Low-interest, fixed-rate government assistance is available to homeowners located in declared disaster areas to repair or replace damaged or destroyed real estate, personal property, and businesses. These funds may cover primary residences, vacation homes, and personal property such as furniture, clothing, and vehicles. For example, a homeowner whose primary residence was damaged by a hurricane could apply for assistance to cover repair costs.

Access to this type of financial aid is vital for community rebuilding after a disaster. It enables individuals to recover financially and restore their lives and properties, often when traditional financing options are unavailable or insufficient. Historically, this form of assistance has played a crucial role in post-disaster recovery efforts, offering a lifeline to individuals and families facing devastating losses. It bridges the gap between immediate needs and long-term recovery, contributing to the overall economic stability of affected communities.

Further details on eligibility criteria, application procedures, loan terms, and frequently asked questions will be explored in the following sections.

Applying for and managing disaster assistance can be a complex process. The following tips are designed to streamline the experience and maximize the potential for a successful outcome.

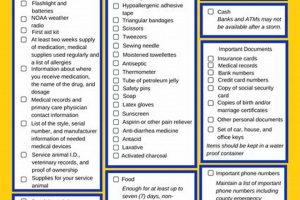

Tip 1: Document Everything. Thoroughly document all damage with photographs, videos, and detailed descriptions. Retain receipts for any repairs or temporary housing expenses incurred.

Tip 2: Apply Promptly. Application deadlines exist. Submitting an application as soon as possible ensures access to available funds and prevents delays in processing.

Tip 3: Understand Eligibility Requirements. Carefully review all eligibility criteria before applying. Ensure all required documentation is readily available.

Tip 4: Maintain Accurate Records. Keep meticulous records of all communication, applications, and loan documents. This organized approach simplifies the loan management process.

Tip 5: Explore All Assistance Options. Investigate all forms of disaster assistance available, including grants, loans, and other programs, to determine which best suits individual needs.

Tip 6: Seek Professional Advice. Consult with financial advisors or disaster recovery experts for guidance on navigating the application process and managing loan funds effectively.

Tip 7: Prepare for the Long Term. Disaster recovery is a marathon, not a sprint. Developing a long-term recovery plan is essential for financial stability and peace of mind.

Following these tips can significantly ease the burden of recovering from a disaster and expedite the process of rebuilding one’s life and property. Careful planning and preparation are crucial components of successful disaster recovery.

By understanding the application process and diligently managing loan funds, individuals can optimize the benefits of disaster assistance and contribute to the overall recovery of their communities. The subsequent section provides concluding remarks and additional resources.

1. Eligibility Requirements

Access to SBA disaster loans for homeowners hinges on meeting specific eligibility requirements. These criteria serve as gatekeepers, ensuring that allocated funds are directed towards those genuinely impacted by declared disasters while safeguarding against misuse. A crucial component is the location of the damaged property. Assistance is confined to areas designated as disaster zones by a governmental agency. This designation triggers the availability of federal aid, establishing a direct link between disaster declaration and eligibility. Furthermore, verifiable damage resulting from the declared disaster is essential. Applicants must provide substantial proof of damage, such as photographs, inspection reports, and insurance assessments, establishing a causal link between the disaster and the claimed losses. For example, a homeowner seeking assistance for flood damage must demonstrate that their property is located within a federally declared flood disaster area and provide evidence of flood-related property damage.

The impact of eligibility requirements extends beyond individual applications. These criteria play a crucial role in efficient resource allocation and equitable distribution of aid. By adhering to stringent standards, the SBA ensures that limited funds reach those most in need, optimizing the impact of disaster relief efforts. Clear eligibility guidelines also promote transparency and accountability, mitigating the risk of fraud and mismanagement. A thorough understanding of these requirements is paramount for potential applicants. It allows individuals to assess their eligibility accurately, gather the necessary documentation proactively, and navigate the application process effectively. This proactive approach streamlines the process, reducing delays and maximizing the potential for securing necessary financial assistance. For instance, understanding the documentation requirements for property damage allows homeowners to compile the necessary evidence efficiently, expediting the application review process.

In summary, eligibility requirements serve as the cornerstone of the SBA disaster loan program for homeowners. These criteria ensure targeted assistance, promote equitable distribution of resources, and uphold program integrity. A thorough understanding of these requirements is not merely a procedural necessity but a crucial step towards accessing vital financial aid and navigating the complex landscape of disaster recovery effectively. Failure to meet these criteria can result in application denial, delaying crucial assistance during a time of significant need. Therefore, careful attention to and fulfillment of these stipulations are critical for successful application outcomes.

2. Loan Amounts & Terms

Loan amounts and terms constitute critical components of SBA disaster loans for homeowners, directly influencing the feasibility and long-term implications of property recovery. A nuanced understanding of these parameters is essential for informed decision-making and effective financial planning during the challenging aftermath of a disaster. Loan amounts are determined by the extent of verifiable, uninsured damage to the primary residence and personal property. A maximum loan amount is established by legislation, providing an upper limit for individual assistance. However, actual loan amounts awarded may be lower, contingent on individual circumstances and the availability of funds. Loan terms, expressed in years, represent the repayment period. Longer terms generally result in lower monthly payments but may accrue higher overall interest costs over the loan’s lifespan. Shorter terms entail higher monthly payments but reduce the total interest paid. The interplay between loan amounts and terms creates a dynamic relationship that must be carefully considered in light of individual financial capacity. For example, a homeowner with substantial damage might opt for a larger loan amount with a longer term to minimize monthly payments, while a homeowner with less extensive damage and greater financial flexibility might choose a smaller loan with a shorter term to reduce overall interest expense.

Several factors influence the determination of loan amounts and terms. Credit history plays a significant role, impacting the interest rate offered and influencing the overall cost of the loan. Verifiable income is another critical factor, demonstrating an applicant’s ability to repay the loan according to the agreed-upon terms. Available collateral, such as the remaining equity in the damaged property, can also affect loan approval and terms. These factors collectively contribute to an individualized assessment of risk and affordability, informing the SBA’s determination of appropriate loan parameters. Understanding these influencing factors allows homeowners to anticipate potential challenges, prepare necessary documentation, and engage in informed discussions with loan officers. For instance, awareness of the importance of credit history might prompt a homeowner to address credit report discrepancies before applying, potentially improving loan terms. Similarly, having a clear understanding of income requirements allows homeowners to gather necessary financial documentation proactively, expediting the application process.

In conclusion, loan amounts and terms represent crucial considerations within the framework of SBA disaster loans for homeowners. These parameters directly impact the feasibility of property repair and replacement, long-term financial stability, and the overall recovery trajectory. Careful evaluation of individual circumstances, available resources, and the interplay between loan amounts and terms empowers homeowners to make informed decisions, optimize financial recovery strategies, and navigate the complex landscape of post-disaster rebuilding effectively. A comprehensive understanding of these elements contributes to a more resilient and sustainable recovery process.

3. Application Process

The application process for SBA disaster loans designed for homeowners serves as a crucial gateway to accessing vital financial assistance following a declared disaster. This structured procedure guides applicants through the necessary steps, ensuring equitable distribution of resources and maintaining program integrity. Navigating this process effectively requires a comprehensive understanding of its components, documentation requirements, and potential challenges. A well-executed application increases the likelihood of approval and expedites the disbursement of much-needed funds. Conversely, an incomplete or inaccurate application can lead to delays, complications, or even denial of assistance, hindering recovery efforts during a vulnerable period. For instance, a homeowner affected by a wildfire must meticulously document the extent of property damage and provide supporting evidence, such as insurance assessments and photographs, to substantiate the claim and facilitate a smooth application process.

Several key elements constitute the application process. Applicants must complete required forms, providing accurate and detailed information regarding the damaged property, financial status, and insurance coverage. Supporting documentation, such as proof of identity, residency, and property ownership, is also essential. This documentation substantiates claims and ensures compliance with program guidelines. Furthermore, applicants may need to provide income verification and tax returns to demonstrate their ability to repay the loan. This financial assessment ensures responsible lending practices and safeguards against overindebtedness. Each component contributes to a comprehensive assessment of the applicant’s situation, enabling informed decision-making regarding loan eligibility and terms. For example, a homeowner applying for assistance after a hurricane must submit documentation verifying their ownership of the damaged property, along with proof of flood insurance coverage, as a prerequisite for loan consideration.

In summary, the application process serves as a critical link between disaster-affected homeowners and essential financial resources. Understanding and meticulously navigating this process maximizes the potential for securing timely and appropriate assistance. Accurate completion of application forms, provision of supporting documentation, and proactive communication with SBA representatives contribute significantly to a successful outcome. Conversely, neglecting any aspect of the application process can jeopardize access to crucial funds, hindering recovery efforts and prolonging the hardship experienced by disaster survivors. Therefore, a thorough and proactive approach to the application process is essential for optimizing outcomes and facilitating a smoother transition towards recovery and rebuilding.

4. Use of Funds

Appropriate utilization of funds received through SBA disaster loans is paramount for homeowners. These loans are intended to facilitate recovery and rebuilding, not to address pre-existing financial obligations or unrelated expenses. Adherence to designated usage guidelines ensures compliance with program regulations and maximizes the impact of disaster relief efforts, contributing to a more efficient and equitable recovery process. Misuse of funds can result in penalties, jeopardizing access to crucial financial assistance and hindering long-term recovery goals. The following facets illuminate permitted and prohibited uses of these funds.

- Home Repair and Reconstruction

Funds can be used to repair or rebuild a primary residence damaged or destroyed by a declared disaster. This includes structural repairs, roof replacement, electrical system restoration, and plumbing repairs. For instance, a homeowner whose house was damaged by a hurricane could use loan proceeds to repair the roof, replace damaged windows, and address water damage. This targeted application of funds directly contributes to restoring safe and habitable living conditions.

- Personal Property Replacement

Essential personal property lost or damaged as a direct result of the declared disaster is eligible for replacement using loan funds. This encompasses furniture, appliances, clothing, and necessary tools. For example, a homeowner who lost furniture due to flooding could use loan proceeds to replace essential household items. However, luxury items or non-essential possessions are typically excluded. This distinction prioritizes the restoration of basic necessities for maintaining a functional household.

- Mitigation Measures

Implementing mitigation measures to protect against future disasters is a permissible use of funds. This can include elevating a home’s foundation, reinforcing structural components, or installing storm shutters. For example, a homeowner in a flood-prone area could use loan proceeds to elevate their home, reducing the risk of future flood damage. These proactive measures contribute to long-term resilience and minimize the impact of subsequent disasters.

- Prohibited Uses

Loan proceeds cannot be used for purposes unrelated to the declared disaster. This includes paying off existing debts, purchasing luxury items, or investing in non-essential assets. For example, using loan funds to purchase a new car or pay off credit card debt would constitute a violation of program guidelines. This restriction ensures that funds are allocated specifically for disaster recovery, maximizing their intended impact and promoting responsible financial management.

Adhering to these guidelines ensures the effective and responsible use of disaster loan funds, optimizing the recovery process and promoting long-term financial stability. A clear understanding of permissible and prohibited uses is paramount for homeowners seeking to rebuild their lives and properties following a disaster. This understanding contributes to a more transparent, accountable, and impactful disaster recovery effort, ultimately fostering community resilience and long-term well-being.

5. Repayment Schedule

Repayment schedules represent a critical component of disaster loan assistance provided to homeowners. A well-structured repayment plan enables borrowers to rebuild their lives and properties while managing the financial burden of loan repayment. The terms of these schedules are influenced by several factors, including loan amount, interest rate, and the borrower’s financial capacity. Establishing a manageable repayment schedule is crucial for avoiding default and ensuring long-term financial stability. A clear understanding of repayment obligations empowers homeowners to budget effectively, prioritize financial resources, and navigate the complexities of post-disaster recovery with greater confidence. For instance, a homeowner with a smaller loan might opt for a shorter repayment period with higher monthly payments to minimize overall interest costs, while a homeowner with a larger loan might choose a longer repayment period with lower monthly payments to reduce the immediate financial strain. This flexibility allows borrowers to tailor repayment plans to their individual circumstances.

The consequences of failing to adhere to the established repayment schedule can be significant. Missed or late payments can negatively impact credit scores, hindering future access to credit. Defaulting on the loan can lead to foreclosure, jeopardizing homeownership and exacerbating the challenges of post-disaster recovery. Therefore, open communication with the lending institution is essential if unforeseen circumstances hinder adherence to the repayment schedule. Exploring options such as loan modification or deferment can provide temporary relief and prevent more severe consequences. For example, a homeowner experiencing temporary job loss due to the disaster might request a temporary deferment of loan payments to avoid default. Proactive communication and exploration of available options are crucial for mitigating the negative impacts of financial hardship.

Understanding the intricacies of repayment schedules associated with disaster loans is essential for responsible financial management and successful long-term recovery. Careful consideration of loan terms, individual financial capacity, and potential challenges enables homeowners to develop sustainable repayment strategies. Open communication with the lending institution and proactive exploration of available options contribute to a more resilient and effective recovery process. This understanding empowers homeowners to rebuild their lives and properties with greater financial security and peace of mind, fostering long-term stability and community resilience in the aftermath of disaster.

Frequently Asked Questions

This section addresses common inquiries regarding disaster loan assistance for homeowners, providing concise and informative responses to facilitate understanding and informed decision-making.

Question 1: What types of disasters qualify for assistance?

Federally declared disasters, including hurricanes, floods, wildfires, tornadoes, earthquakes, and other declared events, typically qualify for assistance. Specific eligibility criteria apply to each disaster declaration.

Question 2: How does credit score influence loan eligibility?

Credit history plays a significant role in the loan approval process. While a low credit score does not automatically disqualify applicants, it may influence the interest rate offered and other loan terms.

Question 3: What is the maximum loan amount available?

Maximum loan amounts are subject to statutory limitations and vary depending on the type of disaster and the extent of damage. Actual loan amounts awarded are contingent on individual circumstances and the availability of funds.

Question 4: Can funds be used for temporary housing?

In certain circumstances, loan funds may be used for temporary housing expenses incurred as a direct result of the declared disaster. Specific eligibility requirements apply.

Question 5: What if insurance doesn’t cover all damages?

Disaster loan assistance can help bridge the gap between insurance coverage and the total cost of disaster-related repairs or replacement. Applicants must provide documentation of insurance settlements and outstanding costs.

Question 6: How long does the application process typically take?

Processing times vary depending on the complexity of the application and the volume of requests received. Submitting a complete and accurate application with all required documentation expedites the process.

Careful consideration of these frequently asked questions provides a foundation for understanding the nuances of disaster loan assistance. Prospective applicants are encouraged to consult official resources and seek professional advice for individualized guidance.

The following section offers concluding remarks and additional resources for further exploration.

Conclusion

Access to timely financial resources is paramount following a disaster. SBA disaster loan assistance offers a crucial lifeline to homeowners facing the daunting task of rebuilding their lives and properties. Understanding eligibility requirements, application procedures, loan terms, and responsible use of funds is essential for navigating this complex process effectively. From documenting damages meticulously to exploring mitigation measures, each step plays a vital role in securing necessary assistance and ensuring a sustainable recovery.

Rebuilding after a disaster requires resilience, resourcefulness, and a comprehensive understanding of available support systems. SBA disaster loans serve as a critical component of this recovery ecosystem, empowering homeowners to overcome adversity and restore stability. Proactive planning, informed decision-making, and diligent financial management are crucial for maximizing the benefits of this assistance and forging a path toward a more secure future. The road to recovery may be challenging, but with appropriate support and informed action, rebuilding is possible.