Withdrawals from retirement accounts, such as 401(k)s and IRAs, before the age of 59 1/2 are typically subject to a 10% penalty, in addition to regular income tax. However, under specific circumstances, such as federally declared disasters, qualified individuals can access these funds without incurring the additional penalty. For example, if someone’s home is severely damaged by a hurricane and they need funds for repairs, they might qualify for penalty-free withdrawal.

Accessing retirement savings early without penalty can be a crucial lifeline for individuals and families impacted by catastrophic events. This provision aims to alleviate financial hardship during emergencies, enabling access to funds for essential needs like temporary housing, repairs, and medical expenses. Historically, legislation enabling penalty-free withdrawals has been enacted in response to major natural disasters and other qualifying emergencies, recognizing the need for financial flexibility in times of crisis.

This discussion will further examine the specific qualifications, eligible expenses, and procedures for accessing retirement funds under these provisions, as well as other important tax considerations related to disaster relief.

Careful planning and understanding of regulations are crucial for utilizing qualified disaster distributions effectively. These tips provide guidance on navigating the complexities of accessing retirement funds during qualifying emergencies.

Tip 1: Verify Eligibility: Confirm that the disaster qualifies for penalty-free withdrawals under IRS guidelines and that individual circumstances meet the specific criteria related to the disaster’s impact.

Tip 2: Document Losses Thoroughly: Maintain meticulous records of all disaster-related expenses and losses. This documentation is essential for substantiating the need for a withdrawal and potentially supporting deductions or other tax benefits.

Tip 3: Explore Alternative Resources: Consider other available resources, such as insurance proceeds, government assistance programs, or low-interest loans, before accessing retirement funds. Qualified disaster distributions should be utilized strategically after exhausting other options.

Tip 4: Understand Tax Implications: While the 10% penalty may be waived, withdrawn amounts are still subject to ordinary income tax. Consult with a tax advisor to understand the potential tax liabilities and develop a plan for minimizing them.

Tip 5: Plan for Repayment: Explore the possibility of repaying the distribution back into a qualified retirement account within a specified timeframe to mitigate the tax impact and maintain retirement savings progress. The rules for repayments should be carefully reviewed to ensure compliance.

Tip 6: Consult with a Financial Advisor: Seeking professional financial advice can help individuals make informed decisions about utilizing qualified disaster distributions and develop a long-term financial recovery strategy.

By understanding these key considerations and taking proactive steps, individuals can leverage qualified disaster distributions effectively to navigate challenging circumstances while minimizing long-term financial repercussions.

This information provides a foundational understanding of qualified disaster distributions. Further research and consultation with relevant professionals are recommended for specific situations.

1. Early Withdrawal

Early withdrawal from retirement accounts is a core component of disaster distribution tax provisions. Understanding the nuances of early withdrawal is crucial for leveraging these provisions effectively during qualifying emergencies.

- Penalty Waiver:

Typically, withdrawing from retirement accounts before age 59 1/2 incurs a 10% penalty in addition to regular income tax. Disaster distribution tax provisions waive this penalty for qualified individuals and disasters, making access to funds less financially burdensome. For example, someone whose home was damaged by a hurricane can access retirement savings for repairs without the additional penalty.

- Qualified Disasters:

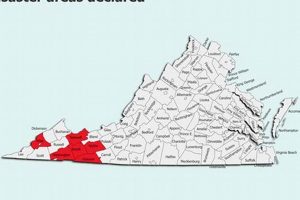

Not all disasters qualify for penalty-free early withdrawals. The disaster must be federally declared, and the individual must be impacted within the designated disaster area. Examples include hurricanes, floods, wildfires, and earthquakes officially declared as disasters by the federal government.

- Eligible Expenses:

Early withdrawals under disaster distribution tax provisions are often restricted to qualified disaster-related expenses. These typically include home repairs, temporary housing, medical expenses, and funeral costs. Purchasing a new vehicle or other non-essential items would likely not qualify.

- Income Tax Liability:

While the 10% penalty may be waived, withdrawn amounts are still considered income and are subject to regular income tax. Individuals should factor in potential tax liabilities when planning early withdrawals and consult with a tax advisor for guidance on minimizing their tax burden.

These facets of early withdrawal highlight its role as a critical tool within disaster distribution tax provisions. By understanding the qualifications, restrictions, and tax implications associated with early withdrawals, individuals can make informed financial decisions during challenging times and effectively utilize these provisions for recovery and rebuilding.

2. Penalty Relief

Penalty relief forms a cornerstone of disaster distribution tax provisions. Ordinarily, withdrawals from tax-advantaged retirement accounts before age 59 1/2 incur a 10% penalty, adding to the financial strain during emergencies. Disaster distribution tax provisions offer relief from this penalty for qualified individuals affected by federally declared disasters, allowing access to crucial funds without the added financial burden. This relief is pivotal, as it directly increases the amount of accessible funds for immediate needs like temporary housing, home repairs, and medical expenses. For example, a family displaced by a wildfire can access their retirement savings for temporary housing without incurring the additional 10% penalty, effectively increasing their available resources for recovery.

The practical significance of penalty relief lies in its capacity to accelerate recovery. By reducing the financial cost of accessing retirement savings, individuals can address immediate needs more effectively. This can be especially crucial in situations where other financial resources, like insurance proceeds, are delayed or insufficient. The absence of the penalty allows a more substantial portion of the withdrawn funds to be directly applied to recovery efforts, potentially shortening the time required to regain stability. For instance, a small business owner whose premises were flooded can use penalty-free withdrawals to cover repairs and reopen more quickly, mitigating long-term financial losses.

In summary, penalty relief within disaster distribution tax provisions is not merely a technicality but a crucial component of financial recovery. Its availability can significantly impact the speed and efficacy of rebuilding efforts, particularly during large-scale disasters. Understanding the eligibility requirements and application of penalty relief is therefore essential for individuals and communities navigating the aftermath of a disaster.

3. Federally Declared Disasters

The concept of “federally declared disasters” is intrinsically linked to disaster distribution tax provisions. These provisions offer tax relief specifically during times of crisis officially recognized by the federal government. Understanding the designation process and its implications is crucial for accessing these benefits.

- Presidential Declaration:

A presidential declaration of a major disaster or emergency is the trigger for activating disaster distribution tax provisions. This declaration follows a formal request from a state governor based on documented need exceeding state and local resources. The declaration signifies the severity of the event and unlocks federal assistance, including tax relief for affected individuals.

- Geographic Specificity:

The presidential declaration defines a specific geographic area affected by the disaster. Only individuals residing or working within this designated area are eligible for disaster distribution tax benefits. This ensures that relief efforts are targeted towards those directly impacted by the disaster.

- Types of Qualifying Disasters:

A wide range of events can qualify for a federal disaster declaration, including natural disasters like hurricanes, earthquakes, floods, and wildfires, as well as certain man-made disasters such as terrorist attacks and major accidents. The specific qualifying event determines the available types of assistance and tax relief.

- Impact on Tax Provisions:

The federal declaration effectively establishes the timeframe during which disaster distribution tax provisions apply. This period is determined by the disaster’s severity and the ongoing recovery efforts. The declaration provides a structured legal framework for accessing tax relief, outlining eligibility criteria and qualifying expenses.

Federally declared disasters provide the critical context within which disaster distribution tax provisions operate. The declaration acts as a gateway to accessing these benefits, ensuring that tax relief is available to those facing the specific financial hardships associated with officially recognized emergencies. This link between federal recognition and tax relief is a key element in understanding and utilizing disaster distribution provisions effectively.

4. Qualified Expenses

Qualified expenses represent a critical component within the framework of disaster distribution tax provisions. The direct link between eligible expenses and the ability to access retirement funds penalty-free underscores the importance of understanding these qualifications. Disaster distribution tax relief targets specific needs arising directly from the disaster, ensuring that funds are utilized for recovery and rebuilding. This connection between qualified expenses and tax relief prevents misuse of the provisions while providing crucial financial support where it is most needed.

Several categories of expenses typically qualify for disaster distribution tax relief. These categories are designed to address the most immediate and pressing needs following a disaster. Common examples include expenses for repairing or rebuilding a primary residence damaged by the disaster, costs associated with temporary housing if displacement occurs, and medical expenses resulting from the disaster. For instance, if a hurricane damages a home, repairs would be a qualified expense, whereas purchasing a new car would not. Similarly, if flooding forces evacuation, temporary lodging costs would qualify, but purchasing new furniture would not. Understanding these distinctions ensures appropriate utilization of disaster distribution provisions.

The practical significance of understanding qualified expenses lies in maximizing available resources during recovery. By focusing on eligible expenses, individuals can leverage the full potential of disaster distribution tax relief, minimizing financial strain and expediting the rebuilding process. Failure to adhere to qualified expense guidelines could result in penalties or disqualification from the program, thereby hindering recovery efforts. Therefore, careful consideration of eligible expenses is paramount for effective utilization of disaster distribution tax provisions. Consulting with a tax advisor or reviewing official IRS guidelines can provide further clarification and ensure compliance, ultimately maximizing the benefits of disaster distribution tax relief during challenging circumstances.

5. Income Tax Implications

Income tax implications represent a crucial aspect of disaster distribution tax provisions. While these provisions offer relief from the 10% early withdrawal penalty, the withdrawn amounts are still considered ordinary income and subject to federal income tax. This taxation applies even if the funds are used for qualified disaster-related expenses. For instance, if an individual withdraws $20,000 from a retirement account to repair hurricane damage, that $20,000 is added to their taxable income for the year, potentially increasing their overall tax liability. The tax impact depends on the individual’s tax bracket and the total amount withdrawn.

Understanding the tax implications is essential for effective financial planning following a disaster. Failing to account for the increased tax liability could lead to unexpected financial strain, hindering recovery efforts. For example, if an individual anticipates using the full withdrawn amount for repairs but has not accounted for the income tax due, they may find themselves with insufficient funds to complete the necessary work. Therefore, individuals should consult with a tax advisor to estimate the potential tax liability and adjust their withdrawal strategy accordingly. Strategies like spreading the withdrawals over multiple tax years might help mitigate the impact. Moreover, some disaster relief programs offer tax deductions or credits that can offset the increased tax burden associated with disaster distributions. Careful exploration of these options can help minimize the financial consequences.

In summary, navigating disaster distribution tax provisions requires careful consideration of income tax implications. While the penalty relief provides immediate access to needed funds, the resulting tax liability can significantly impact long-term financial recovery. Proactive planning, including consultation with a tax professional and exploration of available tax mitigation strategies, is essential for optimizing the use of these provisions and ensuring a successful recovery.

Frequently Asked Questions about Disaster Distributions

This section addresses common questions regarding disaster distributions from retirement accounts, providing clarity on eligibility, usage, and tax implications. Understanding these aspects is crucial for informed financial decision-making during challenging circumstances.

Question 1: What qualifies as a “federally declared disaster”?

A federally declared disaster is an event officially declared by the President of the United States as a major disaster or emergency. This declaration triggers the availability of federal assistance, including access to disaster distribution tax provisions. These declarations typically cover events like hurricanes, earthquakes, floods, wildfires, and certain man-made disasters.

Question 2: Which retirement accounts are eligible for disaster distributions?

Eligible retirement accounts typically include 401(k) plans, 403(b) plans, traditional IRAs, and Roth IRAs. However, specific plan rules may vary, so it’s advisable to consult with the plan administrator for confirmation.

Question 3: What expenses qualify for disaster distributions?

Qualified expenses generally include those incurred as a direct result of the federally declared disaster. Common examples include home repairs, temporary housing costs, medical expenses related to the disaster, and funeral expenses. Non-essential purchases typically do not qualify.

Question 4: Are disaster distributions taxable?

While disaster distributions offer relief from the 10% early withdrawal penalty, the withdrawn amounts are still subject to federal income tax as ordinary income. Tax implications should be considered carefully when planning withdrawals.

Question 5: Can disaster distributions be repaid?

In some cases, disaster distributions can be repaid to an eligible retirement account within a specified timeframe. Repayment can potentially mitigate the tax burden and help maintain retirement savings progress. Specific rules and deadlines for repayment should be reviewed carefully.

Question 6: Where can one find further information on disaster distributions?

The IRS website provides detailed information on qualified disaster distributions, including eligibility requirements, qualified expenses, and tax implications. Consulting with a qualified tax advisor is also recommended for personalized guidance.

Understanding these key aspects of disaster distributions allows individuals to navigate challenging circumstances more effectively and make informed financial decisions. Careful planning and consultation with relevant professionals are essential for maximizing the benefits of these provisions.

The following section explores specific examples of disaster scenarios and their corresponding tax implications, providing practical context to the information presented above.

Disaster Distribution Tax

Disaster distribution tax provisions offer a critical lifeline to individuals facing financial hardship in the wake of federally declared disasters. By waiving the 10% early withdrawal penalty on retirement funds, these provisions enable access to crucial resources for qualified disaster-related expenses, such as home repairs, temporary housing, and medical costs. However, careful consideration of the remaining tax implications and adherence to eligibility requirements are essential for maximizing the benefits and minimizing potential financial strain. Understanding qualified expenses and exploring repayment options further enhance the effectiveness of these provisions as recovery tools.

Navigating the complexities of disaster distribution tax requires diligent planning and a thorough understanding of the applicable regulations. Proactive consultation with financial and tax advisors is highly recommended to develop personalized strategies that align with individual circumstances and long-term financial goals. The ability to access retirement funds penalty-free during times of crisis provides significant relief, but informed utilization of these provisions is crucial for ensuring a resilient and sustainable financial recovery.