A potential downturn of significant magnitude, characterized by widespread financial hardship and instability, poses a substantial threat to global well-being. Such an event could involve sharp declines in economic output, widespread unemployment, business failures, and market volatility. A historical parallel can be drawn to the Great Depression of the 1930s, although the specific causes and consequences of any future crisis would likely differ.

Understanding the factors that contribute to large-scale economic instability is crucial for effective policymaking and risk mitigation. Analysis of historical trends, current economic indicators, and potential future disruptions can inform strategies to prevent or mitigate the impact of such events. This knowledge empowers governments, businesses, and individuals to make informed decisions and prepare for potential challenges. A robust and resilient economic system benefits all stakeholders.

This analysis will explore several key areas relevant to the potential for future economic hardship, including systemic risks within the financial sector, the impact of geopolitical instability, the role of technological disruption, and the challenges posed by environmental change. Each of these areas represents a significant factor influencing the global economic landscape and warrants careful consideration.

Preparing for Potential Economic Hardship

These preparatory steps offer guidance for navigating potential future economic challenges. While no strategy can guarantee complete protection, proactive measures can significantly mitigate risks and enhance resilience.

Tip 1: Diversify Investments: Diversification across asset classes (stocks, bonds, real estate, precious metals) can help mitigate losses in the event of market volatility. A well-diversified portfolio can offer a buffer against significant declines in any single asset class.

Tip 2: Build an Emergency Fund: Maintaining liquid savings equivalent to three to six months of living expenses provides a crucial safety net in times of unexpected job loss or financial hardship. Ready access to funds can bridge the gap during periods of economic uncertainty.

Tip 3: Reduce Debt Burden: Minimizing outstanding debt, particularly high-interest consumer debt, reduces financial vulnerability during economic downturns. Lower debt levels offer greater flexibility and reduce financial strain.

Tip 4: Develop In-Demand Skills: Acquiring skills relevant to evolving industries and market demands enhances employability and income potential, regardless of broader economic conditions. Continuous learning and professional development provide valuable career resilience.

Tip 5: Monitor Economic Indicators: Staying informed about key economic indicators, such as inflation rates, unemployment figures, and market trends, allows for informed financial decision-making and proactive adjustments to personal strategies.

Tip 6: Consider Long-Term Investments: Focusing on long-term investment strategies can help weather short-term market fluctuations. Patience and a long-term perspective can be valuable during periods of economic instability.

Tip 7: Plan for Essential Needs: Ensuring access to essential resources, such as food, water, and shelter, is paramount during times of crisis. Developing contingency plans for essential needs enhances preparedness and resilience.

By taking proactive steps to prepare for potential economic challenges, individuals and families can strengthen their financial well-being and navigate uncertainty with greater confidence. These strategies offer a foundation for building resilience and mitigating the impact of future economic hardship.

These preparatory measures provide a framework for navigating potential future economic challenges. The following section will conclude with a summary of key insights and recommendations for building long-term economic resilience.

1. Market Instability

Market instability, characterized by significant and rapid fluctuations in asset prices, represents a substantial contributor to potential widespread economic hardship. Dramatic price swings can erode investor confidence, triggering a cascade of negative consequences. As uncertainty rises, investors may liquidate assets, further depressing market values and potentially creating a self-reinforcing downward spiral. This deleveraging process can restrict access to credit, hindering investment and economic activity. The 2008 financial crisis serves as a stark example, where the collapse of the housing market triggered a global credit crunch and a severe recession. Similarly, the “dot-com” bubble burst in the early 2000s demonstrated how rapid market declines can erase wealth and disrupt economic growth.

The interconnectedness of global financial markets amplifies the impact of market instability. A crisis in one region can quickly spread to others, as seen during the Asian financial crisis of 1997-98. Contagion effects can transmit market shocks across borders, impacting economies worldwide. Furthermore, market instability can undermine the stability of financial institutions, particularly those heavily exposed to volatile assets. Bank failures and financial sector distress can further exacerbate economic downturns, as seen during the Great Depression. Therefore, understanding the dynamics of market instability is critical for assessing systemic risk and developing strategies to mitigate potential economic disasters.

Effective management of market instability requires a multi-faceted approach. Regulatory frameworks that promote transparency and financial stability are essential. Prudent risk management practices by financial institutions can help limit their exposure to market volatility. Central banks play a crucial role in maintaining financial stability through monetary policy and interventions in times of crisis. However, predicting and preventing market instability remains a significant challenge. The complexity of financial markets and the interplay of various factors make it difficult to anticipate market turning points with precision. Therefore, ongoing monitoring, analysis, and adaptation of policies are crucial for mitigating the risks associated with market instability and preventing it from escalating into a broader economic disaster.

2. Geopolitical Risks

Geopolitical risks represent a significant source of potential economic instability. International tensions, conflicts, and policy shifts can disrupt global trade, investment flows, and supply chains, creating cascading effects that can escalate into widespread economic hardship. Understanding the multifaceted nature of these risks is crucial for assessing vulnerabilities and developing mitigation strategies.

- International Conflicts:

Armed conflicts, whether localized or widespread, disrupt economic activity within affected regions and can have far-reaching global consequences. The war in Ukraine, for example, has disrupted global energy markets, contributing to inflationary pressures and impacting food security in several countries. Beyond the immediate impacts, conflicts can destabilize entire regions, hindering long-term economic development and potentially triggering humanitarian crises with significant economic ramifications.

- Trade Disputes and Protectionism:

Trade disputes and protectionist policies can disrupt established trade relationships, increasing costs for businesses and consumers. Tariff wars and trade barriers can impede economic growth, reduce international trade volumes, and lead to retaliatory measures that further escalate tensions. Such actions can fragment global markets and undermine the benefits of international trade, potentially leading to a decline in global economic output.

- Political Instability and Regime Change:

Political instability within a country or region can create uncertainty for investors, disrupt business operations, and negatively impact economic growth. Sudden regime changes or political upheavals can lead to policy shifts that undermine investor confidence and disrupt established economic relationships. Such instability can also increase the risk of social unrest and conflict, further exacerbating economic challenges.

- Terrorism and Cyberattacks:

Acts of terrorism and cyberattacks pose significant threats to economic stability. Terrorist attacks can disrupt critical infrastructure, damage supply chains, and undermine investor confidence. Cyberattacks can target financial institutions, businesses, and government agencies, disrupting operations, compromising sensitive data, and causing significant economic losses. The increasing frequency and sophistication of these threats underscore the need for robust cybersecurity measures and international cooperation to mitigate their economic impact.

These geopolitical risks are interconnected and can interact in complex ways. For example, a regional conflict can disrupt global supply chains, leading to trade disputes and contributing to inflationary pressures. Political instability can exacerbate social unrest, potentially leading to violent conflict and further economic disruption. Therefore, a comprehensive approach to assessing and mitigating geopolitical risks is crucial for preventing these risks from escalating into a global economic crisis. Understanding the interplay of these factors is paramount for building resilience and navigating the complex geopolitical landscape of the 21st century.

3. Debt Burdens

Excessive debt levels, both at the individual, corporate, and government levels, represent a significant vulnerability within the global economic system and are a key factor in the potential for widespread economic hardship. High debt burdens can amplify economic shocks, restrict financial flexibility, and create systemic instability. Understanding the dynamics of debt accumulation and its potential consequences is crucial for assessing the risk of future economic crises.

- Household Debt:

High levels of household debt, particularly mortgage and consumer debt, can increase individual vulnerability to economic downturns. When incomes decline or unemployment rises, heavily indebted households may struggle to meet debt obligations, leading to defaults, foreclosures, and reduced consumer spending. This can trigger a contraction in economic activity, further exacerbating the downturn. The 2008 financial crisis, partly fueled by excessive mortgage debt, serves as a cautionary tale.

- Corporate Debt:

Elevated corporate debt levels can pose systemic risks to the financial system. During periods of economic stress, highly leveraged companies may face difficulties servicing their debt, increasing the risk of defaults and bankruptcies. This can trigger a chain reaction, impacting creditors, investors, and the broader financial markets. The collapse of Lehman Brothers in 2008, burdened by excessive debt, highlighted the systemic consequences of corporate debt vulnerabilities.

- Government Debt:

High levels of government debt can limit a country’s ability to respond effectively to economic crises. When debt levels are high, governments may have less fiscal space to implement stimulus measures or provide social safety nets during economic downturns. Excessive government debt can also lead to higher interest rates, crowding out private investment and hindering economic growth. The ongoing sovereign debt crisis in several European countries underscores the challenges posed by high levels of public debt.

- Global Debt Interconnectedness:

The interconnectedness of global debt markets amplifies the risks associated with high debt burdens. A debt crisis in one country can quickly spread to others, as seen during the Asian financial crisis of 1997-98. The interconnectedness of financial institutions and cross-border capital flows can transmit financial shocks rapidly, potentially triggering a global crisis. The increasing complexity of global financial markets makes it challenging to assess and manage the risks associated with interconnected debt burdens.

These interconnected debt burdens create a complex web of vulnerabilities within the global economic system. A sudden rise in interest rates, a decline in asset prices, or a slowdown in economic growth can trigger a cascade of defaults and financial distress, potentially leading to a widespread economic crisis. Understanding the dynamics of debt accumulation and its potential consequences is paramount for policymakers, businesses, and individuals to mitigate the risks and build greater resilience against future economic hardship.

4. Inflationary Pressures

Inflationary pressures, characterized by sustained increases in the general price level of goods and services, represent a significant factor contributing to the potential for widespread economic hardship. While moderate inflation is a normal aspect of a healthy economy, uncontrolled or persistent high inflation can erode purchasing power, distort economic decision-making, and destabilize financial markets, potentially leading to severe economic consequences.

One of the primary mechanisms through which inflationary pressures contribute to economic instability is the erosion of purchasing power. As prices rise, consumers can purchase fewer goods and services with the same amount of money, effectively reducing their real income. This can lead to decreased consumer spending, a key driver of economic growth. Furthermore, high inflation can create uncertainty about future prices, making it difficult for businesses to plan investments and for consumers to make informed purchasing decisions. This uncertainty can dampen economic activity and hinder long-term growth.

Historically, periods of high inflation have often been associated with economic hardship. The stagflation of the 1970s, characterized by high inflation and slow economic growth, serves as a prime example. More recently, the hyperinflation experienced in countries like Venezuela and Zimbabwe demonstrates the devastating consequences of uncontrolled inflation, leading to economic collapse and social unrest. These examples underscore the importance of managing inflationary pressures effectively to prevent them from escalating into a broader economic crisis.

Several factors can contribute to inflationary pressures, including supply chain disruptions, excessive money creation, strong consumer demand, and rising commodity prices. The COVID-19 pandemic, for example, disrupted global supply chains, contributing to shortages and price increases for various goods. Geopolitical events, such as the war in Ukraine, can also exacerbate inflationary pressures by disrupting energy markets and increasing commodity prices. Understanding the underlying causes of inflation is crucial for implementing appropriate policy responses.

Addressing inflationary pressures requires a combination of monetary and fiscal policies. Central banks can raise interest rates to curb demand and slow down economic growth, while governments can implement fiscal measures, such as reducing spending or increasing taxes, to control inflation. However, these policies can have unintended consequences, such as increasing unemployment or slowing economic growth. Finding the right balance between controlling inflation and maintaining economic stability is a significant challenge for policymakers. Failure to manage inflationary pressures effectively can contribute to a loss of confidence in the economy, potentially triggering a downward spiral leading to widespread economic hardship. Therefore, vigilance and proactive measures are crucial for mitigating the risks associated with sustained inflationary pressures.

5. Supply Chain Disruptions

Supply chain disruptions represent a critical vulnerability within the globalized economy and a significant contributor to the potential for widespread economic hardship. Modern economies rely on intricate networks of interconnected suppliers, manufacturers, distributors, and retailers to deliver goods and services efficiently. Disruptions to these networks can have cascading effects, impacting production, increasing costs, and leading to shortages of essential goods, potentially triggering broader economic instability.

- Production Bottlenecks:

Disruptions at any stage of the supply chain can create bottlenecks that impede production. For example, a shortage of raw materials, factory closures due to pandemics, or transportation delays can halt or slow down manufacturing processes. These bottlenecks can lead to reduced output, increased costs, and delays in delivering goods to consumers. The automotive industry’s recent struggles with semiconductor chip shortages illustrate the significant impact of production bottlenecks on entire industries.

- Increased Costs and Inflation:

Supply chain disruptions often lead to increased costs for businesses. Shortages of essential components or raw materials can drive up prices, while transportation delays and increased shipping costs further contribute to inflationary pressures. These higher costs are often passed on to consumers, leading to reduced purchasing power and potentially dampening economic activity. The recent surge in global energy prices, partly driven by supply chain disruptions, exemplifies the inflationary impact of these disruptions.

- Shortages and Product Unavailability:

Disruptions can lead to shortages of essential goods, including food, medicine, and other critical products. These shortages can have severe consequences, particularly in vulnerable populations, and can lead to social unrest and political instability. The empty store shelves witnessed during the early stages of the COVID-19 pandemic highlighted the vulnerability of supply chains to unexpected disruptions and the potential for widespread shortages.

- Economic Contagion:

The interconnectedness of global supply chains means that disruptions in one region can quickly spread to others. A disruption in a major manufacturing hub, for example, can impact businesses and consumers worldwide. This interconnectedness can amplify the economic impact of supply chain disruptions, potentially triggering a global economic downturn. The disruption to global trade caused by the blockage of the Suez Canal in 2021 demonstrated the interconnectedness of global supply chains and the potential for widespread economic consequences.

These interconnected facets of supply chain vulnerability highlight the significant risk they pose to global economic stability. The potential for cascading disruptions, combined with the increasing complexity and globalization of supply chains, creates a significant challenge for businesses and policymakers. Building greater resilience into supply chains, diversifying sources of supply, and developing robust contingency plans are crucial for mitigating the risks associated with supply chain disruptions and preventing them from escalating into a broader economic disaster. The potential for these disruptions to trigger widespread economic hardship underscores the need for proactive measures to strengthen the resilience of global supply chains and enhance preparedness for future shocks.

6. Social Unrest

Social unrest, characterized by widespread public discontent and protests, represents a significant factor intertwined with the potential for widespread economic hardship. While social unrest can arise from various social and political factors, economic hardship often serves as a catalyst, exacerbating existing grievances and creating a volatile environment. Understanding the complex relationship between social unrest and economic decline is crucial for assessing risks and developing mitigation strategies.

- Economic Inequality:

Economic inequality, characterized by a wide gap between the rich and the poor, can fuel social unrest, particularly during periods of economic hardship. When economic opportunities are limited and resources are unevenly distributed, resentment and frustration can escalate, potentially leading to protests and social instability. The Occupy Wall Street movement, sparked by economic inequality following the 2008 financial crisis, exemplifies this dynamic.

- Unemployment and Loss of Livelihood:

Widespread unemployment and job losses can trigger social unrest, as individuals struggle to meet basic needs and provide for their families. Economic hardship can erode social cohesion, leading to increased crime rates, social unrest, and political instability. The Great Depression of the 1930s, marked by massive unemployment, witnessed significant social and political upheaval.

- Rising Cost of Living:

A sharp increase in the cost of essential goods and services, such as food, housing, and healthcare, can strain household budgets and fuel social unrest. When the cost of living outpaces wage growth, individuals and families may struggle to make ends meet, leading to frustration and resentment towards the government and economic elites. The Arab Spring uprisings, partly triggered by rising food prices, illustrate the destabilizing potential of economic hardship.

- Erosion of Trust in Institutions:

Economic hardship can erode public trust in government institutions, financial systems, and economic elites. Perceptions of corruption, mismanagement, and unfair economic policies can fuel public anger and distrust, potentially leading to protests and demands for systemic change. The 2019 protests in Chile, sparked by a subway fare hike but rooted in deeper economic grievances, exemplify this dynamic.

These interconnected factors can create a feedback loop, where economic hardship fuels social unrest, further destabilizing the economy and exacerbating existing inequalities. Social unrest can disrupt business operations, discourage investment, and undermine economic confidence, potentially leading to a deeper economic downturn. Understanding the complex relationship between social unrest and economic hardship is crucial for developing policies that promote economic opportunity, address inequality, and build more resilient and inclusive societies. Ignoring the potential for social unrest to exacerbate economic challenges can have severe consequences, potentially leading to a downward spiral of economic decline and social instability.

7. Resource Scarcity

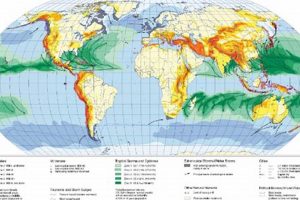

Resource scarcity, the diminishing availability of essential natural resources, poses a substantial threat to global economic stability and is intrinsically linked to the potential for widespread economic hardship. As global populations grow and consumption patterns intensify, the demand for finite resources like water, arable land, minerals, and energy sources increasingly strains supply. This growing imbalance can trigger economic instability, geopolitical tensions, and social unrest, ultimately contributing to a potential economic disaster.

- Water Stress:

Diminishing freshwater supplies, exacerbated by climate change and pollution, pose a significant threat to agriculture, industry, and human health. Water scarcity can lead to reduced agricultural yields, impacting food security and driving up food prices. Competition for dwindling water resources can also escalate tensions between nations and communities, potentially leading to conflict and further economic disruption. The ongoing water crisis in several regions, including parts of Africa and the Middle East, underscores the economic and social consequences of water scarcity.

- Land Degradation and Deforestation:

Unsustainable agricultural practices, deforestation, and urbanization contribute to land degradation, reducing the availability of fertile land for food production. Loss of arable land can lead to food shortages, price increases, and displacement of populations, potentially triggering social unrest and economic instability. The expansion of deserts in regions like the Sahel highlights the long-term economic consequences of land degradation.

- Mineral Resource Depletion:

The increasing demand for minerals essential for modern technologies, such as lithium, cobalt, and rare earth elements, raises concerns about resource depletion and supply chain vulnerabilities. Depletion of these critical minerals can disrupt the production of essential goods, including electronics, batteries, and renewable energy technologies, hindering economic growth and potentially triggering price volatility. The geopolitical implications of mineral resource dependence further exacerbate the risks associated with resource scarcity.

- Energy Security:

The transition from fossil fuels to renewable energy sources is essential for mitigating climate change, but it also presents challenges related to resource availability and supply chain security. The production of renewable energy technologies requires significant quantities of minerals and other resources, potentially creating new resource dependencies. Ensuring a secure and sustainable supply of energy resources is crucial for maintaining economic stability and preventing future energy crises.

These interconnected facets of resource scarcity paint a concerning picture of the potential for future economic hardship. As resources become scarcer and more expensive, competition for access to these essential resources will likely intensify, exacerbating existing geopolitical tensions and potentially leading to conflict. The economic consequences of resource scarcity, including rising food and energy prices, supply chain disruptions, and social unrest, can undermine global economic stability and contribute to a potential economic disaster. Addressing resource scarcity requires a multi-faceted approach, including sustainable resource management, technological innovation, and international cooperation. Failure to address these challenges effectively could have severe and long-lasting economic and social consequences.

Frequently Asked Questions

This section addresses common concerns regarding the potential for significant economic downturn.

Question 1: What are the most likely triggers for a major economic crisis?

Several factors could trigger a significant economic downturn. These include a major financial crisis, a sharp increase in energy prices, a geopolitical conflict, a global pandemic, or a combination of these factors. Identifying potential triggers is crucial for proactive risk management.

Question 2: How can individuals prepare for potential economic hardship?

Building financial resilience is crucial. This includes maintaining an emergency fund, diversifying investments, reducing debt, developing in-demand skills, and staying informed about economic trends. Preparedness enhances the ability to navigate economic challenges effectively.

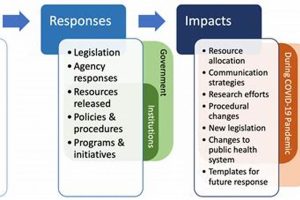

Question 3: What role do governments play in mitigating economic risks?

Governments play a critical role in maintaining economic stability. This includes implementing sound fiscal and monetary policies, regulating financial institutions, investing in education and infrastructure, and providing social safety nets. Effective governance is essential for mitigating systemic risks.

Question 4: How can businesses enhance their resilience to economic shocks?

Businesses can enhance resilience through robust risk management practices, diversification of markets and suppliers, cost optimization strategies, and investment in innovation. Adaptability and preparedness are crucial for navigating economic uncertainty.

Question 5: What are the long-term consequences of a major economic downturn?

Long-term consequences can include increased poverty and inequality, reduced economic growth, social unrest, and political instability. The depth and duration of the downturn significantly influence the severity of the long-term impacts.

Question 6: What is the likelihood of a global economic disaster in the near future?

Predicting the timing of economic events with certainty is challenging. While various indicators suggest increasing economic vulnerabilities, the precise timing and magnitude of any future crisis remain uncertain. Continuous monitoring and analysis of economic trends are crucial.

Understanding the factors that contribute to economic instability empowers individuals, businesses, and governments to make informed decisions and take proactive steps to mitigate risks. Preparedness is key to navigating future economic challenges effectively.

The subsequent section will analyze historical economic crises, extracting valuable lessons for navigating future challenges.

Averting Economic Disaster

The potential for widespread economic hardship, driven by factors such as market instability, geopolitical risks, unsustainable debt burdens, inflationary pressures, supply chain vulnerabilities, social unrest, and resource scarcity, poses a substantial threat to global well-being. This analysis has explored each of these critical areas, highlighting their interconnectedness and potential to amplify economic shocks. Understanding these vulnerabilities is not merely an academic exercise; it is a crucial step towards developing effective mitigation strategies and building a more resilient global economic system.

The imperative now is to translate awareness into action. Proactive measures are essential at all levels, from individual financial planning to national economic policies and international cooperation. Delaying action increases vulnerability and risks exacerbating the potential consequences of future economic shocks. Building a more resilient and sustainable economic future requires a collective commitment to addressing the underlying vulnerabilities that threaten global prosperity. The time for decisive action is now, before potential risks escalate into a full-blown economic disaster.