Policies specifically designed to protect against financial losses arising from natural disasters exist. These policies typically cover a range of perils, including earthquakes, floods, hurricanes, wildfires, and other similar events. For example, a homeowner might purchase a separate flood insurance policy in addition to a standard homeowner’s policy, as most standard policies exclude flood damage.

Protection against the often-devastating financial consequences of natural catastrophes is critically important for both individuals and communities. Such coverage can provide financial stability following a disaster, enabling homeowners and businesses to rebuild and recover. Historically, the development of specialized insurance products for natural disasters has been driven by the increasing frequency and severity of these events and a growing awareness of the need for comprehensive risk management strategies. This specialized coverage helps bridge the gap left by traditional insurance and plays a vital role in fostering resilience in the face of natural hazards.

This article will further explore the specifics of various natural catastrophe insurance options, including availability, coverage types, cost factors, and the claims process. It will also delve into the broader context of disaster preparedness and mitigation, highlighting the crucial role insurance plays in comprehensive risk management.

Securing adequate financial protection against natural disasters requires careful planning and consideration. The following tips offer guidance for navigating the complexities of catastrophe coverage.

Tip 1: Assess Risk Profile: Carefully evaluate the specific risks prevalent in one’s geographic location. Coastal residents face different threats than those in earthquake-prone zones. Understanding these risks informs appropriate coverage choices.

Tip 2: Understand Policy Exclusions: Standard homeowner’s and renter’s insurance policies often exclude specific natural disasters, notably floods and earthquakes. Supplemental coverage is typically required.

Tip 3: Evaluate Coverage Limits: Ensure coverage limits adequately reflect the potential cost of rebuilding or replacing property in the event of a total loss. Underinsurance can lead to significant financial hardship following a disaster.

Tip 4: Consider Deductibles: Understand the deductible structure and its impact on premium costs. Higher deductibles typically result in lower premiums but require greater out-of-pocket expenses in the event of a claim.

Tip 5: Research Government-Backed Programs: Explore government-sponsored insurance programs, such as the National Flood Insurance Program (NFIP), which may offer coverage options where private insurers do not.

Tip 6: Document Possessions: Maintaining a detailed inventory of belongings, including photographs or videos, simplifies the claims process and helps ensure adequate compensation for losses.

By following these tips, individuals can take proactive steps to secure appropriate insurance coverage and protect their financial well-being in the face of natural disasters. Comprehensive coverage is a cornerstone of effective disaster preparedness and recovery.

This information provides practical guidance for navigating the complexities of natural catastrophe insurance. The subsequent conclusion will offer final thoughts and emphasize the importance of proactive planning.

1. Availability Varies.

The availability of natural disaster insurance is not uniform. Whether specific coverage can be obtained depends on a complex interplay of factors, creating a situation where some property owners can easily access necessary protections while others face significant challenges. Understanding these variations is crucial for effective risk management and financial preparedness.

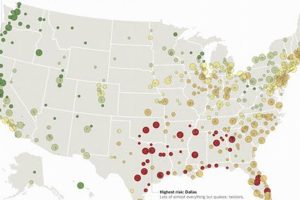

- Geographic Location

Insurance availability is heavily influenced by location. Properties situated in high-risk areas, such as coastal regions prone to hurricanes or floodplains, may find it difficult to secure coverage from private insurers. Conversely, properties in areas deemed lower risk often have more readily available options. This geographic disparity highlights the uneven distribution of risk and the challenges faced by those in hazard-prone areas.

- Type of Peril

The specific type of natural disaster also impacts coverage availability. Standard homeowner’s policies typically exclude coverage for floods and earthquakes. Specialized policies are required for these perils, and their availability can vary significantly. Some insurers may not offer earthquake coverage in certain regions, for instance, while flood insurance may be primarily available through government-backed programs like the National Flood Insurance Program (NFIP).

- Insurance Provider

Different insurance providers have varying underwriting guidelines and risk appetites. Some insurers may specialize in certain types of catastrophe coverage or focus on specific geographic regions. This specialization can lead to discrepancies in availability, requiring property owners to research multiple providers to find appropriate coverage.

- Property Characteristics

The characteristics of the property itself can influence coverage availability. Factors such as age, construction materials, and mitigation measures can affect an insurer’s willingness to provide coverage. Properties built to withstand specific hazards may have an easier time securing coverage, while older or more vulnerable structures might face limitations.

These variations in availability underscore the complex nature of natural disaster insurance. Property owners must carefully assess their individual circumstances, considering their location, the specific risks they face, and the options available from various insurance providers. Proactive research and consultation with insurance professionals are essential for navigating this landscape and ensuring adequate protection against the financial consequences of natural disasters.

2. Specific Perils Covered.

A crucial aspect of natural disaster insurance lies in understanding the specific perils covered under a given policy. The question “Is there natural disaster insurance?” cannot be fully answered without a detailed examination of the range of hazards addressed. Policies are not uniform in their coverage, and assuming comprehensive protection without careful review can lead to significant financial vulnerability in the aftermath of a disaster. This section explores the specific perils typically covered by natural disaster insurance policies, highlighting the importance of careful policy selection.

- Earthquakes

Earthquake insurance typically covers damage caused by ground shaking and related earth movement, including damage to buildings and their contents. However, policies may exclude certain types of damage, such as those resulting from landslides or tsunamis, which might require separate coverage. For example, a homeowner in California might purchase a specific earthquake policy to supplement their standard homeowner’s insurance, which typically excludes earthquake damage.

- Floods

Flood insurance covers damage caused by rising water, including riverine flooding, coastal flooding, and storm surges. Standard homeowner’s insurance policies almost universally exclude flood damage. The National Flood Insurance Program (NFIP) is a primary source of flood insurance in the United States, though private flood insurance options are increasingly available. A business owner located in a floodplain would likely need a separate flood insurance policy to cover potential losses from rising waters.

- Hurricanes

Hurricane insurance typically covers wind damage and damage from wind-driven rain. Flood damage resulting from storm surge or heavy rainfall is usually excluded from standard hurricane policies and requires separate flood insurance. Coastal residents in hurricane-prone areas should carefully consider both windstorm and flood coverage to ensure comprehensive protection. For instance, a homeowner in Florida might need separate policies for wind damage from a hurricane and flooding caused by the storm surge.

- Wildfires

Wildfire insurance covers damage caused by fire, smoke, and related heat damage. Policies may also cover costs associated with evacuation and debris removal. Homeowners in areas prone to wildfires, such as those in the western United States, should ensure their policies adequately cover wildfire risks. This includes considering coverage for landscaping and other exterior property elements that might be damaged in a fire.

The specific perils covered by natural disaster insurance significantly impact its value and relevance. Carefully reviewing policy details and understanding the specific hazards covered and excluded is paramount. Addressing the question “Is there natural disaster insurance?” necessitates a deeper dive into these specific perils, ensuring appropriate coverage aligned with individual needs and the specific risks present in a given geographic location.

3. Separate Policies Needed.

The availability of natural disaster insurance often necessitates obtaining separate policies for specific perils. Understanding this requirement is crucial when exploring the broader question of whether natural disaster insurance exists. While a standard homeowner’s insurance policy provides baseline protection, it typically excludes coverage for major natural disasters, creating a potential gap in coverage that requires separate, specialized policies. Exploring the need for these separate policies reveals a critical aspect of comprehensive disaster preparedness.

- Standard Homeowner’s Insurance Exclusions

Standard homeowner’s insurance policies typically exclude coverage for floods, earthquakes, and other specific natural disasters. This means that even with a comprehensive homeowner’s policy, significant financial vulnerabilities remain. A homeowner might assume they are adequately insured, only to discover after a flood that their policy does not cover the resulting damage. This common exclusion necessitates separate flood insurance, often obtained through the National Flood Insurance Program (NFIP) or private insurers.

- Specialized Peril Policies

The need for separate policies stems from the unique nature of various natural disasters. Flood risk, for example, differs significantly from earthquake risk, requiring distinct underwriting and risk assessment methodologies. A property located in a floodplain requires specialized flood insurance to address the specific risk of rising water, while a property in an earthquake-prone zone needs a separate earthquake policy to cover potential damage from ground shaking. This specialization allows for more accurate risk assessment and tailored coverage.

- Government-Backed Programs

Due to the high risk associated with certain natural disasters, private insurers may be hesitant to offer coverage. This has led to the creation of government-backed programs, such as the NFIP, to provide coverage options not readily available in the private market. These programs often operate as separate entities, requiring separate applications and policy management. A homeowner seeking flood insurance, for instance, would typically obtain coverage through the NFIP rather than their standard homeowner’s insurance provider.

- Comprehensive Coverage Strategy

Building a comprehensive insurance strategy for natural disasters often requires assembling a portfolio of policies. This approach acknowledges the limitations of standard homeowner’s insurance and the need for specialized coverage to address specific perils. A homeowner in a coastal area might require separate policies for wind damage from hurricanes, flooding from storm surge, and even earthquake coverage if located in a seismically active zone. This multi-layered approach ensures comprehensive financial protection.

The need for separate policies highlights the complexity and fragmented nature of natural disaster insurance. Addressing the question “Is there natural disaster insurance?” requires acknowledging this complexity and recognizing the need for proactive research and planning to secure comprehensive coverage against a range of potential hazards. The absence of universal coverage within standard policies necessitates a more nuanced approach to disaster preparedness, involving a combination of standard insurance and specialized policies tailored to specific risks.

4. Cost depends on location.

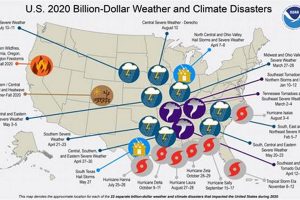

Location plays a significant role in determining the cost of natural disaster insurance, directly influencing both availability and affordability. This geographic dependence stems from the uneven distribution of risk associated with various natural hazards. Properties located in high-risk areas face a greater likelihood of experiencing a catastrophic event, leading to higher premiums. Conversely, properties in lower-risk areas typically benefit from lower insurance costs. This location-based pricing reflects the fundamental principles of insurance underwriting, where premiums are calculated based on the probability and potential severity of loss. For example, a homeowner in a coastal Florida community will likely pay significantly more for hurricane and flood insurance than a homeowner in a landlocked region with minimal exposure to such risks.

The relationship between location and cost has several practical implications. It underscores the need for careful consideration of location when assessing the overall cost of homeownership or business operation in disaster-prone areas. The seemingly lower initial cost of property in a high-risk zone might be offset by significantly higher insurance premiums. Furthermore, the availability of insurance itself can be impacted by location. Insurers may be reluctant to offer coverage in areas deemed excessively high-risk, creating challenges for property owners seeking adequate protection. This can lead to situations where specialized insurance programs or government-backed initiatives become necessary to provide coverage options. For instance, the National Flood Insurance Program (NFIP) plays a vital role in providing flood insurance in high-risk areas where private insurers may limit their offerings.

Understanding the location-based pricing of natural disaster insurance is crucial for informed decision-making. Prospective homeowners and business owners should carefully evaluate the long-term costs associated with property ownership in various locations, factoring in the potential financial burden of high insurance premiums or the difficulty of securing coverage in high-risk areas. This understanding helps individuals make informed choices that align with their risk tolerance and financial capabilities. The geographic variability of insurance costs underscores the complexity of navigating natural disaster risk and the importance of proactive planning and research. It also highlights the broader societal implications of unevenly distributed risk and the need for comprehensive strategies to mitigate the financial impact of natural disasters on vulnerable communities.

5. Government programs exist.

Government-backed insurance programs play a significant role in answering the question, “Is there natural disaster insurance?” For certain perils, particularly those where private insurers are hesitant to offer widespread coverage due to high risk, government programs often serve as a critical safety net, providing essential financial protection against catastrophic events. These programs represent a key component of the broader natural disaster insurance landscape, filling gaps in private market offerings and ensuring access to coverage for vulnerable populations and properties.

- National Flood Insurance Program (NFIP)

The NFIP stands as a prominent example of a government-sponsored insurance program, offering flood insurance to homeowners, renters, and business owners in participating communities. Given that standard homeowner’s policies typically exclude flood damage, the NFIP provides a crucial resource for individuals and communities located in flood-prone areas. It enables property owners to secure financial protection against a peril that private insurers often avoid due to the high risk involved. For instance, a homeowner in a coastal community might rely on the NFIP to insure their property against flood damage resulting from storm surge or heavy rainfall.

- State-Specific Programs

In addition to federal programs like the NFIP, many states offer their own insurance programs tailored to specific regional needs and risks. California, for example, has the California Earthquake Authority (CEA), a publicly managed, privately funded organization that provides earthquake insurance to homeowners and renters. These state-specific programs often address unique challenges and fill gaps in coverage left by the private market, offering tailored solutions for particular perils and geographic locations.

- Subsidies and Incentives

Government involvement in natural disaster insurance extends beyond direct coverage offerings. Many governments provide subsidies or incentives to encourage property owners to mitigate their risk and purchase necessary insurance. These programs can help reduce the overall cost of insurance, making it more affordable for individuals and communities to secure protection against catastrophic events. Such initiatives reflect a broader government role in promoting disaster resilience and protecting citizens from financial hardship.

- Data Collection and Risk Assessment

Government agencies play a crucial role in data collection and risk assessment, informing insurance practices and policy development. By gathering data on natural hazards, mapping floodplains, and conducting seismic studies, government agencies provide valuable information that insurers use to assess risk and price policies. This data-driven approach improves the accuracy of risk assessment and ensures that insurance premiums reflect the actual risk exposure of individual properties.

The existence of government programs significantly expands the availability and affordability of natural disaster insurance. These programs demonstrate a commitment to protecting individuals and communities from the financial devastation of catastrophic events. By filling the gaps left by private insurers and offering specialized coverage options, government programs contribute significantly to the answer of “Is there natural disaster insurance?” Their presence affirms that insurance solutions exist, albeit sometimes through government-backed channels, providing a critical layer of financial protection in the face of natural hazards.

Frequently Asked Questions about Natural Disaster Insurance

This section addresses common inquiries regarding the availability, coverage, and cost of insurance for natural disasters, providing clarity on key aspects of financial protection against catastrophic events. Understanding these frequently asked questions empowers individuals and communities to make informed decisions regarding disaster preparedness and risk mitigation.

Question 1: Does standard homeowner’s insurance cover natural disasters?

Standard homeowner’s insurance typically covers damage from events like fire, windstorms, and hail. However, it generally excludes coverage for floods and earthquakes, which require separate policies. Certain other perils, such as landslides or sinkholes, may also be excluded, depending on the specific policy and location.

Question 2: How does one obtain flood insurance?

Flood insurance is primarily available through the National Flood Insurance Program (NFIP) or, increasingly, through private insurance companies. Contacting an insurance agent or visiting the NFIP website can provide information on obtaining coverage. It’s important to note that there’s often a waiting period before a flood insurance policy takes effect, so proactive planning is essential.

Question 3: What factors influence the cost of natural disaster insurance?

Several factors influence insurance costs, including location, property type, construction materials, and the specific perils covered. Properties located in high-risk areas, such as floodplains or coastal regions, generally face higher premiums due to the increased likelihood of a catastrophic event.

Question 4: Are government-backed insurance programs available for natural disasters other than floods?

Yes, government-backed programs exist for specific perils beyond flooding. The California Earthquake Authority (CEA), for example, provides earthquake insurance in California. Other states may have similar programs for specific regional risks. It is advisable to research programs available at the state level.

Question 5: How can property owners mitigate their risk and potentially lower insurance premiums?

Mitigation measures, such as elevating a structure in a floodplain or reinforcing a building against earthquakes, can reduce risk and potentially lower insurance premiums. Implementing safety features and adhering to building codes can also demonstrate proactive risk management and influence insurance costs.

Question 6: What steps should one take after a natural disaster to file an insurance claim?

Contacting one’s insurance provider as soon as possible after a disaster is the first step in filing a claim. Documenting damage with photographs and videos is crucial. Maintaining a detailed inventory of possessions simplifies the claims process and helps ensure adequate compensation for losses.

Securing appropriate insurance coverage for natural disasters requires careful planning and a thorough understanding of available options. Proactive research and consultation with insurance professionals are highly recommended.

The following section delves further into specific types of natural disaster insurance policies and provides resources for additional information.

Conclusion

Exploration of the question “Is there natural disaster insurance?” reveals a nuanced landscape. Specialized coverage exists to address a range of perils, including floods, earthquakes, hurricanes, and wildfires. However, securing comprehensive protection often necessitates a multi-layered approach, combining standard homeowner’s or renter’s insurance with separate policies tailored to specific threats. Government-backed programs, such as the National Flood Insurance Program, play a crucial role in filling coverage gaps left by the private market, particularly for high-risk perils like flooding. The cost and availability of coverage are significantly influenced by geographic location and property-specific risk factors, emphasizing the importance of careful assessment and proactive planning.

Given the increasing frequency and intensity of natural disasters, securing adequate insurance coverage is no longer a matter of choice but a necessity. Financial preparedness through comprehensive insurance is paramount for individual and community resilience. Proactive engagement with insurance providers, thorough policy review, and a clear understanding of specific coverage limitations are critical steps in mitigating the devastating financial impacts of natural catastrophes. Continuous adaptation to evolving risk profiles and insurance landscapes will remain essential for effective disaster preparedness in the years to come.