A proactive strategy involving temporarily postponing debt payments for borrowers in good standing contrasts sharply with the severe consequences of unforeseen calamities. For instance, a homeowner facing temporary job loss might secure a sanctioned postponement of mortgage payments, maintaining a positive credit history. This differs drastically from the widespread financial hardship experienced after a natural disaster, where individuals might default on loans due to property damage or loss of income.

Preserving financial stability for individuals and the broader economy is a key advantage of planned payment suspensions. By offering temporary relief to responsible borrowers during challenging times, such programs can prevent widespread defaults and foreclosures, mitigating the risk of systemic financial instability. Historically, such measures have been employed during economic downturns and other crises to cushion the impact and facilitate recovery. Moreover, these preventative measures minimize the need for more drastic interventions later.

This exploration will delve into the mechanics of pre-arranged payment postponements, examining eligibility criteria, implementation processes, and potential long-term implications. Furthermore, it will analyze the multifaceted impacts of catastrophic events on personal finances and the broader economy, highlighting strategies for mitigation and recovery.

Proactive planning and informed decision-making are crucial for mitigating the impact of unforeseen circumstances and navigating financial challenges effectively.

Tip 1: Establish an Emergency Fund: A readily accessible reserve of funds provides a crucial buffer during unexpected income disruptions or essential expenditures. Maintaining three to six months of living expenses in a liquid account can prevent reliance on high-interest debt during emergencies.

Tip 2: Understand Available Resources: Familiarization with government programs, community assistance initiatives, and financial institution policies concerning payment flexibility can provide valuable options during times of hardship. Exploring these resources in advance allows for informed choices should the need arise.

Tip 3: Maintain Open Communication with Lenders: Proactive communication with creditors at the first sign of financial difficulty can often lead to mutually agreeable solutions, such as temporary payment modifications or forbearance agreements. Open dialogue fosters trust and increases the likelihood of avoiding default.

Tip 4: Prioritize Essential Expenses: Developing a clear hierarchy of necessary expenditures during financial constraints ensures that critical needs are met. Distinguishing between needs and wants facilitates responsible resource allocation during challenging periods.

Tip 5: Develop a Realistic Budget: Creating and adhering to a well-defined budget provides a framework for managing finances and tracking spending. A comprehensive budget helps individuals understand their financial inflows and outflows, enabling informed decision-making and improved financial stability.

Tip 6: Explore Additional Income Streams: Investigating opportunities for supplemental income can provide financial relief during periods of reduced primary income. Considering part-time employment, freelance work, or the utilization of existing skills can bolster financial resilience.

Tip 7: Seek Professional Financial Guidance: Consulting with a qualified financial advisor can offer personalized strategies for navigating financial challenges and planning for long-term stability. Expert advice can provide valuable insights and support during difficult times.

By implementing these strategies, individuals can significantly enhance their financial preparedness and navigate challenging situations with greater confidence. Proactive planning and informed decision-making empower individuals to mitigate the impact of unforeseen events and protect their financial well-being.

This discussion concludes by examining the long-term implications of various financial strategies and emphasizing the importance of informed financial management.

1. Proactive Planning

Proactive planning forms the cornerstone of effective financial management, serving as a critical buffer against unforeseen hardships and fostering long-term stability. In the context of “non-delinquent deferral vs. disaster,” proactive planning represents the deliberate, preemptive measures taken to mitigate potential financial distress, contrasting sharply with reactive responses to unexpected crises. This proactive approach empowers individuals and organizations to navigate challenging circumstances with greater resilience and control.

Consider the example of a small business owner anticipating a seasonal downturn in revenue. By proactively establishing a line of credit or negotiating deferred payment terms with suppliers in advance, the business can weather the lean period without jeopardizing its creditworthiness or operational capacity. This contrasts starkly with a business forced to scramble for emergency loans or default on payments after an unexpected economic downturn, potentially incurring significant penalties and damage to its long-term financial health. Similarly, individuals who establish emergency funds and maintain open communication with lenders are better positioned to navigate unforeseen job losses or medical emergencies without resorting to high-interest debt or risking foreclosure. This proactive approach underscores the importance of anticipating potential financial challenges and implementing preemptive strategies to mitigate their impact.

The practical significance of proactive planning lies in its capacity to transform potential disasters into manageable challenges. By anticipating vulnerabilities and developing contingency plans, individuals and organizations can minimize the negative consequences of unforeseen events and maintain a trajectory toward long-term financial stability. While reactive strategies are sometimes necessary in the face of unavoidable crises, proactive planning represents a crucial element of responsible financial management, empowering stakeholders to navigate uncertainty with greater confidence and control.

2. Reactive Response

Reactive responses represent actions taken in the aftermath of unforeseen events, often characterized by urgency and a need to mitigate immediate damage. Within the context of “non-delinquent deferral vs. disaster,” reactive responses typically follow unforeseen calamities, contrasting sharply with the proactive planning exemplified by non-delinquent deferrals. Understanding the nature and implications of reactive responses is crucial for effective crisis management and recovery.

Consider the scenario of a community devastated by a hurricane. Immediate reactive responses include emergency rescue operations, provision of temporary shelter and essential supplies, and assessment of infrastructure damage. These actions address the immediate consequences of the disaster, focusing on preserving life and safety. In the financial realm, reactive responses might involve emergency loan applications, insurance claims filings, and requests for government assistance. These measures aim to mitigate the economic fallout of the disaster and support recovery efforts. Unlike pre-arranged deferrals, which represent a planned approach to managing anticipated financial challenges, reactive responses address the urgent needs arising from unforeseen circumstances.

The effectiveness of reactive responses often hinges on the robustness of pre-existing infrastructure, preparedness plans, and available resources. Communities with well-defined disaster response protocols and readily accessible emergency funds are generally better equipped to handle unforeseen crises than those lacking such provisions. Furthermore, the speed and efficiency of reactive responses play a critical role in mitigating long-term damage and facilitating recovery. While proactive planning represents the ideal approach to managing financial risk, the capacity to implement effective reactive responses is essential for navigating the inevitable uncertainties inherent in individual and collective financial well-being. A comprehensive understanding of both proactive and reactive strategies is crucial for navigating the complex landscape of financial stability and crisis management.

3. Financial Stability

Financial stability, both at the individual and systemic levels, represents a critical objective intertwined with the concepts of non-delinquent deferral and disaster preparedness. A non-delinquent deferral, a proactive measure, directly contributes to financial stability by enabling borrowers to navigate temporary hardships without jeopardizing their creditworthiness or long-term financial health. This contrasts sharply with the destabilizing effects of disasters, which can disrupt income streams, damage assets, and necessitate reactive financial measures that may erode long-term stability. The interplay between these concepts highlights the importance of proactive planning in mitigating the risks associated with unforeseen circumstances.

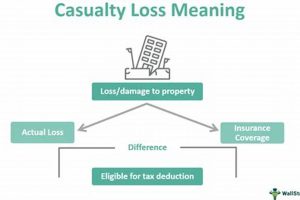

Consider the case of a homeowner who experiences a temporary job loss. A non-delinquent deferral on their mortgage payments allows them to maintain their financial obligations without incurring penalties or damaging their credit score, thereby preserving their long-term financial stability. Conversely, if a natural disaster strikes a community, the resulting property damage, job losses, and business disruptions can significantly undermine financial stability, potentially leading to widespread defaults, foreclosures, and economic hardship. The availability of disaster relief programs and insurance coverage plays a crucial role in mitigating these destabilizing effects and supporting recovery efforts. Understanding this dynamic underscores the importance of both individual and collective preparedness in safeguarding financial stability.

The practical significance of this understanding lies in its implications for policy development and individual financial planning. Policies that facilitate access to non-delinquent deferrals and robust disaster preparedness programs contribute to broader financial stability by reducing the vulnerability of individuals and communities to unforeseen shocks. At the individual level, adopting proactive financial management strategies, such as establishing emergency funds and maintaining open communication with lenders, enhances resilience and mitigates the potential for long-term financial instability. Recognizing the interconnectedness of these concepts empowers individuals, communities, and policymakers to make informed decisions that promote financial well-being and mitigate the risks associated with unforeseen circumstances.

4. Crisis Mitigation

Crisis mitigation encompasses strategies employed to reduce the severity and impact of adverse events. Within the framework of “non-delinquent deferral vs. disaster,” crisis mitigation represents a crucial bridge between proactive planning and reactive response. Non-delinquent deferrals serve as a proactive crisis mitigation tool, reducing the potential for financial distress stemming from predictable challenges like temporary job loss. Conversely, disasters often necessitate reactive crisis mitigation strategies focused on minimizing immediate harm and facilitating long-term recovery.

Consider the example of a farmer facing a severe drought. Securing a non-delinquent deferral on loan payments represents a proactive crisis mitigation strategy, allowing them to weather the temporary hardship without jeopardizing their farm’s viability. This contrasts with the reactive crisis mitigation required after a wildfire, which might involve emergency grants, insurance claims, and community support to rebuild homes and businesses. The efficacy of crisis mitigation efforts hinges on factors such as preparedness, resource availability, and the speed of response. A well-defined disaster recovery plan, including access to emergency funds and clear communication channels, can significantly enhance crisis mitigation efforts and accelerate the recovery process.

The practical significance of understanding crisis mitigation within this context lies in its capacity to inform policy decisions and individual preparedness strategies. Policies that promote access to non-delinquent deferrals and strengthen disaster preparedness infrastructure contribute to enhanced community resilience and reduce the long-term costs associated with crises. At the individual level, proactive financial planning and the development of personalized crisis mitigation plans empower individuals to navigate unforeseen challenges with greater confidence and minimize the potential for long-term financial hardship. A comprehensive understanding of crisis mitigation strategies within the framework of “non-delinquent deferral vs. disaster” is therefore essential for fostering financial stability and resilience at both individual and societal levels. It underscores the critical interplay between proactive planning, reactive response, and the effective mitigation of unforeseen challenges.

5. Controlled risk

Controlled risk management forms a cornerstone of proactive financial planning, particularly within the context of “non-delinquent deferral vs. disaster.” A non-delinquent deferral exemplifies controlled risk, allowing borrowers to navigate anticipated financial challenges while minimizing negative consequences. This proactive approach contrasts sharply with the uncontrolled risk inherent in disasters, where unforeseen circumstances necessitate reactive measures with potentially significant financial repercussions. Understanding this distinction is crucial for effective financial decision-making and long-term stability.

Consider the case of a self-employed individual anticipating a period of reduced income due to a planned sabbatical. Securing a non-delinquent deferral on mortgage payments represents a controlled risk strategy, allowing them to maintain their financial obligations without incurring penalties or damaging their credit rating. This calculated approach contrasts starkly with the uncontrolled risk faced by businesses in the path of a hurricane. While insurance can mitigate some losses, the potential for unforeseen damage, business interruption, and economic hardship represents a significant uncontrolled risk, often necessitating reactive financial measures with uncertain outcomes. Another example lies in planned medical procedures. Patients can often arrange payment plans or deferrals in advance, representing a controlled risk approach to managing healthcare expenses. This differs from the uncontrolled risk associated with unexpected medical emergencies, which can strain finances and necessitate reactive, often costly, financial solutions.

The practical significance of understanding controlled risk within this framework lies in its capacity to inform strategic financial decisions. Proactive measures, such as non-delinquent deferrals, empower individuals and organizations to mitigate predictable financial challenges, preserving stability and minimizing potential long-term consequences. While eliminating all financial risks is impossible, the ability to identify and control specific risks through careful planning and proactive measures significantly enhances financial resilience and reduces vulnerability to unforeseen circumstances. A comprehensive appreciation of controlled risk management within the context of “non-delinquent deferral vs. disaster” is essential for fostering long-term financial well-being and navigating the complex landscape of economic uncertainty.

6. Unforeseen Hardship

Unforeseen hardship represents a critical element within the framework of “non-delinquent deferral vs. disaster,” highlighting the inherent limitations of proactive planning and the inevitable need for reactive responses. While non-delinquent deferrals address anticipated financial challenges, unforeseen hardships, by their very nature, defy prediction and necessitate adaptive strategies. Understanding the nature and potential impact of unforeseen hardship is crucial for developing comprehensive financial plans and building resilience.

- Job Loss:

Sudden job loss constitutes a common unforeseen hardship with significant financial implications. While severance packages and unemployment benefits can provide temporary relief, the unexpected cessation of income can disrupt mortgage or rent payments, loan repayments, and daily living expenses. This scenario underscores the importance of emergency funds and the potential need for reactive measures like loan modifications or government assistance programs. The contrast with a non-delinquent deferral, typically arranged in advance of a predictable event, highlights the distinct nature of unforeseen hardship.

- Medical Emergencies:

Serious illness or unexpected medical emergencies can impose substantial financial burdens, including hospitalization costs, specialist fees, and ongoing treatment expenses. Even with health insurance, out-of-pocket expenses can strain personal finances and necessitate reactive financial measures. While planned medical procedures often allow for prearranged payment plans or deferrals, the unforeseen nature of medical emergencies typically precludes such proactive strategies, highlighting the need for robust emergency funds and contingency planning.

- Natural Disasters:

Natural disasters, such as hurricanes, earthquakes, or wildfires, represent catastrophic unforeseen hardships with widespread financial ramifications. Property damage, business closures, and supply chain disruptions can create significant economic hardship, often necessitating large-scale government intervention and community support. The reactive nature of disaster response contrasts sharply with the proactive planning inherent in non-delinquent deferrals, underscoring the importance of comprehensive disaster preparedness strategies.

- Global Pandemics:

Global pandemics, such as the recent COVID-19 outbreak, exemplify large-scale unforeseen hardships with far-reaching economic and social consequences. Widespread business closures, job losses, and increased healthcare costs can strain individual finances and disrupt global economic activity. The scale and complexity of such events necessitate coordinated responses, often involving government stimulus packages, loan forbearance programs, and international aid efforts. These reactive measures highlight the critical role of adaptability and resilience in navigating unforeseen hardships of this magnitude.

These diverse examples of unforeseen hardship underscore the critical importance of incorporating flexibility and resilience into financial planning. While proactive strategies like non-delinquent deferrals can mitigate predictable financial challenges, unforeseen hardship necessitates adaptive responses and highlights the value of emergency preparedness, insurance coverage, and access to support networks. Understanding the potential impact of unforeseen hardship within the framework of “non-delinquent deferral vs. disaster” empowers individuals and communities to navigate uncertainty with greater preparedness and resilience.

Frequently Asked Questions

This section addresses common inquiries regarding proactive financial planning, specifically concerning pre-arranged payment postponements, and reactive responses to unforeseen financial crises.

Question 1: What distinguishes a pre-arranged, non-delinquent payment postponement from other forms of debt relief?

A pre-arranged postponement allows borrowers in good standing to temporarily suspend payments without incurring penalties or negative credit reporting. This contrasts with forbearance or loan modifications, often employed after a borrower experiences financial hardship. Pre-arranged postponements are typically implemented proactively, anticipating potential financial challenges, whereas other forms of debt relief are often reactive, addressing existing financial distress.

Question 2: How does one qualify for a pre-arranged payment postponement?

Eligibility criteria vary depending on the lender and the specific program. Generally, a consistent history of on-time payments and a demonstrable need for temporary relief are required. Lenders may consider factors such as upcoming maternity leave, planned sabbaticals, or anticipated seasonal income fluctuations when assessing eligibility. Proactive communication with lenders is crucial for exploring available options and understanding specific requirements.

Question 3: What are the potential long-term implications of utilizing a pre-arranged payment postponement?

When used responsibly and according to agreed-upon terms, pre-arranged postponements typically do not negatively impact credit scores. However, it is crucial to understand the terms of the postponement, including any accrued interest or changes to the loan repayment schedule. Careful planning and adherence to the agreed-upon terms are essential for minimizing potential long-term financial implications.

Question 4: How does proactive financial planning mitigate the impact of unforeseen financial crises?

Proactive planning, including establishing emergency funds, diversifying income streams, and maintaining open communication with lenders, strengthens financial resilience. These measures provide a buffer against unexpected events, reducing reliance on high-interest debt or drastic financial measures during crises. Proactive planning empowers individuals and organizations to navigate unforeseen challenges with greater control and stability.

Question 5: What are the key steps to take in the immediate aftermath of a financial crisis?

Prioritizing essential expenses, contacting creditors to explore available options, and seeking guidance from financial advisors are crucial first steps. Assessing available resources, such as government assistance programs or community support initiatives, can provide additional support during challenging times. Swift and informed action can mitigate the long-term impact of financial crises.

Question 6: How does insurance coverage factor into financial crisis mitigation?

Adequate insurance coverage, including property, health, and life insurance, provides a crucial safety net against unforeseen events. Insurance can mitigate financial losses associated with natural disasters, medical emergencies, or other unforeseen circumstances. Regularly reviewing insurance policies and ensuring adequate coverage levels is a vital aspect of proactive financial planning and crisis mitigation.

Understanding the distinctions between proactive financial management and reactive crisis response empowers informed decision-making and strengthens long-term financial well-being. Proactive planning provides a crucial foundation for mitigating the impact of unforeseen hardship and preserving financial stability.

The subsequent section will provide practical guidance for developing a comprehensive financial plan tailored to individual circumstances and risk profiles.

Non-Delinquent Deferral vs. Disaster

This exploration has examined the critical distinction between proactive financial management, exemplified by non-delinquent deferrals, and reactive responses to unforeseen financial hardship, often associated with disasters. The analysis highlighted the importance of controlled risk management through pre-arranged payment postponements, contrasting it with the uncontrolled risk inherent in unexpected calamities. The benefits of proactive planning, including preserving financial stability and mitigating the severity of potential crises, were underscored. Furthermore, the discussion emphasized the necessity of effective reactive strategies, including crisis mitigation and access to resources, for navigating unforeseen hardships. The interplay between proactive measures and reactive responses forms the foundation of comprehensive financial resilience.

Financial well-being requires a nuanced understanding of both proactive planning and reactive response mechanisms. While pre-arranged deferrals offer valuable tools for managing anticipated financial challenges, the unpredictable nature of disasters necessitates robust contingency planning and access to support networks. Cultivating a proactive approach to financial management, coupled with a well-defined strategy for navigating unforeseen hardship, empowers individuals and communities to weather financial storms and build a more secure future. The ongoing pursuit of financial literacy and preparedness remains paramount in an increasingly complex and uncertain world.