qualified disaster, enabling access to retirement funds for specific disaster-related expenses. Understanding these requirements is crucial for individuals seeking to utilize this resource during times of crisis.

4. Eligible Expenses

Disaster distributions offer access to retirement funds, but their use is restricted to specific eligible expenses directly related to the declared disaster. This crucial stipulation ensures these funds serve their intended purpose: alleviating financial hardship stemming from the disaster. Understanding these eligible expenses is vital for utilizing this resource appropriately.

- Home Repairs

Damage to primary residences necessitates costly repairs. Disaster distributions can cover expenses for restoring habitability, such as structural repairs, roof replacement, or plumbing and electrical work. For example, funds could be used to repair a hurricane-damaged roof or replace flooring destroyed by flooding. This provision ensures individuals can safely return to their homes and mitigate further losses.

- Temporary Housing

Displacement due to disaster often requires temporary housing solutions. Eligible expenses include hotel stays, rental properties, or temporary relocation costs. For instance, individuals displaced by wildfires could use distributions to cover hotel expenses while their homes are uninhabitable. This ensures safe and stable temporary accommodations during recovery.

- Funeral Expenses

Disaster-related deaths create significant financial burdens. Distributions can cover funeral and burial costs for immediate family members whose deaths resulted directly from the disaster. This provision offers crucial financial relief during a period of profound emotional stress. For example, funds could cover funeral arrangements for a family member lost in a tornado.

- Medical Expenses

Disasters often result in injuries requiring medical attention. Eligible medical expenses might include hospital stays, doctor visits, prescription medications, and necessary medical equipment directly related to the disaster. For instance, an individual injured during an earthquake could utilize funds for hospital bills and rehabilitation costs. This provision ensures access to necessary medical care during recovery.

These eligible expenses illustrate the targeted nature of disaster distributions. By restricting access to specific needs directly arising from the disaster, these provisions ensure funds are utilized for their intended purpose: mitigating the financial impact of catastrophic events. Understanding these eligible expenses allows individuals to effectively leverage this resource and navigate the recovery process with greater financial security. Misuse of these funds for non-eligible expenses can result in penalties and jeopardize long-term financial well-being.

5. Withdrawal Limits

Withdrawal limits are integral to disaster distributions, governing the amount of retirement funds accessible during qualified disasters. These limits serve a crucial function: balancing the immediate needs of affected individuals with the long-term preservation of retirement savings. Understanding these limitations is essential for responsible financial planning during emergencies. The rationale behind these limits stems from the recognition that retirement funds represent long-term financial security. While disaster distributions offer crucial relief, unrestricted access could jeopardize future financial stability. For instance, while an individual might face substantial home repair costs after a hurricane, withdrawing the entirety of their retirement savings could severely compromise their future financial well-being.

Specific withdrawal limits can vary depending on the type of retirement plan and the nature of the disaster. Regulations often stipulate a maximum withdrawal amount, either a fixed dollar figure or a percentage of the vested balance. Furthermore, certain plans may impose restrictions on the frequency of disaster distributions within a specified timeframe. For example, an individual might be limited to a single withdrawal within a calendar year, even if multiple qualified disasters occur. These limitations encourage careful consideration of immediate needs versus long-term financial goals. Practical considerations include assessing available insurance coverage, exploring alternative funding sources, and developing a comprehensive recovery budget that balances immediate needs with the preservation of retirement savings.

Navigating disaster distributions requires a comprehensive understanding of applicable withdrawal limits. These limits are not arbitrary restrictions but rather safeguards designed to protect long-term financial security. By understanding these parameters and seeking professional financial guidance, individuals can make informed decisions that address immediate needs while mitigating potential long-term consequences. Failing to consider these limits can jeopardize future financial stability and undermine the intended purpose of disaster distributions. This understanding underscores the importance of responsible financial planning, even during times of crisis.

6. Tax Implications

Tax implications represent a critical component of disaster distributions, significantly influencing financial outcomes. While these distributions provide access to retirement funds during qualifying emergencies, they are not tax-free. Understanding the tax consequences is crucial for informed financial planning and mitigating potential liabilities. A key aspect is the treatment of these distributions as ordinary income. This means the withdrawn amount is added to taxable income for the year, potentially increasing tax burdens. For example, a $10,000 disaster distribution could push an individual into a higher tax bracket, resulting in a larger tax liability than anticipated. Furthermore, individuals younger than 59 1/2 may incur an additional 10% early withdrawal penalty, further increasing the financial impact. This penalty underscores the importance of exploring alternative funding sources before accessing retirement funds.

Mitigating the tax impact of disaster distributions requires careful planning. Strategies such as spreading the withdrawal over multiple tax years or utilizing available tax credits or deductions can help minimize liabilities. For instance, individuals may qualify for tax credits related to disaster relief, potentially offsetting some of the increased tax burden. Consulting with a tax advisor can provide personalized guidance tailored to individual circumstances. Furthermore, understanding the specific tax rules governing disaster distributions within different retirement plan types401(k), IRA, etc.is essential. Each plan type may have specific regulations affecting tax treatment, impacting overall financial outcomes. For example, certain plans may allow for tax-deferred repayment of disaster distributions, offering an opportunity to reduce long-term tax liabilities and replenish retirement savings.

Navigating the tax complexities of disaster distributions requires proactive planning and professional guidance. Failure to consider these implications can result in unexpected tax burdens, potentially undermining the financial relief intended by these provisions. By understanding the tax treatment of disaster distributions, individuals can make informed decisions, mitigate potential liabilities, and utilize these resources effectively during times of crisis. This awareness empowers informed decision-making and reinforces the importance of integrating tax considerations into disaster recovery planning. Integrating tax planning into overall financial strategies is crucial for both disaster recovery and long-term financial well-being.

Frequently Asked Questions

This section addresses common inquiries regarding access to retirement funds during qualified disasters, providing clarity on eligibility, procedures, and potential implications.

Question 1: How does one confirm a disaster qualifies for distributions?

Official IRS announcements, typically published on the IRS website and through other public channels, designate qualified disasters. These announcements specify affected areas and eligible timeframes.

Question 2: What documentation is necessary to substantiate a claim?

Required documentation varies depending on the specific circumstances and the nature of the disaster. Generally, proof of residence or employment within the affected area, along with documentation of disaster-related expenses, is required. Consulting plan administrators provides specific guidance.

Question 3: Are there limitations on the amount accessible through disaster distributions?

Specific limits vary depending on plan type and IRS regulations. These limits balance immediate needs with the preservation of long-term retirement savings. Plan documents and IRS publications provide specific details.

Question 4: What are the tax implications of disaster distributions?

Disaster distributions are generally treated as ordinary income and may be subject to an additional 10% early withdrawal penalty if taken before age 59 1/2. Consulting a tax professional is recommended.

Question 5: Can withdrawn funds be repaid to the retirement account?

Certain plans may allow for repayment of disaster distributions, subject to specific rules and limitations. This can mitigate long-term tax implications and help restore retirement savings. Consult plan documents for specific provisions.

Question 6: Where can individuals find further guidance on disaster distributions?

The IRS website, plan administrators, and qualified financial advisors offer comprehensive information and personalized guidance tailored to individual circumstances.

Understanding the specific requirements and implications of disaster distributions is crucial for informed financial decision-making during challenging times. Proactive planning and professional guidance ensure appropriate utilization of this resource while safeguarding long-term financial well-being.

For further information on specific disaster-related topics, consult the following resources…

Understanding Disaster Distributions

Disaster distributions, as explored in this article, represent a crucial safety net for individuals facing financial hardship due to qualified disasters. Eligibility hinges on specific criteria, including IRS declarations, affected individual status, eligible expense categories, and adherence to withdrawal limits. Tax implications are significant, requiring careful consideration and planning to mitigate potential liabilities. The information presented provides a framework for understanding the complexities of these distributions, emphasizing the importance of informed decision-making during challenging circumstances.

Navigating the complexities of disaster-related financial recovery requires proactive planning and a comprehensive understanding of available resources. Seeking professional guidance from financial advisors and tax specialists is essential for informed decision-making. Ultimately, responsible utilization of disaster distributions balances immediate needs with long-term financial well-being, ensuring a secure financial future despite unforeseen adversity. Proactive engagement with these provisions empowers individuals to navigate challenging circumstances and build resilience in the face of future uncertainties.