The Federal Emergency Management Agency (FEMA) provides financial assistance to individuals and communities affected by disasters. This aid can cover a range of needs, from temporary housing and home repairs to grants for lost property and unemployment benefits stemming from a disaster. Specific aid amounts vary depending on the disaster’s severity, the extent of damage, and the applicant’s verified needs. For example, grants for home repairs might cover necessary repairs but not upgrades or improvements.

This financial support plays a crucial role in helping disaster survivors recover and rebuild their lives. Established in 1979, FEMA’s mandate is to strengthen the nation’s capacity to prepare for, protect against, respond to, recover from, and mitigate all hazards. By offering a safety net, the agency lessens the long-term economic and social impacts of disasters, allowing communities to return to normalcy more swiftly. A robust system of disaster relief fosters community resilience and contributes to national security and economic stability.

The following sections will explore the various types of assistance available, eligibility requirements, the application process, and other essential information regarding FEMA’s disaster relief programs.

Applying for and receiving disaster relief can be a complex process. The following tips offer guidance for navigating the system effectively.

Tip 1: Document Everything. Thorough documentation of losses is critical. Photograph or video damage before cleanup begins. Retain receipts for all disaster-related expenses, such as temporary housing, repairs, and replacement items.

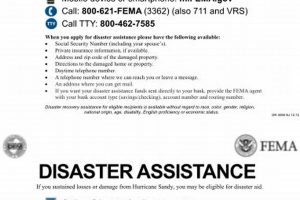

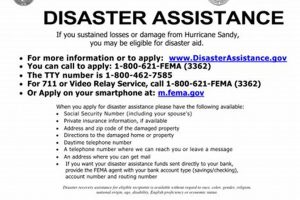

Tip 2: Register with FEMA Promptly. Registration initiates the assistance process. Apply online at DisasterAssistance.gov, via the FEMA mobile app, or by phone. Delays can impact aid disbursement.

Tip 3: Understand Assistance Types. FEMA offers various forms of aid, including grants for housing repairs, temporary rental assistance, and other needs assistance. Research the specific programs available and determine eligibility.

Tip 4: Maintain Contact with FEMA. Respond promptly to all FEMA requests for information or documentation. Keep records of all communications, including case numbers and contact information.

Tip 5: Appeal Denied Claims. If an application is denied, applicants have the right to appeal. Carefully review the denial letter and provide any requested supporting documentation.

Tip 6: Seek Assistance from Community Organizations. Numerous non-profit and community organizations offer support to disaster survivors. These groups may provide additional resources and guidance throughout the recovery process.

Tip 7: Be Aware of Fraudulent Schemes. After disasters, fraudulent schemes targeting survivors become prevalent. Be cautious of unsolicited offers of assistance and verify the legitimacy of any organization before providing personal information.

Following these tips can streamline the application process and improve the likelihood of receiving necessary aid, enabling a smoother recovery.

By understanding the process and available resources, disaster survivors can begin the path toward rebuilding their lives and communities.

1. Need-based Assistance

FEMA’s disaster relief operates on a need-based assistance model. This means the amount of financial aid provided is directly tied to the demonstrated needs of disaster survivors. A comprehensive assessment of individual circumstances, including the extent of damage, available insurance coverage, and financial resources, determines eligibility and award amounts. This approach ensures that limited resources are directed to those with the greatest needs.

- Verified Losses:

Applicants must provide documentation verifying losses incurred due to the disaster. This may include photographs, receipts, insurance documents, and other evidence of damage or expenses. The verified losses, combined with other factors, determine the amount of assistance offered. For example, an individual with significant home damage and limited insurance coverage may receive a larger grant than someone with minimal damage and comprehensive insurance.

- Available Resources:

FEMA considers an applicant’s available resources when determining aid eligibility and amounts. These resources may include savings, insurance payouts, and other forms of financial assistance. The goal is to bridge the gap between available resources and the cost of essential disaster-related needs, not to fully compensate for all losses. For example, if an applicant has already received substantial insurance payments for home repairs, the FEMA grant may be adjusted accordingly.

- Extent of Damage:

The severity of disaster-related damage directly impacts the amount of assistance offered. Individuals with destroyed homes require different levels of support compared to those with minor damage. FEMA inspections and assessments determine the extent of the damage, influencing the appropriate aid amount. For instance, a completely destroyed home may qualify for the maximum grant for housing assistance, while a partially damaged home may qualify for a smaller grant.

- Type of Disaster:

The nature of the disaster also influences the types and amounts of assistance available. Different disasters create different needs. Flooding, for example, may necessitate temporary housing and mold remediation assistance, while wildfires may require funds for debris removal and rebuilding. FEMA tailors its programs to address the specific needs arising from each disaster type.

By linking aid to demonstrated need, FEMA strives to maximize the impact of its limited resources. This ensures that those most impacted by disasters receive the necessary support to begin the recovery process, while also acknowledging that full recovery may involve a combination of resources and individual effort.

2. Capped Grant Amounts

Capped grant amounts represent a critical component of FEMA’s disaster relief framework. These predetermined limits on individual grant amounts directly influence how much financial assistance disaster survivors receive. Capped amounts ensure equitable distribution of limited resources across a potentially large pool of applicants. While individual needs vary significantly following a disaster, capped grants ensure that funds are available to assist a greater number of individuals rather than fully covering the potentially extensive losses of a smaller group. This approach prioritizes providing a baseline level of support to as many eligible survivors as possible. For example, the maximum grant for Individuals and Households Program (IHP) housing assistance may be capped at a specific amount, regardless of the total cost of repairing or replacing a damaged home. This means even if repair costs exceed the cap, the grant will not exceed that predetermined limit.

The existence of capped grant amounts underscores the importance of other resources in disaster recovery. Insurance coverage, personal savings, and assistance from community organizations play vital roles in bridging the gap between capped grants and the total cost of recovery. Understanding these limitations allows individuals and communities to prepare more effectively for potential disasters by securing adequate insurance coverage and developing robust financial safety nets. For instance, homeowners insurance, flood insurance (often separate from standard homeowner’s policies), and even renters insurance can provide crucial financial support for losses not fully covered by FEMA grants. This highlights the importance of a multi-layered approach to disaster preparedness and recovery.

Navigating the complexities of disaster recovery requires a realistic understanding of FEMA’s role and limitations. Capped grant amounts serve as a crucial mechanism for distributing limited resources efficiently and equitably. Recognizing this reality empowers individuals and communities to proactively plan for potential disasters by securing appropriate insurance coverage, developing personal savings strategies, and fostering strong community support networks. This proactive approach complements FEMAs assistance, contributing to a more resilient and comprehensive disaster recovery process.

3. Verified Losses

Verification of disaster-related losses forms the cornerstone of FEMA’s assistance programs. The amount of aid provided directly correlates to the credible evidence of damage and expenses incurred. A clear understanding of the verification process is essential for accessing appropriate levels of support.

- Documentation Requirements:

Applicants must provide comprehensive documentation supporting their claims. This may include photographs and videos of the damage, receipts for repair expenses, insurance claim documents, proof of ownership or residency, and other relevant records. Clear, organized documentation streamlines the verification process and strengthens the application. For example, a homeowner seeking assistance for flood damage should provide photographs of the floodwaters inside the home, receipts for water removal services, and repair estimates from contractors. Incomplete documentation can lead to delays or reduced aid.

- Inspection Process:

FEMA may conduct inspections to verify the reported damage. Inspectors assess the extent of the damage and compare it to the provided documentation. Cooperation with inspectors and providing access to the damaged property is crucial. In cases of widespread damage, remote inspections using satellite imagery or aerial photography may supplement or replace in-person visits. Discrepancies between reported and observed damage may trigger further investigation.

- Impact on Aid Amounts:

The verified extent of loss directly impacts the aid amount. Minor damage with documented repair costs will likely result in a smaller grant compared to substantial damage with verifiable expenses. For example, a homeowner whose primary residence suffered severe structural damage may be eligible for significantly more assistance than a renter whose apartment experienced minor water damage. Accurate and detailed documentation is essential for maximizing eligible aid.

- Appealing Denied Claims:

If a claim is denied due to insufficient verification, applicants have the right to appeal. Appeals require additional documentation or evidence demonstrating the validity of the claimed losses. Detailed records of all communication with FEMA, including case numbers and contact information, are essential throughout the appeal process. A successful appeal often hinges on the ability to provide compelling evidence that supports the initial claim.

The verification process serves to ensure responsible and equitable distribution of disaster relief funds. By providing robust documentation and cooperating with FEMA throughout the process, applicants maximize their chances of receiving appropriate assistance based on their verified needs. This rigorous verification process ensures that limited resources reach those most impacted by disasters, contributing to a more effective and equitable recovery.

4. Available Funding

Available funding directly impacts the amount of disaster relief FEMA can provide. Congressional appropriations and the Disaster Relief Fund balance significantly influence individual assistance amounts and program implementation. Understanding the funding mechanisms provides context for potential limitations and variations in aid following different disasters.

- Congressional Appropriations:

Congress appropriates funds for FEMA’s Disaster Relief Fund. These appropriations vary annually and are influenced by the predicted and actual occurrence of disasters. Supplemental appropriations may be necessary following large-scale events. The level of Congressional funding directly affects FEMA’s capacity to respond to disasters and provide individual assistance. For example, following a particularly active hurricane season, Congress might allocate additional funds to replenish the Disaster Relief Fund and address unmet needs.

- Disaster Relief Fund Balance:

The Disaster Relief Fund balance fluctuates based on disaster activity and Congressional appropriations. A high fund balance allows for greater flexibility and responsiveness in providing aid. Conversely, a low balance can lead to delays or limitations in assistance, particularly following multiple large-scale disasters in close succession. Monitoring the fund balance offers insights into FEMA’s capacity to respond effectively to future events. Historically, periods of intense disaster activity have strained the fund, highlighting the importance of adequate funding and responsible resource management.

- Competition for Resources:

Following major disasters, demand for FEMA assistance often surges. Limited available funding necessitates prioritization of needs and can result in capped grant amounts or extended processing times. The allocation of resources across multiple simultaneous or closely timed disasters can impact individual aid amounts. For example, if two major hurricanes strike different regions within a short period, the available funding may be stretched thin, potentially affecting the speed and amount of assistance provided to survivors in both areas.

- Impact on Program Implementation:

Available funding influences the implementation of specific FEMA programs. Limited funding may restrict eligibility criteria, reduce maximum grant amounts, or delay the rollout of certain assistance programs. Understanding these potential limitations underscores the importance of preparedness and exploring alternative resources. For example, if funding for the Individuals and Households Program is constrained, FEMA might prioritize aid for those with the most immediate and critical needs, potentially delaying or reducing assistance for less severe cases.

The interplay between available funding and disaster relief is complex. Congressional appropriations, the Disaster Relief Fund balance, and the frequency and severity of disasters all influence the amount and availability of aid. Recognizing these factors underscores the importance of disaster preparedness, insurance coverage, and community support networks in supplementing FEMA assistance and fostering a more resilient recovery process. A proactive approach to disaster planning, combined with a realistic understanding of available resources, empowers individuals and communities to navigate the challenges of post-disaster recovery more effectively.

5. Type of Disaster

The type of disaster significantly influences the types and amounts of FEMA aid available. Different disasters create distinct needs, requiring tailored assistance programs. Understanding this connection is crucial for anticipating potential aid and preparing for specific disaster scenarios.

- Damage Type and Severity:

Disasters vary significantly in the types of damage they inflict. Hurricanes often cause flooding and wind damage, requiring assistance for home repairs, temporary housing, and flood insurance deductibles. Earthquakes may necessitate structural repairs and inspections for earthquake-resistant upgrades. Wildfires create unique needs for debris removal, temporary housing, and smoke-related health issues. The severity of damage within each disaster type further influences aid amounts. A completely destroyed home, regardless of the causing disaster, will likely qualify for higher assistance than a partially damaged home.

- Individual vs. Public Assistance:

The type of disaster influences the balance between individual and public assistance. Large-scale disasters often require substantial public assistance for infrastructure repair, debris removal, and emergency protective measures. Individual assistance focuses on housing repairs, temporary housing, and other needs of affected individuals and families. For example, a widespread hurricane might necessitate significant public assistance for rebuilding roads and bridges, while localized flooding might primarily trigger individual assistance for homeowners.

- Geographic Impact:

The geographic extent of a disaster influences resource allocation. Widespread disasters impacting large populations often necessitate greater funding and more complex logistical operations compared to localized events. This can influence the speed and accessibility of individual assistance. For example, a hurricane affecting multiple states may require a larger allocation of resources compared to a tornado impacting a single town, potentially influencing individual aid timelines and availability.

- Declaration Type:

The type of Presidential disaster declaration (emergency or major disaster) impacts the available programs and funding. Major disaster declarations typically unlock a broader range of federal assistance programs, including Individual Assistance and Public Assistance, compared to emergency declarations, which may focus on more limited emergency measures. The declaration type reflects the severity and scope of the disaster, influencing the scale of FEMA’s response and the available aid for individuals and communities.

The connection between disaster type and FEMA aid is multifaceted. The specific needs generated by each disaster type, the balance between individual and public assistance, the geographic scope, and the type of Presidential declaration all play crucial roles in determining the available aid and its distribution. Recognizing these interconnected factors allows for a more informed understanding of FEMA’s role in disaster recovery and underscores the importance of preparing for the specific hazards prevalent in one’s region.

6. Insurance Coverage

Insurance coverage plays a crucial role in determining FEMA disaster relief eligibility and award amounts. FEMA assistance serves as a safety net, not a replacement for insurance. Understanding the interplay between insurance and FEMA aid is essential for maximizing recovery potential.

- Primary Insurance Coverage:

Applicants must utilize available insurance coverage before receiving FEMA assistance. FEMA grants often cover expenses not covered by insurance, such as deductibles or unmet needs. For example, if homeowner’s insurance covers structural repairs but not temporary housing, FEMA might provide assistance for temporary housing needs. Maximizing insurance coverage reduces reliance on limited FEMA resources.

- Flood Insurance:

Flood insurance, often separate from standard homeowner’s policies, is crucial for flood-related disasters. FEMA aid for flood damage is often limited without flood insurance. Properties located in floodplains should maintain adequate flood insurance to ensure access to full disaster relief options. Flood insurance functions as the primary coverage for flood-related losses, with FEMA grants potentially supplementing unmet needs or covering specific uninsured items.

- Documentation of Insurance Claims:

Applicants must provide documentation of insurance claims and payouts when applying for FEMA assistance. This documentation verifies existing coverage and demonstrates the extent of unmet needs. Clear records of insurance communications, policy details, and claim settlements streamline the FEMA application process and ensure accurate assessment of eligibility. Failure to provide insurance documentation can delay or reduce FEMA assistance.

- Impact on Grant Eligibility and Amounts:

Existing insurance coverage directly impacts FEMA grant eligibility and award amounts. FEMA grants supplement insurance, covering unmet needs and filling gaps in coverage. Applicants with comprehensive insurance may receive smaller FEMA grants or be ineligible for certain programs if insurance adequately covers their losses. Conversely, those with limited or no insurance may qualify for higher grant amounts, though still subject to program limitations and available funding.

Insurance functions as the first line of defense in disaster recovery. Adequate insurance coverage minimizes reliance on FEMA, allowing limited federal resources to address the most critical unmet needs. Understanding the relationship between insurance and FEMA aid empowers individuals and communities to prepare effectively for disasters and maximize their recovery potential by combining insurance benefits with available federal assistance. This combined approach ensures a more resilient and comprehensive recovery strategy.

Frequently Asked Questions

This section addresses common questions regarding FEMA’s disaster relief programs and financial assistance. Clarity on these points can assist individuals in navigating the application process and understanding available support.

Question 1: What is the maximum amount of financial assistance FEMA provides?

Maximum grant amounts vary depending on the specific disaster, available funding, and the applicant’s verified needs. No fixed maximum applies universally. Consulting the FEMA website for the specific disaster declaration provides current program limits.

Question 2: Does FEMA cover all losses incurred during a disaster?

FEMA assistance is not designed to cover all losses. Aid focuses on meeting basic needs and jumpstarting recovery, not providing full replacement value for all damaged or lost items. Insurance coverage and other resources are essential for comprehensive recovery.

Question 3: How are grant amounts determined?

Grant amounts are determined based on verified losses, available insurance coverage, and demonstrated need. Applicants must provide documentation supporting their claims. FEMA inspections may also verify reported damage. Factors like the extent of damage and available resources influence final grant amounts.

Question 4: What types of assistance does FEMA offer besides financial aid?

Besides financial aid, FEMA offers various forms of assistance, including crisis counseling, unemployment assistance, legal aid, case management, and assistance with navigating the appeals process. These services complement financial grants, addressing a broader range of disaster-related needs.

Question 5: How does insurance impact FEMA eligibility?

Applicants must utilize existing insurance coverage before receiving FEMA assistance. FEMA grants often cover unmet needs or expenses not covered by insurance, such as deductibles. Maintaining adequate insurance is crucial for maximizing recovery potential.

Question 6: What if my FEMA application is denied?

Applicants have the right to appeal denied claims. Appeals require additional documentation supporting the claim. Detailed records of all communication with FEMA, including case numbers and contact information, are crucial during the appeals process.

Understanding these key points helps manage expectations and facilitates a smoother application process. Thorough preparation, including comprehensive insurance coverage and detailed documentation, significantly strengthens applications and improves the likelihood of receiving appropriate assistance.

For further information and specific program details, consult the official FEMA website or contact a FEMA representative.

Understanding FEMA Disaster Relief Payments

Disaster relief funding from FEMA hinges on a complex interplay of factors. The amount provided isn’t a fixed sum, but rather a calculated response to verified needs, available resources, and the specifics of each disaster. Insurance coverage plays a pivotal role, serving as the first line of financial defense. While FEMA assistance aims to bridge the gap between insured losses and essential recovery needs, limitations exist due to funding constraints and equitable distribution principles. Therefore, anticipating potential aid requires a realistic assessment of these interconnected elements.

Preparedness remains paramount. Adequate insurance coverage, meticulous documentation of losses, and a clear understanding of FEMA’s role are crucial for navigating the complexities of disaster recovery. While FEMA provides vital support, individual and community resilience relies on a proactive approach, combining available resources and fostering a culture of preparedness. This multifaceted strategy empowers individuals and communities to rebuild and recover more effectively in the aftermath of disaster.