Low-interest loans offered by the Federal Emergency Management Agency (FEMA) provide a crucial lifeline to individuals and businesses affected by declared disasters. These loans cover essential needs not met by insurance or other sources, such as repairing or replacing damaged homes, vehicles, and personal property. For instance, after a hurricane, these resources could help a homeowner repair a damaged roof or replace essential appliances.

Access to such financial assistance is often critical for recovery and rebuilding following catastrophic events. They bridge the gap between immediate needs and long-term recovery, enabling communities to regain stability. Historically, these programs have played a significant role in disaster recovery efforts across the United States, offering vital support during numerous emergencies, from floods and wildfires to earthquakes and tornadoes.

Further exploration of this topic will cover eligibility requirements, application processes, loan terms, and other vital details related to accessing this form of disaster aid.

Securing financial assistance after a disaster requires careful planning and thorough documentation. The following tips provide guidance for applicants seeking aid from the Federal Emergency Management Agency.

Tip 1: Document Losses Meticulously: Maintain thorough records of all damaged or lost property. Photographs, videos, receipts, and appraisals strengthen applications and help ensure accurate assessments of losses. Detailed inventories of household items are particularly valuable.

Tip 2: Apply Promptly: Disaster assistance has deadlines. Applicants are urged to apply as soon as possible after a disaster declaration. Prompt application increases the likelihood of receiving timely aid and avoids potential delays in the recovery process.

Tip 3: Understand Eligibility Requirements: Specific criteria determine eligibility. Review official resources to confirm eligibility before initiating the application process. This can prevent unnecessary delays or application rejection.

Tip 4: Maintain Contact Information: Ensure FEMA has current contact information. Changes in address, phone number, or email address should be communicated promptly to avoid missed communications regarding application status or loan servicing.

Tip 5: Explore All Available Assistance: Federal assistance may encompass grants and other aid in addition to loans. Research all available programs to maximize potential support and identify the best fit for individual circumstances.

Tip 6: Keep Records of All Communications: Maintain records of all interactions, including application numbers, caseworker names, and dates of contact. Organized records are crucial for tracking progress and resolving any potential issues.

Tip 7: Seek Professional Guidance When Necessary: Navigating disaster assistance can be complex. Consulting with financial advisors or disaster recovery specialists can provide valuable support and clarify the process.

By following these tips, individuals and businesses can navigate the often complex process of securing federal disaster assistance more effectively and increase their chances of obtaining needed support for recovery.

Understanding the application process, maintaining accurate records, and exploring all available options significantly contributes to successful recovery outcomes.

1. Low-Interest Rates

Low-interest rates are a defining characteristic of FEMA disaster loans, setting them apart from conventional financing options. This feature is critical in post-disaster recovery, as affected individuals and businesses often face significant financial strain. The lower rates lessen the burden of repayment, making rebuilding and recovery more manageable. For example, a family rebuilding after a fire might secure a loan at a significantly lower rate than a standard personal loan, reducing the overall cost of recovery and enabling them to return to normalcy more quickly.

The availability of these reduced rates directly impacts the accessibility of crucial funds. Without low-interest options, many disaster survivors might be forced to take on high-interest debt or forgo necessary repairs, hindering long-term recovery efforts. This distinction underscores the importance of these loans as a safety net, facilitating access to capital that might otherwise be unavailable or prohibitively expensive in a time of crisis. This can mean the difference between a community rebuilding after a hurricane and prolonged economic hardship.

In summary, low-interest rates are a critical component of the effectiveness and accessibility of FEMA disaster loans. They lessen the financial impact of disasters, facilitate access to essential funds, and contribute significantly to successful long-term recovery efforts. Understanding the role of these reduced rates is essential for individuals and communities seeking to navigate the complexities of post-disaster financial recovery.

Disaster-related expenses represent the core purpose of FEMA disaster loans. These loans are specifically designed to address the financial burdens imposed by declared disasters, covering costs that would otherwise hinder recovery. Understanding eligible expenses is critical for applicants seeking to maximize available assistance.

- Home Repairs:

Structural damage to homes, including roofs, walls, and foundations, often constitutes a substantial portion of disaster-related costs. FEMA loans can assist with necessary repairs, enabling homeowners to restore safe and habitable living conditions. For example, following a hurricane, a homeowner might utilize a loan to repair roof damage, replace broken windows, and address water damage to interior walls. This assistance is crucial for regaining stability and preventing further deterioration of the property.

- Personal Property Replacement:

Disasters often result in the loss or damage of essential personal belongings, such as furniture, appliances, clothing, and electronics. FEMA loans can provide funds to replace these items, helping individuals re-establish basic household necessities. For instance, after a flood, individuals might use loan funds to replace damaged furniture, appliances, and clothing. This support enables families to regain a sense of normalcy and begin rebuilding their lives.

- Vehicle Replacement:

Damage or loss of vehicles due to disasters can severely impact mobility and access to essential services. FEMA loans can assist in replacing damaged or destroyed vehicles, ensuring individuals can maintain access to transportation for work, medical appointments, and other critical needs. For example, following a wildfire, a family might use a loan to replace a vehicle destroyed by the fire, enabling them to maintain access to employment and essential services.

- Moving and Storage Expenses:

In certain situations, disaster-related damage may necessitate temporary relocation or storage of belongings. FEMA loans can cover moving and storage costs, providing financial relief during this transitional period. For instance, a family displaced by a flood might use a loan to cover moving expenses to temporary housing and storage fees for their belongings until their home is repaired.

These categories of disaster-related expenses demonstrate the scope of FEMA loan assistance. By addressing a range of needs, from home repairs to personal property replacement, these loans provide a vital safety net for individuals and families as they navigate the complex process of disaster recovery. Access to these funds directly influences the speed and effectiveness of recovery, enabling communities to rebuild and regain stability after devastating events.

3. Individual Assistance

Individual Assistance is a crucial component of FEMA’s disaster relief programs, providing direct support to individuals and families affected by declared disasters. A significant aspect of this assistance encompasses disaster loans, offering a critical financial lifeline for recovery. This connection is essential because individual recovery directly contributes to community-wide resilience. When individuals receive the support they need to rebuild their lives, the entire community benefits. For example, after a tornado devastates a town, individual assistance in the form of loans enables residents to repair homes, replace essential belongings, and begin the process of emotional and financial recovery. This individual recovery, in turn, fuels the overall recovery of the affected community.

The practical significance of understanding this connection lies in the ability to access necessary resources effectively. Individuals impacted by disasters often face overwhelming challenges, and navigating the complexities of aid programs can be daunting. Recognizing disaster loans as a critical element of Individual Assistance simplifies the process, enabling affected individuals to identify and access the financial support they need more efficiently. This understanding can significantly impact long-term recovery outcomes, helping individuals regain stability and rebuild their lives. For instance, a family displaced by a hurricane can utilize individual assistance loans to secure temporary housing, replace lost belongings, and address immediate needs, facilitating a smoother transition back to normalcy.

In summary, the relationship between Individual Assistance and disaster loans is fundamental to effective disaster recovery. Individual Assistance provides a framework for delivering crucial support, and disaster loans serve as a vital financial tool within that framework. Recognizing this connection empowers individuals to navigate the recovery process more effectively, fostering both individual and community resilience. This understanding underscores the importance of disaster preparedness and the role of accessible financial assistance in mitigating the long-term impacts of catastrophic events.

4. Business Assistance

Business assistance programs offered by FEMA, including disaster loans, play a vital role in post-disaster economic recovery. These programs aim to mitigate the financial impacts of declared disasters on businesses, enabling them to resume operations, rebuild infrastructure, and retain employees. Understanding the scope and function of this assistance is crucial for business owners navigating the complexities of disaster recovery.

- Economic Injury Disaster Loans (EIDLs):

EIDLs address working capital needs caused by disasters. These loans provide crucial funding for businesses unable to meet operating expenses due to disaster-related disruptions. For example, a restaurant forced to close due to flood damage could use an EIDL to cover payroll, rent, and other ongoing expenses during the closure. This prevents layoffs and maintains business continuity, facilitating a quicker return to normal operations. EIDLs often bridge the gap until business operations normalize, mitigating long-term economic hardship.

- Physical Disaster Loans:

Physical disaster loans address the repair or replacement of disaster-damaged property. This encompasses buildings, equipment, inventory, and other physical assets essential for business operations. For example, a manufacturer whose warehouse was damaged by a hurricane could secure a physical disaster loan to repair the building, replace damaged machinery, and replenish lost inventory. This enables the business to restore production capacity and minimize disruptions to supply chains, contributing to broader economic recovery.

- Loan Terms and Repayment:

FEMA disaster loans for businesses typically feature favorable terms, including low interest rates and extended repayment periods. These terms are designed to minimize the financial burden on businesses already struggling with disaster-related losses. For instance, a small business receiving a loan to rebuild after a wildfire might benefit from a lower interest rate and a longer repayment period than a conventional loan, reducing the strain on cash flow and enabling reinvestment in recovery efforts. Understanding loan terms is essential for effective financial planning during the recovery process.

- Mitigation Assistance:

Beyond immediate recovery, FEMA also offers mitigation assistance to help businesses reduce future disaster risks. This might involve funding for structural improvements, relocation efforts, or other measures that enhance disaster resilience. For example, a business located in a flood-prone area could receive mitigation assistance to elevate its building or install flood barriers, minimizing the impact of future floods and reducing the need for future disaster assistance. This proactive approach contributes to long-term community resilience and reduces the overall economic impact of future disasters.

The various facets of business assistance, including EIDLs, physical disaster loans, favorable loan terms, and mitigation assistance, represent a comprehensive approach to disaster recovery. These programs are integral to restoring economic stability after disasters, enabling businesses to rebuild, retain employees, and contribute to the overall recovery of their communities. Access to these resources plays a pivotal role in mitigating the long-term economic consequences of disasters and fostering greater resilience within the business sector.

5. Application Process

The application process for FEMA disaster loans is a critical step for individuals and businesses seeking financial assistance after a declared disaster. A clear understanding of this process is essential for navigating the complexities of disaster recovery and ensuring timely access to much-needed funds. Efficiency in completing the application process directly impacts the speed of recovery, enabling affected individuals and communities to rebuild and regain stability more effectively. A streamlined and well-understood application process contributes significantly to the overall effectiveness of disaster relief efforts.

- Online Application:

The online application portal provides a convenient and accessible platform for submitting loan requests. Applicants can access the portal from any location with internet access, eliminating the need for in-person visits or paper-based applications. This online system streamlines the process, enabling rapid submission and efficient processing of applications, which is particularly crucial in the immediate aftermath of a disaster. For instance, individuals displaced by a hurricane can apply for assistance from a mobile device or computer, even if their homes are inaccessible. This accessibility ensures that those in need can receive timely assistance regardless of their location or circumstance.

- Required Documentation:

Supporting documentation plays a vital role in verifying losses and determining eligibility. Applicants typically need to provide proof of identity, residency, insurance coverage, and disaster-related damage. Gathering these documents in advance streamlines the application process and reduces potential delays. For example, homeowners applying for assistance to repair flood damage should compile photographs of the damage, insurance policy information, and proof of homeownership. Having these documents readily available ensures a smoother and more efficient application process.

- Application Deadlines:

Adhering to application deadlines is crucial for securing disaster assistance. FEMA establishes deadlines for submitting applications, and missing these deadlines can jeopardize eligibility. Prompt application is strongly encouraged to avoid delays and ensure timely access to funds. For instance, after a wildfire, FEMA may set a deadline for submitting loan applications. Individuals and businesses affected by the fire must submit their applications before the deadline to be considered for assistance. Awareness of and adherence to these deadlines is essential for maximizing access to available resources.

- Post-Application Communication:

Maintaining communication with FEMA after submitting an application is essential. Applicants should monitor their application status, respond promptly to any requests for additional information, and keep FEMA informed of any changes in contact information. Effective communication ensures a smooth and efficient process. For example, if FEMA requires additional documentation to verify losses, applicants should respond promptly to avoid processing delays. Proactive communication helps expedite the application process and ensures timely access to much-needed financial assistance.

Understanding and effectively navigating the application process for FEMA disaster loans significantly increases the likelihood of receiving timely assistance. From the initial online application to post-submission communication, each step plays a critical role in securing the financial support needed to rebuild and recover after a disaster. Proactive preparation, thorough documentation, and timely submission are essential for maximizing the effectiveness of this crucial resource. By emphasizing efficiency and preparedness throughout the application process, individuals and communities can enhance their resilience and navigate the complexities of disaster recovery more successfully.

Frequently Asked Questions about Federal Disaster Assistance Loans

This section addresses common inquiries regarding loans offered through the Federal Emergency Management Agency (FEMA) following declared disasters. Clarity on these points is crucial for effective navigation of the assistance process.

Question 1: What types of disasters qualify for federal assistance loans?

Eligibility is tied to presidentially declared disasters. These typically include natural disasters such as hurricanes, floods, earthquakes, tornadoes, wildfires, and other significant events causing widespread damage. Specific declarations determine eligible areas and types of assistance.

Question 2: How do interest rates for these loans compare to conventional loans?

Interest rates are typically lower than conventional loan rates. The specific rates depend on the disaster declaration and individual applicant circumstances. These lower rates aim to make recovery financially manageable for disaster survivors.

Question 3: What can these loans be used for?

Eligible uses include home repairs, personal property replacement, vehicle replacement, moving and storage expenses, and business-related costs. Expenses must be directly related to the declared disaster and not covered by insurance or other sources.

Question 4: What is the process for applying?

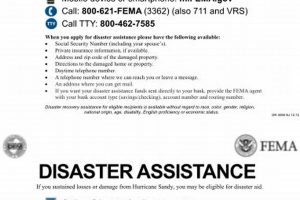

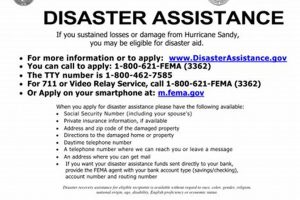

Applications are typically submitted online through the official FEMA disaster assistance website. Required documentation includes proof of identity, residency, insurance coverage, and disaster-related damage. Prompt application is recommended.

Question 5: What if insurance doesn’t cover all losses?

These loans are intended to cover needs unmet by insurance or other sources. Applicants must document all losses and insurance settlements to determine eligibility and loan amounts.

Question 6: What if an application is denied?

Applicants have the right to appeal denial decisions. Appeals must be submitted within a specified timeframe and include supporting documentation justifying the appeal. Specific appeal procedures are outlined in the denial notification.

Understanding these key points contributes significantly to successful navigation of the disaster assistance process. Further resources and specific details are available through official FEMA channels.

For additional information and resources, consult the official FEMA website.

Federal Disaster Assistance Loans

Federal disaster assistance loans administered through FEMA provide crucial support to individuals and businesses impacted by declared disasters. These loans offer a financial bridge to recovery, covering essential needs unmet by insurance or other resources. Key aspects explored include eligibility requirements, application procedures, loan terms, and the importance of thorough documentation. Understanding these elements is fundamental to navigating the complexities of disaster recovery effectively.

Preparedness and access to timely resources are essential for mitigating the long-term impacts of disasters. Federal disaster assistance loans represent a critical component of community resilience, enabling individuals and businesses to rebuild, recover, and regain stability after catastrophic events. Proactive planning and awareness of available resources significantly contribute to successful disaster recovery outcomes.