Federal Emergency Management Agency (FEMA) assistance for disaster recovery varies significantly based on the specific disaster, the extent of damage, and the applicant’s individual circumstances. Aid can take numerous forms, including grants for temporary housing, home repairs, personal property losses, and unemployment benefits. The maximum individual and household grants are set by law and are adjusted periodically. For example, grants for home repairs may cover necessary repairs to make a primary residence habitable, but not necessarily restore it to its pre-disaster condition. Other needs, such as medical, dental, funeral, and transportation expenses, may also be eligible for assistance. The agency uses a thorough process to assess needs and verify eligibility before disbursing funds.

Governmental disaster relief programs are crucial for community recovery and individual well-being following devastating events. These programs provide a safety net, helping those affected regain stability and rebuild their lives. Historically, such programs have evolved in response to the increasing frequency and severity of disasters, reflecting a growing understanding of the importance of government support in times of crisis. These programs aim to not only address immediate needs but also to mitigate future risks and promote community resilience.

Understanding the nuances of disaster relief funding is essential for both potential applicants and for a broader comprehension of emergency management. Exploring the eligibility requirements, application procedures, and the various types of assistance available will be covered in the following sections. Additionally, we will examine how these programs interact with other forms of disaster aid, such as insurance and community support networks.

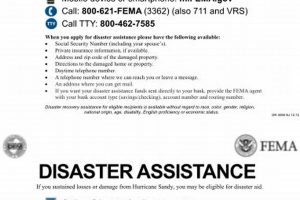

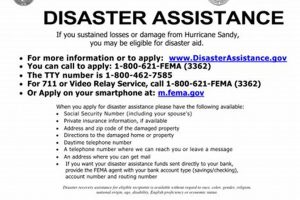

Securing necessary aid after a disaster requires careful planning and thorough documentation. The following tips offer guidance for individuals seeking assistance.

Tip 1: Register with FEMA as soon as possible. Disaster declarations often have specific deadlines for registration. Prompt registration helps expedite the assistance process.

Tip 2: Document all damages thoroughly. Photographic and video evidence of damage to property and possessions is crucial for substantiating claims. Retain all receipts related to disaster-related expenses.

Tip 3: Maintain detailed records of communication with FEMA. Keep records of application numbers, caseworker contact information, and correspondence. This documentation proves invaluable if issues arise during the process.

Tip 4: Understand the specific eligibility requirements for each type of assistance. FEMA offers various programs, each with specific criteria. Research these criteria carefully to ensure accurate application completion.

Tip 5: Be prepared to provide supporting documentation. Proof of identity, residency, and ownership may be required. Gather these documents in advance to streamline the application process.

Tip 6: Explore additional resources beyond FEMA assistance. Numerous organizations, including charities and community groups, offer aid following disasters. Leveraging these resources can supplement FEMA assistance.

Tip 7: Appeal denied claims if necessary. Applicants have the right to appeal if assistance is denied. Ensure all necessary documentation and justification are included in the appeal.

Following these tips increases the likelihood of a successful application and helps individuals access the necessary resources to rebuild their lives after a disaster.

By understanding the process and being prepared, individuals can navigate the complexities of disaster aid and begin the recovery process more effectively. The subsequent section offers concluding thoughts on disaster preparedness and community resilience.

1. Need-based Assistance

Need-based assistance forms the cornerstone of FEMA’s disaster relief framework. The amount of aid provided directly correlates to the demonstrated need arising from a disaster. This principle ensures that those with the greatest losses receive the most substantial support. A thorough needs assessment, conducted by FEMA inspectors, evaluates the extent of damage to property and the impact on an individual’s or family’s essential needs. This assessment considers factors like the habitability of the primary residence, the loss of essential personal property, and disaster-caused unemployment. For instance, a family whose home is completely destroyed will typically qualify for more assistance than a family whose home suffered minor damage, even if the disaster impacted both equally.

The link between need and assistance levels is crucial for equitable distribution of limited resources. Prioritizing those with the most significant needs ensures that funds are directed where they can have the greatest impact. However, this principle also introduces complexities. Accurately assessing need requires a nuanced understanding of individual circumstances and potential long-term consequences of disaster-related losses. Consider two individuals whose homes require identical repairs. One individual may have lost their primary source of income due to the disaster, while the other may have maintained stable employment. The former’s need is demonstrably greater, justifying a higher level of assistance to address not only housing repairs but also the loss of income. Documenting and verifying these nuanced needs requires robust assessment procedures and supporting evidence from applicants.

Understanding the need-based nature of FEMA assistance highlights the importance of thorough documentation when applying for aid. Clear evidence of losses, coupled with accurate representations of individual circumstances, directly influences the amount of assistance received. While need drives assistance, the available funding and legal limits constrain the maximum amount disbursed. Navigating this complex interplay requires a clear understanding of both individual needs and the regulatory framework governing FEMA assistance. This comprehension empowers individuals to effectively seek and utilize the resources available to rebuild their lives following a disaster.

2. Capped Assistance Amounts

Capped assistance amounts play a critical role in determining FEMA’s disaster relief payouts. While need-based assistance forms the foundation of FEMA’s approach, congressionally mandated limits and agency regulations cap the maximum amount any individual or household can receive. These caps exist to ensure equitable distribution of limited funds across a potentially large pool of applicants following a widespread disaster. For example, the maximum grant for home repairs may be capped at a specific amount, regardless of whether the estimated repair costs exceed that limit. This cap ensures that funds are spread as widely as possible, recognizing that exceeding the cap for one applicant might deplete resources needed for others. Consequently, applicants must explore alternative funding sources, such as personal insurance or loans, to cover costs exceeding FEMAs maximum grant.

Understanding these limitations allows applicants to develop realistic expectations and explore supplementary financial resources. For instance, if an individual’s home requires $50,000 in repairs, but the FEMA cap for home repairs is $30,000, the individual must identify other funding sources to bridge the $20,000 gap. Relying solely on FEMA without recognizing these caps can lead to financial shortfalls during the recovery process. Furthermore, different types of assistance have different caps. The maximum grant for temporary housing will differ from the cap for home repairs or personal property loss. Recognizing these varying limits is essential for effective financial planning during recovery.

In summary, capped assistance amounts serve as a practical constraint on FEMA’s disaster relief payouts. While these caps may limit the extent of individual aid, they function as a critical mechanism to distribute limited resources equitably across disaster-affected populations. Recognizing the existence and implications of these caps allows individuals to navigate the recovery process more effectively, supplementing FEMA aid with other resources to address unmet needs. This understanding empowers individuals to develop realistic financial plans and make informed decisions during a challenging period.

3. Verified Losses

Verified losses form the evidentiary basis for FEMA disaster relief. The amount of assistance received hinges directly on the ability to substantiate losses with credible documentation. This process ensures that aid is distributed fairly and appropriately, reflecting actual damages rather than speculative claims. Understanding the verification process is crucial for accessing appropriate levels of assistance.

- Documentation Requirements

Specific documentation requirements vary depending on the type of loss claimed. Damage to a primary residence requires different documentation than loss of personal property or disaster-caused unemployment. Photographs and videos of damaged property are essential. Receipts, insurance documents, and proof of ownership or lease agreements further substantiate claims. For example, a damaged vehicle requires photographic evidence of the damage, a copy of the vehicle title, and repair estimates. Missing documentation can lead to delays or denial of assistance.

- Inspection Process

FEMA often conducts inspections to verify reported damages. Inspectors assess the extent of the damage and compare it to the documentation provided. This independent verification ensures the accuracy of claims and identifies potential discrepancies. For instance, an inspector might verify that flood damage reached a claimed height within a home. Cooperation with inspectors and providing access to the damaged property is crucial for a successful verification process.

- Appeals Process

An appeals process exists for applicants who disagree with FEMA’s determination of verified losses. Applicants must provide additional documentation or evidence to support their claims during the appeal. For example, if FEMA denies a claim for structural damage, the applicant might submit a structural engineer’s report during the appeal to substantiate the claim. Understanding the appeals process is essential for advocating for accurate assessment of losses.

- Impact on Aid Amounts

The extent of verified losses directly influences the amount of aid received. Greater verified losses, supported by robust documentation, generally translate to higher levels of assistance. However, this remains subject to program caps and available funding. For instance, even with substantial verified losses, the aid received will not exceed the maximum grant amount for a given program. Therefore, while verification maximizes potential assistance, other factors contribute to the final aid amount.

In conclusion, verifying losses represents a crucial link between disaster-related damages and the amount of FEMA relief received. Meticulous documentation, cooperation with inspections, and understanding the appeals process are essential for maximizing potential assistance. While verified losses significantly influence aid amounts, they interact with program caps and available funding to determine the final disbursement. Therefore, a comprehensive understanding of the verification process and its implications empowers applicants to navigate the complexities of disaster relief effectively.

4. Available Funding

Available funding directly impacts the amount of disaster relief FEMA can disburse. Congressional appropriations dictate the total resources allocated to FEMA’s Disaster Relief Fund (DRF). This funding pool covers a wide range of disaster-related expenses, including individual assistance, public assistance, and hazard mitigation grants. When a major disaster strikes, the demand for aid can rapidly deplete available funds. The balance between available funding and disaster-related needs creates a dynamic relationship where funding availability influences individual aid amounts. For instance, following Hurricane Katrina in 2005, the unprecedented scale of destruction strained FEMA’s resources, leading to delays and challenges in distributing aid. This underscores the direct link between available funding and the agency’s capacity to respond effectively.

This connection necessitates careful resource management by FEMA and influences policy decisions regarding aid distribution. Prioritization of needs, implementation of spending caps, and coordination with other aid organizations become crucial when available funding is limited. Consider a scenario where two communities experience similar levels of damage from different disasters occurring close together. If the DRF faces constraints after the first disaster, the second community might receive comparatively less assistance, even with equivalent needs. This highlights the practical significance of available funding as a limiting factor, even with established needs assessments and verification processes. Furthermore, supplemental appropriations from Congress often become necessary following large-scale disasters to replenish the DRF and ensure adequate response capacity.

In summary, available funding serves as a critical determinant of FEMA’s disaster relief capacity. The finite nature of the DRF requires strategic resource allocation to address the dynamic and often unpredictable nature of disaster-related needs. Understanding this connection underscores the importance of both congressional appropriations and FEMA’s internal resource management in shaping individual disaster relief outcomes. This understanding also highlights the potential challenges posed by funding limitations in responding to multiple or large-scale disasters, reinforcing the need for comprehensive disaster preparedness and resilient financial planning at both individual and governmental levels.

5. Specific Disaster Type

The specific type of disaster significantly influences the types and amounts of FEMA aid available. Different disasters create different needs, requiring specialized response programs and eligibility criteria. Understanding these distinctions is essential for navigating the complexities of disaster relief and accessing appropriate assistance.

- Damage Type and Severity

The nature of the damage caused by a disaster plays a critical role in determining aid eligibility and amounts. For example, flooding often leads to different types of damage than wildfires. Flooding might necessitate assistance for temporary housing and replacement of personal property, while wildfires might prioritize debris removal and rebuilding assistance. Furthermore, the severity of the damage influences the amount of aid. A home completely destroyed by a hurricane will likely qualify for maximum assistance amounts, whereas a home with minor wind damage from the same hurricane may only qualify for limited aid.

- Available Programs

Specific disaster types trigger different FEMA programs, each with unique eligibility criteria and assistance levels. Individuals affected by flooding might be eligible for the Individuals and Households Program, which covers housing assistance and personal property losses. Those affected by earthquakes might be eligible for crisis counseling assistance. Disasters requiring extensive public infrastructure repair may trigger Public Assistance grants, indirectly benefiting individuals through community rebuilding efforts. The interplay between specific disaster types and available programs influences aid amounts.

- Geographic Location

Geographic location influences the types of disasters that commonly occur and the resources allocated for response and recovery. Coastal areas are more prone to hurricanes, while inland areas face greater risks from wildfires or tornadoes. FEMA’s resource allocation considers these regional variations in disaster risk. Furthermore, rebuilding costs can vary significantly by location due to differences in construction costs and material availability. These factors influence the amount of aid deemed necessary and appropriate for different disaster-affected areas. For example, rebuilding costs after a hurricane in a high-cost coastal area may exceed those in a less expensive inland region.

- Declaration Type

The type of disaster declaration issued by the federal government impacts the availability of certain aid programs and funding levels. Major disaster declarations typically unlock a broader range of assistance programs and larger funding pools than emergency declarations. The declaration type reflects the scale and severity of the disaster, influencing both the scope of FEMA’s response and the maximum individual aid available. For example, a major disaster declaration might make both individual assistance and public assistance grants available, whereas an emergency declaration might prioritize immediate, short-term needs.

In conclusion, the specific disaster type is a pivotal factor shaping FEMA’s disaster relief response and the amount of aid available to individuals. Damage type and severity, available programs, geographic location, and declaration type all interact to determine the scope and scale of assistance. Understanding these factors empowers individuals to navigate the complexities of disaster relief, anticipate potential aid amounts, and effectively utilize available resources to rebuild their lives after a disaster.

6. Individual Circumstances

Individual circumstances play a significant role in determining the amount of disaster relief aid received from FEMA. While general eligibility criteria and program caps exist, the specific needs and situations of each applicant factor into the final aid calculation. This personalized approach ensures that assistance aligns with the unique challenges faced by disaster survivors.

- Insurance Coverage

Existing insurance coverage significantly influences FEMA aid. FEMA assistance serves as a secondary resource, supplementing insurance payouts rather than duplicating them. Applicants must file insurance claims before seeking FEMA assistance. The amount of insurance coverage and the extent of losses covered by insurance directly impact the amount of FEMA aid received. For example, an individual with flood insurance covering 80% of flood-related losses will receive less FEMA aid than someone without flood insurance facing similar damages. This principle ensures responsible use of federal funds by leveraging existing insurance resources.

- Income and Financial Resources

While FEMA primarily focuses on needs-based assistance, income and financial resources may play a role in determining eligibility for certain programs or the amount of aid received. Some programs may have income limits, while others may consider available financial resources when calculating need. This ensures aid prioritizes those with the fewest resources to recover independently. For instance, an individual with substantial savings might receive less aid for temporary housing than someone with limited financial resources, even if both experienced similar housing displacement due to the disaster. This approach aims to direct aid where it is most needed.

- Household Size and Composition

Household size and composition influence aid calculations, particularly for programs related to housing and personal property. Larger households require larger temporary housing accommodations and generally experience greater personal property losses. The presence of vulnerable individuals within the household, such as elderly members or those with disabilities, may also influence eligibility for certain types of assistance. For example, a family of six will likely receive a larger housing assistance grant than a single individual, reflecting the increased need for space and resources. Similarly, households with members requiring specialized medical equipment may qualify for additional aid to replace damaged equipment.

- Accessibility of Damaged Property

Accessibility of the damaged property influences the assessment and verification process, impacting aid disbursement. If inspectors cannot safely access a damaged property due to ongoing hazards or structural instability, accurately assessing losses and verifying damages becomes challenging. This can delay aid delivery or lead to underestimation of losses if full assessment is impossible. For example, if a home is located in a flooded area still inaccessible due to high water levels, inspectors cannot immediately assess the full extent of damage. This underscores the importance of ensuring safe access for inspectors once conditions permit to facilitate accurate assessment and timely aid delivery.

In summary, individual circumstances represent a crucial layer of consideration within FEMA’s disaster relief framework. Factors such as insurance coverage, income, household composition, and property accessibility interact with general eligibility criteria to determine the final amount of aid received. This individualized approach tailors assistance to the unique needs of disaster survivors, promoting equitable and effective distribution of limited resources. Understanding how these factors influence aid decisions empowers individuals to navigate the application process effectively and maximize their potential assistance.

7. Designated Eligible Expenses

Designated eligible expenses directly determine the scope of FEMA’s disaster relief payments. FEMA assistance focuses on specific needs arising from disasters, not all conceivable losses. Understanding these eligible expenses is crucial for accurate application preparation and realistic expectation management. The link between designated eligible expenses and aid amounts operates on a clear principle: FEMA only provides assistance for costs directly related to eligible disaster-caused needs. These needs typically include temporary housing, essential home repairs, personal property replacement, and necessary medical or funeral expenses. For example, FEMA might cover the cost of repairing a damaged roof to make a home habitable but not the cost of replacing a damaged swimming pool. Similarly, FEMA might cover the cost of replacing essential furniture damaged by flooding, but not luxury items or collectibles. This distinction ensures that limited resources address fundamental needs first.

Several practical implications arise from this connection. Applicants must meticulously document expenses related to eligible needs, providing evidence such as receipts, invoices, and repair estimates. Expenses falling outside the scope of designated eligible expenses will not receive FEMA support, necessitating alternative funding sources. For example, if a disaster-caused landslide necessitates retaining wall repairs to prevent further damage, documenting the necessity of this repair as a preventative measure for habitability becomes essential for securing FEMA aid. Simply documenting the damage without linking it to an eligible need might lead to denial of assistance. Understanding eligible expenses also allows applicants to prioritize spending and resource allocation during recovery. Focusing on eligible expenses maximizes the potential for FEMA assistance, allowing individuals to allocate remaining personal resources to non-eligible but necessary expenses.

In conclusion, designated eligible expenses serve as a critical filter determining the extent of FEMA disaster relief. Aligning recovery efforts with these eligible expenses maximizes potential FEMA assistance. Accurate documentation of eligible expenses is paramount for successful application outcomes. Recognizing the limitations imposed by designated eligible expenses allows for proactive planning and efficient resource allocation during the often challenging recovery period. This understanding empowers individuals to effectively navigate the complexities of disaster relief, focusing on eligible needs and exploring alternative funding options for non-eligible expenses.

Frequently Asked Questions about Disaster Relief Assistance

This section addresses common questions regarding financial assistance available following a disaster.

Question 1: What is the maximum amount of financial assistance available from FEMA?

Maximum assistance amounts vary based on the specific disaster, the type of assistance needed, and current FEMA regulations. Contacting FEMA directly or reviewing their official website provides the most current information regarding specific program limits.

Question 2: Does FEMA assistance cover all losses incurred during a disaster?

FEMA assistance does not cover all losses. Aid focuses on essential needs such as temporary housing, essential home repairs, and personal property losses. Luxury items, non-essential repairs, and losses covered by insurance typically fall outside the scope of FEMA assistance.

Question 3: How are individual assistance amounts determined?

Individual assistance amounts are determined based on a needs assessment conducted by FEMA. Factors considered include the extent of damage, the applicant’s living situation, insurance coverage, and available resources. Supporting documentation is crucial for verifying losses and establishing eligibility for maximum assistance.

Question 4: How does insurance coverage affect FEMA assistance?

Insurance coverage serves as the primary resource for disaster recovery. FEMA assistance supplements insurance payouts for uncovered losses. Applicants must file insurance claims before applying for FEMA aid. The amount of insurance coverage directly affects the amount of FEMA assistance available.

Question 5: What types of disasters qualify for FEMA assistance?

Federally declared disasters qualify for FEMA assistance. These declarations are typically issued for events such as hurricanes, floods, wildfires, tornadoes, earthquakes, and other significant natural disasters causing widespread damage. The specific programs available vary depending on the disaster type.

Question 6: How long does it take to receive FEMA assistance?

The timeframe for receiving FEMA assistance varies based on the disaster’s severity, the number of applicants, and the complexity of individual cases. While some assistance may be provided within days, more complex cases requiring inspections and verification can take several weeks or longer. Maintaining contact with FEMA and promptly responding to requests for information can expedite the process.

Understanding these key aspects of FEMA assistance allows individuals to navigate the application process more effectively and make informed decisions regarding disaster recovery. Thorough documentation, accurate information, and timely communication with FEMA remain crucial for accessing appropriate aid.

Additional resources and information regarding disaster preparedness and recovery will be explored in the following section.

Conclusion

Navigating the complexities of federal disaster relief requires a nuanced understanding of the factors influencing aid disbursement. The amount of assistance provided by FEMA hinges not on a fixed formula, but on a dynamic interplay of individual needs, verified losses, available funding, specific disaster characteristics, and designated eligible expenses. Capped assistance amounts further constrain potential aid, necessitating realistic expectations and proactive exploration of supplemental resources. Recognizing the individualized nature of the process emphasizes the importance of thorough documentation, accurate information, and timely communication with FEMA officials.

Disaster preparedness remains paramount. Understanding the intricacies of FEMA’s approach to disaster relief allows for proactive planning and informed decision-making during recovery. While federal aid serves as a crucial safety net, effective disaster preparedness necessitates a multi-faceted approach, incorporating insurance coverage, personal savings, and community support networks. A comprehensive approach to disaster recovery recognizes the limitations of federal aid while maximizing the potential benefits through informed engagement with the process. Proactive planning and a thorough understanding of available resources empower individuals and communities to navigate the challenges of disaster recovery more effectively, fostering resilience and promoting a more secure future.