An emergency withdrawal from a retirement account, typically a 401(k) or IRA, made under specific hardship circumstances defined by the Internal Revenue Service (IRS), allows access to funds without the usual penalties for early withdrawal. Qualifying events often include natural disasters such as hurricanes, floods, earthquakes, and wildfires, as well as other unforeseen and severe financial hardships. For instance, unreimbursed medical expenses exceeding a certain percentage of adjusted gross income may qualify. The specific rules and documentation requirements vary depending on the type of retirement plan and the nature of the hardship.

Access to these funds can provide crucial financial relief for individuals and families facing devastating events and unexpected expenses, offering a lifeline to cover essential needs like temporary housing, medical care, or repairs. Historically, the regulations around these withdrawals have evolved to address a broader range of qualifying events and to simplify the process for those affected. This accessibility allows individuals to rebuild their lives and regain financial stability following unforeseen calamities.

The following sections will explore the various types of qualifying hardships in greater detail, outline the process for requesting such a withdrawal, discuss potential tax implications, and offer guidance on minimizing the long-term impact on retirement savings.

Careful consideration and planning are essential when deciding whether to pursue an emergency withdrawal from retirement savings. Understanding the rules, requirements, and potential long-term consequences can help individuals make informed decisions during challenging times.

Tip 1: Exhaust all other options. Before accessing retirement funds, thoroughly explore alternative resources such as insurance claims, government assistance programs, and personal loans. Hardship withdrawals should be a last resort due to their potential impact on long-term financial security.

Tip 2: Understand eligibility requirements. Carefully review the specific criteria for hardship withdrawals defined by the IRS and the retirement plan provider. Ensure all required documentation is gathered and accurately submitted to avoid delays or denial of the request.

Tip 3: Assess the tax implications. Withdrawals are typically subject to income tax and may incur a 10% early withdrawal penalty if applicable. Consulting with a financial advisor can help minimize the tax burden and explore strategies for repayment.

Tip 4: Withdraw only the necessary amount. Carefully calculate the funds needed to address the immediate hardship, avoiding excessive withdrawals that further deplete retirement savings.

Tip 5: Explore repayment options. While not always mandatory, consider repaying the withdrawn amount to minimize the impact on long-term retirement goals. Some plans allow for subsequent contributions to replenish the withdrawn funds.

Tip 6: Document everything meticulously. Keep detailed records of all communication, documentation, and transactions related to the hardship withdrawal. This organized record-keeping will be crucial for tax reporting and future financial planning.

Tip 7: Seek professional guidance. Consulting with a financial advisor or tax professional is highly recommended. They can offer personalized guidance on navigating the complexities of hardship withdrawals and developing a sound financial recovery plan.

By understanding these crucial aspects of hardship withdrawals, individuals can make informed decisions and mitigate the potential long-term impact on their financial well-being.

The subsequent section provides a comprehensive checklist for navigating the hardship withdrawal process and outlines essential resources for further assistance.

1. IRS-defined hardship

The concept of “IRS-defined hardship” is central to understanding disaster distributions. These distributions, which allow for penalty-free withdrawals from retirement accounts, are contingent on experiencing a hardship officially recognized by the IRS. Clarifying the specific criteria for these hardships is crucial for determining eligibility and understanding the implications of such withdrawals.

- Unreimbursed Medical Expenses

Significant medical expenses exceeding 7.5% of adjusted gross income (AGI) can qualify as an IRS-defined hardship. This includes expenses for treatment, prevention, and diagnosis of a medical condition for the taxpayer, spouse, or dependents. In the context of disaster distributions, this allows individuals facing catastrophic medical costs due to a disaster to access retirement funds without the typical penalties. For example, someone injured during a hurricane and facing substantial medical bills could potentially access their retirement savings through a disaster distribution if the expenses exceed the AGI threshold.

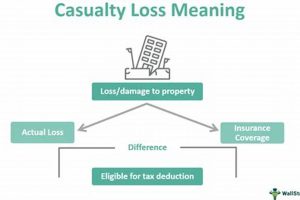

- Casualty Losses

Losses sustained from a federally declared disaster, such as a hurricane, earthquake, or wildfire, can qualify. These losses must be directly related to the disaster and exceed 10% of AGI, after subtracting any insurance reimbursements. Disaster distributions provide a mechanism for individuals to access funds to rebuild or repair their homes and replace essential belongings following such events. Documentation demonstrating the extent of the damage and insurance coverage is crucial for substantiating the claim.

- Purchase of Principal Residence

While not directly related to immediate disaster relief, the purchase of a principal residence can qualify under certain specific circumstances. This generally requires demonstrating an immediate and heavy need for housing, and the withdrawal must be used to buy the primary home for the taxpayer, spouse, or dependent. This facet of IRS-defined hardship is less directly tied to disaster distributions, but could be relevant in the aftermath of a disaster that resulted in the loss of a home.

- Tuition and Educational Fees

The IRS recognizes the financial burden of higher education and allows hardship withdrawals to cover qualified tuition and related educational fees. These expenses must be for the next 12 months of education for the taxpayer, spouse, dependent, or designated beneficiary. This particular hardship, while important, is generally less relevant in the context of disaster distributions, as it addresses a different category of financial need.

Understanding these IRS-defined hardships provides a framework for determining eligibility for a disaster distribution. While disaster distributions are primarily associated with casualty losses incurred from federally declared disasters, other hardships, such as unreimbursed medical expenses, may also intersect with the consequences of disasters and allow access to needed funds. Careful consideration of these criteria and appropriate documentation are essential for successfully navigating the process and obtaining financial relief when facing difficult circumstances.

2. Early Withdrawals

Early withdrawals from retirement accounts are typically subject to a 10% penalty, in addition to regular income tax. However, disaster distributions represent an exception to this rule, allowing access to funds before retirement age without the usual penalty. Understanding the circumstances under which these penalty-free withdrawals are permitted is crucial for leveraging this provision during times of hardship.

- Penalty Exception for Disaster-Related Hardship

The core feature of disaster distributions is the waiver of the 10% early withdrawal penalty. This exception applies specifically to distributions taken due to a federally declared disaster that has affected the taxpayer. This provision recognizes the extraordinary financial burdens imposed by such events and aims to provide accessible financial relief. For instance, if an individual’s home is destroyed by a hurricane, the penalty would be waived on withdrawals used to cover the costs of temporary housing or repairs.

- Qualifying Disaster Designation and Proof

A crucial aspect of qualifying for the penalty exception is the official designation of the disaster by the relevant federal authorities. Individuals must provide documentation proving they reside or work in the affected area. This documentation requirement ensures that the provision is applied correctly and prevents misuse. Official declarations and proof of residence or employment serve as verifiable evidence linking the individual to the disaster.

- Income Tax Liability Remains

While the 10% penalty is waived for disaster distributions, the withdrawn amount remains subject to regular income tax. This distinction is important for financial planning, as individuals must account for the tax liability when determining the amount to withdraw. Strategies to minimize the tax burden, such as spreading the withdrawal over multiple tax years, may be advisable.

- Impact on Long-Term Retirement Savings

Even with the penalty waiver, early withdrawals deplete retirement savings, potentially affecting long-term financial security. The lost growth potential due to the withdrawn funds must be considered carefully. Repaying the withdrawn amount, if possible, can help mitigate the long-term impact and maintain retirement goals. This underscores the importance of viewing disaster distributions as a last resort, to be used only after exhausting other financial avenues.

Disaster distributions provide a vital safety net by enabling access to retirement funds without the usual early withdrawal penalty during times of significant hardship. However, careful consideration of the remaining tax liability and the long-term impact on retirement savings is essential for responsible financial planning. Understanding these factors allows individuals to utilize this provision effectively while mitigating potential drawbacks.

3. Penalty Relief

Penalty relief is a critical component of disaster distributions, differentiating them from standard early withdrawals from retirement accounts. Ordinarily, accessing retirement funds before a specified age incurs a 10% penalty in addition to regular income taxes. Disaster distributions, however, offer an exception to this penalty, providing crucial financial flexibility during times of extreme hardship.

- Federally Declared Disasters

Penalty relief applies only to distributions taken due to hardships caused by federally declared disasters. This designation ensures that the relief is targeted toward those affected by significant and widespread events, such as hurricanes, earthquakes, or wildfires. For instance, if an individual’s home is severely damaged by a federally declared hurricane, withdrawals from their retirement account to cover repair costs would qualify for penalty relief. This specificity prevents misuse of the provision while providing targeted assistance to those legitimately in need.

- IRS-Defined Hardship Requirements

While a federal disaster declaration is a prerequisite, meeting specific IRS-defined hardship requirements is also essential for penalty relief. These requirements define the types of expenses that qualify for penalty-free withdrawals, typically including unreimbursed medical expenses exceeding a certain percentage of adjusted gross income, and casualty losses exceeding a defined threshold. This ensures that the funds are used for legitimate hardship-related expenses, maintaining the integrity of the provision. Documentation demonstrating the connection between the disaster and the incurred expenses is crucial for substantiating the claim.

- Documentation and Verification

Substantiating the claim for penalty relief requires meticulous documentation. Individuals must provide proof of residence or employment in the federally declared disaster area, along with evidence of the disaster-related expenses. This documentation may include insurance claims, receipts for repairs, or medical bills. This verification process safeguards against fraudulent claims and ensures that the relief reaches those genuinely affected by the disaster. Thorough record-keeping is essential for a smooth and successful claim process.

- Long-Term Financial Implications

While penalty relief provides immediate financial assistance, the long-term impact on retirement savings must be considered. Even without the penalty, withdrawals reduce the funds available for growth, potentially impacting future financial security. Exploring repayment options or adjusting long-term savings strategies can help mitigate this impact. Understanding the trade-off between immediate relief and long-term savings goals is crucial for informed decision-making.

Penalty relief within the context of disaster distributions provides vital financial assistance during catastrophic events. However, the specific requirements and implications, from the federal disaster declaration to the long-term impact on retirement savings, must be thoroughly understood. This comprehensive understanding allows individuals to utilize this provision effectively and responsibly while navigating the challenges of disaster recovery.

4. Retirement Funds Access

Retirement funds access becomes a critical concern following a disaster. Disaster distributions provide a mechanism for accessing these funds, typically held in 401(k)s or IRAs, under specific hardship circumstances. Understanding the nuances of this access is essential for effective financial recovery.

- Hardship Withdrawal Provisions

Disaster distributions fall under the umbrella of hardship withdrawals, but are specifically tied to federally declared disasters. These provisions allow individuals affected by such events to access retirement funds without the standard 10% early withdrawal penalty. For example, following a major earthquake, an individual could withdraw funds to cover temporary housing or repair costs without incurring the penalty. These provisions recognize that standard retirement planning can be disrupted by unforeseen catastrophic events.

- IRS Qualification Requirements

Accessing retirement funds through a disaster distribution requires meeting specific IRS requirements. These requirements typically include residing or working in a federally declared disaster area and demonstrating that the funds will be used for disaster-related expenses. Proof of these conditions, such as documentation of property damage or medical bills, is typically required. These stringent requirements ensure the proper and appropriate use of disaster distribution provisions.

- Impact on Long-Term Savings Goals

While disaster distributions offer essential financial relief, withdrawals inevitably impact long-term retirement savings. The withdrawn amount is no longer contributing to investment growth, potentially affecting future financial security. Careful consideration and strategic planning are necessary to mitigate this impact, potentially through subsequent increased contributions or adjustments to investment strategies. Balancing immediate needs with long-term financial goals is a crucial aspect of disaster recovery.

- Alternatives to Retirement Fund Access

Before accessing retirement funds, exploring alternative resources is essential. Options such as insurance claims, government assistance programs, and personal loans may offer less detrimental long-term financial consequences. Disaster distributions should be viewed as a last resort, to be utilized only after exhausting other avenues. This prudent approach preserves retirement savings to the greatest extent possible.

Access to retirement funds through disaster distributions provides a crucial safety net during catastrophic events. However, understanding the specific requirements, potential long-term impacts, and available alternatives allows individuals to make informed decisions that balance immediate needs with long-term financial well-being. A comprehensive disaster recovery plan should include a thorough evaluation of all available resources before accessing retirement funds.

5. Specific Documentation

Specific documentation plays a crucial role in substantiating claims for disaster distributions. Providing verifiable evidence of the hardship, its connection to a federally declared disaster, and the intended use of funds is essential for accessing retirement savings through this provision. Meticulous documentation not only facilitates the approval process but also protects individuals from potential tax implications and legal complications. This section explores the essential documentation required for disaster distributions, clarifying the importance of each component.

- Proof of Residence or Employment in the Disaster Area

Establishing a direct link between the individual and the federally declared disaster area is paramount. Acceptable documentation typically includes utility bills, bank statements, or official government correspondence clearly indicating the individual’s residential or employment address within the affected area. For example, a recent utility bill with the disaster-affected address would suffice. Failure to provide adequate proof of location can lead to denial of the distribution request. This documentation serves as a primary filter, ensuring that the relief is provided to those directly impacted by the disaster.

- Documentation of the Federally Declared Disaster

Verification of the disaster’s official federal declaration is non-negotiable. This involves providing documentation from a credible source, such as FEMA or another relevant government agency, clearly stating the date, location, and nature of the declared disaster. A copy of the official disaster declaration document itself is typically sufficient. This documentation establishes the context of the hardship, linking it to a qualifying event for disaster distribution purposes.

- Evidence of Disaster-Related Expenses

Justification for the withdrawal requires demonstrating how the funds will be used to address disaster-related expenses. This involves providing detailed documentation of the incurred or anticipated costs, such as receipts for repairs, medical bills, insurance claims, or estimates for replacement of essential household items. For instance, receipts for lumber and other building materials purchased for home repairs would be relevant. This documentation demonstrates the direct connection between the requested funds and the disaster-related hardship, ensuring that the provision is used as intended.

- Records of Retirement Plan Information

Accurate identification of the retirement plan from which the distribution is requested is essential. This typically involves providing the plan name, account number, and contact information for the plan administrator. This information streamlines the withdrawal process and prevents delays or complications. Having this information readily available ensures a smooth and efficient transaction.

The specific documentation requirements outlined above serve as gatekeepers for accessing retirement funds through disaster distributions. These requirements not only protect the integrity of the provision but also provide a framework for individuals to effectively demonstrate their eligibility. Meticulous documentation is crucial for navigating the process successfully and obtaining much-needed financial relief during times of extraordinary hardship. Failure to provide adequate documentation can result in delays or denial of the request, further compounding the challenges faced by disaster victims. Therefore, careful attention to these requirements is paramount for a successful outcome.

Frequently Asked Questions about Disaster Distributions

This section addresses common inquiries regarding disaster distributions, providing clear and concise answers to facilitate informed decision-making during challenging times.

Question 1: What types of disasters qualify for a disaster distribution?

Qualifying disasters are those officially declared by a federal agency, typically FEMA. These often include hurricanes, earthquakes, wildfires, floods, and other significant natural disasters.

Question 2: How does one prove eligibility for a disaster distribution?

Eligibility requires documentation demonstrating both residency or employment in the federally declared disaster area and the incurred expenses resulting from the disaster. Acceptable documentation may include utility bills, insurance claims, or official damage assessments.

Question 3: Are disaster distributions subject to penalties?

While the typical 10% early withdrawal penalty is waived for qualified disaster distributions, the withdrawn amount remains subject to regular income tax.

Question 4: What is the maximum amount that can be withdrawn under a disaster distribution?

The maximum distributable amount depends on specific plan rules and the extent of the disaster-related losses. Consulting with the plan administrator is crucial for determining individual limits.

Question 5: Can withdrawn funds be repaid to the retirement account?

Some retirement plans may allow for repayment of disaster distributions, although this is not always mandatory. Repayment can help mitigate the long-term impact on retirement savings.

Question 6: Where can one find further information and assistance regarding disaster distributions?

The IRS website, plan administrators, and qualified financial advisors are valuable resources for further guidance and support regarding disaster distribution eligibility, procedures, and tax implications.

Understanding these key aspects of disaster distributions is crucial for navigating the complexities of accessing retirement funds during times of extraordinary hardship. Careful planning and consultation with relevant professionals are highly recommended.

The following section provides a comprehensive checklist for initiating the disaster distribution process and highlights essential considerations for long-term financial planning.

Understanding Disaster Distributions

Disaster distributions offer a critical lifeline for individuals facing financial hardship due to federally declared disasters. Access to retirement funds, typically restricted by penalties for early withdrawal, becomes permissible under specific IRS guidelines. This access, while providing much-needed relief, requires careful consideration of eligibility requirements, documentation procedures, and long-term financial implications. Understanding the interplay between immediate needs and the potential impact on retirement savings is paramount for responsible financial decision-making during challenging circumstances. The availability of penalty relief, contingent on proper documentation and adherence to IRS rules, underscores the importance of meticulous record-keeping and thorough understanding of the process. Furthermore, exploring alternative resources before accessing retirement funds remains a prudent financial strategy.

Navigating the complexities of disaster distributions requires a comprehensive understanding of the interplay between federal regulations, retirement plan provisions, and individual financial circumstances. Proactive planning, including maintaining accurate records and seeking professional guidance, can facilitate a smoother process and mitigate potential long-term consequences. Ultimately, disaster distributions serve as a crucial safety net, enabling individuals to rebuild their lives while preserving long-term financial well-being. Continued refinement of these provisions and increased public awareness remain essential for optimizing disaster recovery efforts and ensuring equitable access to essential financial resources.