Information pertaining to Hurricane Ian’s impacts and subsequent qualification for disaster relief programs, as of the year 2024, encompasses a range of crucial data. This includes details on the types of aid... Read more »

Information regarding the official designation of Hurricane Ian as a qualifying event for federal disaster assistance is crucial for individuals and communities impacted by the storm. This designation unlocks access to various... Read more »

The catastrophic impact of Hurricane Ian resulted in its designation as a major disaster across several regions. This classification signifies that the affected areas experienced widespread damage and destruction meeting federally established... Read more »

Federally declared disasters occurring in the year 2023, eligible for government assistance programs, encompass a range of events. These include natural occurrences such as floods, wildfires, hurricanes, and earthquakes, as well as... Read more »

Information released on the current date concerning Hurricane Ian’s designation as a qualifying event for federal disaster relief provides critical details about available aid. This typically includes specifics on the types of... Read more »

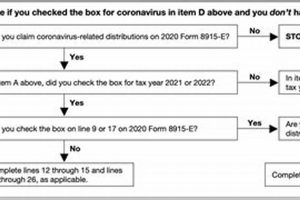

The question of whether the COVID-19 pandemic qualifies individuals for hardship withdrawals from retirement accounts, such as 401(k)s and IRAs, centers around the definition of a “qualified disaster.” Typically, this involves events... Read more »

Distributions from retirement accounts, made available to individuals and families impacted by federally declared disasters in 2023, offer relief from financial hardship. These withdrawals, often subject to relaxed penalties and potential for... Read more »

Certain government-approved retirement plans, such as 401(k)s and IRAs, permit penalty-free withdrawals under specific circumstances related to federally declared disasters. These withdrawals, designed to provide financial relief for those impacted, are generally... Read more »

Distributions from retirement accounts made under specific IRS provisions for those impacted by federally declared disasters are generally exempt from the 10% early withdrawal penalty. These withdrawals, with specific limitations and requirements... Read more »

Governmental and charitable organizations often provide financial assistance to individuals and businesses affected by natural disasters such as hurricanes, floods, wildfires, and earthquakes. These funds typically cover expenses like temporary housing, repairs,... Read more »