Temporary postponement or reduction of loan payments granted to borrowers affected by qualifying catastrophic events, such as earthquakes, floods, or hurricanes, is a crucial financial tool. For instance, a homeowner impacted by a wildfire might receive a temporary suspension of mortgage payments while rebuilding. This type of relief provides breathing room for individuals and families to recover and regain financial stability after experiencing devastating loss.

This form of aid plays a vital role in community recovery after widespread devastation. It allows individuals to focus on essential needs like securing temporary housing, replacing vital documents, and accessing necessary medical care, rather than worrying about immediate debt obligations. Historically, such programs have proven instrumental in supporting affected regions as they rebuild following calamitous events. By easing the financial burden on individuals and families, these programs contribute to faster and more sustainable recovery for entire communities.

The following sections will explore the specific eligibility criteria for these programs, the application process, and the various types of assistance available depending on the specific event and the lending institution. Additionally, resources and further support options for those impacted by catastrophic events will be detailed.

Proactive planning and informed action are crucial for effectively utilizing temporary financial relief options following a catastrophic event. The following tips provide guidance for borrowers seeking such assistance.

Tip 1: Maintain Thorough Records. Document all damage to property and possessions with photographs, videos, and written descriptions. These records will be essential when applying for assistance and substantiating the extent of the impact. Retain all communication with insurance companies and government agencies.

Tip 2: Contact Lenders Immediately. Reach out to all lenders mortgage companies, auto loan providers, credit card companies as soon as possible after an event. Early communication is key to understanding available options and initiating the relief process.

Tip 3: Understand the Terms. Carefully review the specific terms and conditions offered. Pay close attention to the duration of the relief period, the repayment plan, and any accruing interest or fees. Clarity on these aspects is crucial for avoiding future financial complications.

Tip 4: Explore All Available Resources. Investigate government assistance programs, non-profit organizations, and charitable foundations that may offer additional support. These resources can provide valuable supplemental aid during recovery.

Tip 5: Develop a Post-Relief Financial Plan. Consider how regular payments will resume after the relief period ends. Create a budget that accounts for the reinstated obligations and ensures ongoing financial stability. Financial counseling services can assist with this process.

Tip 6: Prioritize Essential Expenses. Focus available funds on critical needs such as housing, food, and medical care during the relief period. Developing a prioritized spending plan helps ensure efficient use of resources while recovering.

Tip 7: Maintain Open Communication. Keep lenders informed of any changes in circumstances or challenges encountered during the recovery process. Ongoing communication facilitates a collaborative approach to managing the temporary financial relief.

By following these tips, individuals can effectively navigate the process of securing and managing temporary financial relief after experiencing a catastrophic event. Proactive preparation and informed decision-making are essential for mitigating the long-term financial impact of such events.

The concluding section will reiterate key points and emphasize the importance of proactive planning for financial resilience in the face of unforeseen catastrophic events.

1. Temporary Relief

Temporary relief forms the cornerstone of natural disaster forbearance programs. It functions as a critical bridge, allowing borrowers affected by catastrophic events to navigate immediate financial challenges while focusing on essential recovery efforts. This relief manifests primarily as a temporary suspension or reduction of loan payments. The causal link between a natural disaster and the need for temporary relief is direct; the devastation often renders individuals unable to meet their regular financial obligations due to property damage, job loss, or displacement. For instance, following a major earthquake, homeowners might face significant repair costs alongside potential income disruption, making mortgage payments untenable. Temporary relief, in this context, provides the essential breathing room necessary to address immediate needs and begin the rebuilding process.

The significance of temporary relief as a component of forbearance programs extends beyond individual financial stability. By alleviating immediate financial pressures, these programs contribute to broader community recovery efforts. They enable individuals to prioritize essential needs such as securing temporary housing, accessing medical care, and replacing vital documents, rather than struggling with debt repayment. This collective focus on recovery fosters community resilience and accelerates the overall rebuilding process. Furthermore, temporary relief can mitigate the long-term economic consequences of natural disasters, preventing widespread defaults and foreclosures that could destabilize local economies. Consider a coastal community devastated by a hurricane; temporary relief for affected businesses can enable them to rebuild and rehire, preventing long-term economic stagnation.

In conclusion, temporary relief serves as a vital mechanism within natural disaster forbearance programs. Its importance lies in its ability to bridge the gap between immediate financial hardship and long-term recovery. By understanding this crucial connection, both lenders and borrowers can effectively leverage these programs to navigate the challenges posed by catastrophic events and contribute to a more resilient future.

2. Qualifying Events

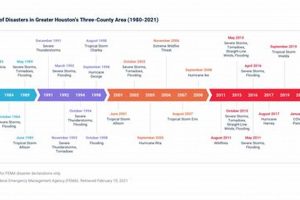

The concept of “qualifying events” is central to natural disaster forbearance. These specific occurrences trigger the availability of forbearance options, acting as the gateway to much-needed financial relief. A direct causal relationship exists: a qualifying event precipitates the need for forbearance. These events are typically large-scale natural disasters causing widespread damage and disruption. Examples include federally declared disasters such as hurricanes, earthquakes, wildfires, floods, tornadoes, volcanic eruptions, and tsunamis. The severity and scope of these events necessitate intervention to support affected individuals and communities. Without clearly defined qualifying events, the application of forbearance would be arbitrary and potentially inequitable. A standardized system ensures that relief efforts are targeted toward those demonstrably impacted by catastrophic natural occurrences.

The importance of “qualifying events” as a component of forbearance extends beyond simply triggering relief mechanisms. It provides a structured framework for assessing need and distributing assistance. For example, if a hurricane causes widespread flooding in a specific region, the federal government’s disaster declaration allows lenders to offer forbearance to borrowers within that designated area. This streamlined approach ensures that aid reaches those who require it most, preventing delays and minimizing bureaucratic hurdles. Furthermore, the definition of qualifying events often influences the specific terms and duration of forbearance offered. A highly destructive earthquake might warrant a longer forbearance period than a less severe flood, reflecting the differing levels of impact and recovery time required. This tailored approach ensures that the relief provided is proportionate to the damage sustained.

A clear understanding of what constitutes a qualifying event is essential for both lenders and borrowers. Lenders must accurately identify eligible borrowers based on established criteria, while borrowers need to be aware of their potential eligibility for relief. This shared understanding facilitates a smoother and more efficient process, ensuring that assistance is delivered promptly and effectively. Challenges can arise, however, when the impact of a natural disaster is localized or less widespread, potentially falling outside designated disaster zones. In such cases, advocating for broader recognition of qualifying events or exploring alternative relief options becomes crucial. Ultimately, the efficacy of natural disaster forbearance hinges on a robust and well-defined system of qualifying events that accurately reflects the diverse impacts of catastrophic natural occurrences.

3. Loan Payments Paused

The ability to temporarily suspend loan payments forms a cornerstone of natural disaster forbearance programs. This critical feature provides immediate financial relief to borrowers grappling with the aftermath of catastrophic events. Pausing loan payments allows individuals and families to redirect limited resources toward essential needs such as temporary housing, repairs, and replacing essential possessions. This section explores key facets of this crucial component.

- Immediate Relief and Reduced Financial Stress

The immediate cessation of loan payments following a qualifying disaster provides crucial breathing room for borrowers. This relief allows them to focus on immediate needs like securing safe shelter, addressing medical concerns, and contacting insurers without the added burden of impending loan deadlines. For example, a family displaced by a wildfire can prioritize finding temporary housing and replacing essential documents without the immediate worry of mortgage payments. This reduction in financial stress during a traumatic period is invaluable.

- Resource Reallocation for Recovery Efforts

Suspending loan payments frees up financial resources that can be redirected toward recovery efforts. Funds normally allocated to mortgage payments, auto loans, or student loans can be used for immediate repairs, replacing damaged or lost property, and covering temporary living expenses. This reallocation is crucial for rebuilding and regaining stability after a disaster. A business owner, for instance, could use the funds normally allocated for loan payments to repair damaged equipment and re-open their business sooner, contributing to the community’s economic recovery.

- Preventing Default and Foreclosure

Natural disaster forbearance programs, by enabling the pausing of loan payments, prevent widespread defaults and foreclosures in the wake of catastrophic events. This protection safeguards individuals and families from losing their homes or businesses due to circumstances beyond their control. For example, a homeowner whose property is severely damaged by a hurricane can avoid foreclosure by temporarily suspending mortgage payments while awaiting insurance settlements and undertaking repairs. This safeguard is critical for maintaining community stability during recovery.

- Tailored Relief Options and Repayment Plans

The duration of paused loan payments and subsequent repayment plans are often tailored to the specific circumstances of the disaster and the individual borrower’s needs. This flexibility ensures that the relief provided is appropriate and manageable. For instance, a borrower impacted by a widespread flood might receive a longer forbearance period and a more gradual repayment plan than someone affected by a localized storm. This individualized approach maximizes the effectiveness of the relief and facilitates long-term financial stability.

The ability to pause loan payments during times of crisis, therefore, forms a critical bridge to recovery. By offering immediate relief, facilitating resource reallocation, preventing defaults, and providing tailored repayment options, natural disaster forbearance programs empower individuals, families, and communities to rebuild their lives and regain financial stability after catastrophic events. This crucial component emphasizes the importance of proactive planning and communication between borrowers and lenders in preparing for and navigating the aftermath of natural disasters.

4. Borrower Protection

Borrower protection forms a critical component of natural disaster forbearance programs, shielding individuals and families from the potentially devastating financial consequences of catastrophic events. These protections are essential for preserving financial stability and enabling recovery in the wake of widespread damage and disruption. This section explores key facets of borrower protection within the context of natural disaster forbearance.

- Preservation of Credit Scores

Forbearance programs typically protect borrowers’ credit scores during the relief period. This safeguard prevents the negative impact that missed or reduced payments might otherwise have on creditworthiness. Maintaining a healthy credit score is crucial for accessing future credit and financial opportunities, making this protection essential for long-term financial recovery. For instance, a homeowner utilizing forbearance after a hurricane will not see their credit score negatively impacted due to the temporarily suspended mortgage payments.

- Prevention of Foreclosure and Repossession

Natural disaster forbearance programs often include provisions to prevent foreclosure on homes and repossession of vehicles. This protection offers a crucial safety net, preventing individuals and families from losing essential assets due to temporary financial hardship caused by a disaster. A family whose home is damaged by flooding, for instance, can avoid foreclosure by entering a forbearance agreement with their mortgage lender, allowing them time to repair their home and regain financial stability.

- Access to Financial Counseling and Resources

Many forbearance programs provide access to financial counseling and resources to help borrowers navigate the complexities of disaster recovery. This support can include budgeting assistance, debt management advice, and information about other available aid programs. Such resources empower borrowers to make informed decisions and develop sustainable financial plans for rebuilding their lives. A small business owner, for example, could benefit from financial counseling to develop a plan for reopening their business after a natural disaster.

- Legal Protections Against Predatory Lending

Forbearance programs frequently incorporate legal protections to shield borrowers from predatory lending practices in the aftermath of disasters. These safeguards prevent lenders from exploiting vulnerable individuals by offering high-interest loans or imposing unfair terms. This protection ensures that borrowers have access to fair and reasonable financial assistance during a time of need. For example, regulations might prevent lenders from dramatically increasing interest rates on existing loans for borrowers in disaster-declared areas.

These facets of borrower protection collectively contribute to the efficacy of natural disaster forbearance programs. By safeguarding credit scores, preventing asset loss, offering financial guidance, and protecting against predatory lending, these programs empower individuals and communities to navigate the financial challenges of disaster recovery and rebuild their lives with greater security and resilience. This integrated approach recognizes the multifaceted nature of disaster recovery and the crucial role of comprehensive borrower protection in facilitating long-term financial stability.

5. Recovery Assistance

Recovery assistance forms an integral part of natural disaster forbearance programs, providing crucial support beyond the temporary suspension of loan payments. While forbearance offers immediate financial relief, recovery assistance addresses the longer-term needs of individuals and communities rebuilding after catastrophic events. This assistance can take various forms, including grants, low-interest loans, tax breaks, and direct aid for rebuilding homes and businesses. The causal link between natural disaster forbearance and recovery assistance is clear: forbearance stabilizes immediate finances, creating space for recovery assistance to take effect. For example, a small business owner utilizing forbearance to pause loan payments can simultaneously apply for a recovery grant to repair damaged equipment and restock inventory, fostering a quicker return to operation. Without initial stabilization through forbearance, accessing and effectively utilizing recovery assistance becomes significantly more challenging.

Recovery assistance plays a crucial role in the broader context of natural disaster forbearance by addressing the systemic challenges posed by large-scale catastrophic events. These programs recognize that recovery extends beyond individual financial stability and encompasses community revitalization, infrastructure repair, and economic recovery. For instance, government-funded recovery assistance programs might provide grants for rebuilding damaged public infrastructure, such as roads and bridges, which are essential for community function and long-term economic stability. These broader recovery efforts complement individual forbearance programs, creating a synergistic approach to rebuilding after disaster. Furthermore, recovery assistance can address specific vulnerabilities within communities, such as providing accessible housing options for displaced individuals or offering specialized support for small businesses crucial to local economies. This targeted approach maximizes the impact of assistance and fosters more equitable recovery outcomes.

A comprehensive understanding of the connection between recovery assistance and natural disaster forbearance is crucial for both individuals and policymakers. Individuals impacted by disasters need to be aware of available resources and understand how forbearance can facilitate access to further recovery support. Policymakers, on the other hand, must ensure that recovery assistance programs are adequately funded, accessible, and designed to complement the immediate relief provided by forbearance. A key challenge lies in ensuring equitable distribution of recovery assistance, particularly to vulnerable populations who may face greater barriers to accessing resources. Addressing this challenge requires proactive outreach, streamlined application processes, and culturally sensitive support services. Ultimately, the effectiveness of natural disaster response hinges on the seamless integration of forbearance and recovery assistance, creating a comprehensive safety net that empowers individuals, families, and communities to rebuild and thrive after catastrophic events.

Frequently Asked Questions about Natural Disaster Forbearance

This section addresses common inquiries regarding programs designed to provide financial relief to borrowers affected by catastrophic natural events. Clarity on these points is crucial for effectively navigating these programs.

Question 1: What types of loans are typically eligible for natural disaster forbearance?

Federally backed mortgages, student loans, and some auto and personal loans may be eligible. Specific eligibility criteria vary depending on the lender and the nature of the disaster. Contacting individual lenders directly is crucial for confirming eligibility.

Question 2: How does one apply for forbearance after a qualifying disaster?

Contact lenders directly to initiate the application process. Documentation of the disaster’s impact, such as property damage reports or FEMA assistance confirmations, is typically required. Proactive communication with lenders is essential throughout the process.

Question 3: What is the typical duration of a forbearance period?

The length of forbearance varies based on the specific disaster, the lender’s policies, and individual borrower circumstances. Initial forbearance periods often range from three to six months, with possible extensions depending on ongoing recovery needs.

Question 4: Does interest accrue on loans during forbearance?

Interest may continue to accrue during the forbearance period, depending on the loan type and the lender’s policies. Understanding the terms regarding accruing interest is critical for avoiding unexpected financial obligations later.

Question 5: What happens after the forbearance period ends?

Lenders typically work with borrowers to establish a repayment plan for the deferred payments. Options may include loan modification, lump-sum payments, or an extension of the loan term. Open communication with the lender is essential to create a manageable repayment strategy.

Question 6: Are there resources available to assist borrowers navigating forbearance and recovery?

Government agencies, non-profit organizations, and financial institutions offer resources, including financial counseling and legal assistance, to support borrowers throughout the recovery process. Exploring these resources can provide valuable guidance and support.

Understanding these key aspects of natural disaster forbearance empowers borrowers to make informed decisions and navigate the recovery process effectively. Proactive planning and communication with lenders are crucial for maximizing the benefits of these programs.

The following section provides a comprehensive checklist for preparing for and responding to natural disasters, emphasizing the importance of proactive financial planning.

Natural Disaster Forbearance

This exploration of natural disaster forbearance has highlighted its crucial role in mitigating the financial impact of catastrophic events. From temporary payment relief and borrower protections to the importance of qualifying events and the integration of recovery assistance, the multifaceted nature of these programs underscores their significance in fostering individual and community resilience. Understanding the core components temporary relief, qualifying events, paused loan payments, borrower protections, and recovery assistance provides a framework for navigating these complex programs effectively. Furthermore, addressing common questions regarding eligibility, application procedures, and post-forbearance repayment strategies equips individuals with the knowledge necessary to make informed decisions during times of crisis.

Proactive planning and open communication with lenders remain paramount in preparing for and navigating the financial challenges posed by natural disasters. The ability to access timely and appropriate financial relief can significantly impact long-term recovery outcomes. Natural disaster forbearance serves not merely as a temporary reprieve but as a crucial bridge to rebuilding lives and communities in the aftermath of devastating events. Continued focus on strengthening these programs, ensuring their accessibility, and promoting financial literacy surrounding their utilization will be essential for fostering greater resilience in the face of future catastrophic events.