Supplemental compensation provided to individuals performing crucial services during emergenciessuch as healthcare professionals, first responders, and utility workersrecognizes the increased risks and demands these situations impose. For instance, a paramedic working extended hours during a hurricane might receive additional hourly wages or a lump-sum payment.

Such remuneration serves several vital functions. It incentivizes individuals to work under hazardous conditions, ensuring critical services remain operational during crises. Furthermore, it offers financial relief for potential added expenses like childcare or temporary housing. Historically, the recognition of the need for this type of compensation has grown alongside the increasing complexity and frequency of large-scale emergencies, leading to evolving policies and legislation at various governmental levels.

The following sections will delve deeper into eligibility criteria, legislative frameworks, and the ongoing debate surrounding the adequacy and equitable distribution of these crucial funds.

Tips Regarding Supplemental Compensation During Emergencies

Navigating compensation policies during crises can be complex. The following tips offer guidance for essential personnel and employers.

Tip 1: Understand Existing Policies: Thoroughly review employer handbooks, collective bargaining agreements, and relevant local, state, and federal regulations to understand pre-existing provisions for hazard pay, overtime, and other forms of compensation applicable during emergencies.

Tip 2: Maintain Accurate Records: Meticulous documentation of hours worked, additional expenses incurred, and hazardous conditions encountered is crucial for substantiating claims for supplemental compensation.

Tip 3: Communicate with Employers: Open communication with employers regarding concerns about compensation and working conditions during emergencies is vital for addressing potential issues promptly and collaboratively.

Tip 4: Explore Union Resources (If Applicable): Union members should leverage union resources and representation for assistance in navigating compensation negotiations and ensuring compliance with relevant labor agreements.

Tip 5: Familiarize Oneself with Government Programs: Research government programs that might offer financial assistance or other resources to essential workers during emergencies. These can include federal, state, or local initiatives specifically designed to support individuals in critical roles.

Tip 6: Seek Legal Counsel if Necessary: If disputes arise regarding compensation or working conditions, consulting with an attorney specializing in labor law can provide valuable guidance and representation.

Tip 7: Plan for Financial Contingencies: Establishing an emergency fund can offer crucial financial stability during crises, supplementing any additional compensation received and addressing unexpected expenses.

Following these guidelines can assist in ensuring fair compensation and facilitate a smooth process for receiving earned funds, allowing individuals to focus on their essential duties during critical times.

This information aims to provide general guidance. Specific situations may require further research and consultation with appropriate professionals. The concluding section will summarize key takeaways and offer additional resources for further information.

1. Eligibility Criteria

Access to supplemental compensation during emergencies hinges on established eligibility criteria, ensuring that resources are directed to those facing heightened risks and responsibilities. Clearly defined parameters are essential for equitable and efficient distribution of funds, preventing ambiguity and potential disputes.

- Occupational Category:

Eligibility often centers on specific occupational categories deemed essential during emergencies. These typically include healthcare professionals, first responders (police, fire, paramedics), utility workers, and sanitation personnel. For example, a physician working in a disaster-stricken area would likely qualify, while an administrative staff member working remotely might not. This distinction underscores the focus on roles directly involved in emergency response and critical infrastructure maintenance.

- Location and Duration of Service:

Geographic location and duration of service within a designated disaster area are key factors. Individuals must demonstrate service within the officially declared disaster zone for a specified period. A paramedic deployed to a flood-affected region for two weeks might qualify, while a colleague stationed elsewhere in the same state might not. This criterion ensures compensation reaches those directly impacted by and responding to the specific emergency.

- Employment Status:

Employment status can influence eligibility. Full-time, part-time, and contract employees might be subject to different requirements or compensation levels. A full-time firefighter would likely be covered under existing departmental policies, while a volunteer firefighter might fall under a separate set of regulations. Understanding these distinctions is vital for navigating the application process.

- Specific Duties Performed:

Eligibility might further refine based on specific duties performed during the emergency. A nurse assigned to a triage unit in a disaster zone would likely qualify for hazard pay, while a nurse working in a non-emergency department within the same hospital might not. This emphasizes the connection between compensation and the level of risk and demand associated with particular tasks.

These interwoven criteria shape access to disaster pay, reflecting the complex considerations involved in fairly compensating essential workers while managing resource allocation effectively. Variations in these criteria across jurisdictions and organizations underscore the need for clear communication and readily accessible information for eligible individuals.

2. Funding Mechanisms

Securing adequate and timely financial resources for essential personnel during emergencies requires robust and diverse funding mechanisms. These mechanisms determine the availability and sustainability of disaster pay, directly impacting the ability to attract, retain, and support individuals performing critical services under challenging circumstances. Understanding these funding sources is crucial for effective policy development and implementation.

- Government Appropriations:

Dedicated allocations within government budgets at the federal, state, or local levels represent a primary funding source. These appropriations can be pre-designated for disaster relief or allocated on an ad-hoc basis following an emergency declaration. For example, the Federal Emergency Management Agency (FEMA) provides funding for disaster response and recovery, including personnel costs. This reliance on public resources underscores the governmental responsibility for ensuring the continuity of essential services during crises.

- Employer-Sponsored Programs:

Many organizations, particularly in healthcare and public safety, maintain internal programs to provide supplemental compensation during emergencies. These programs may involve dedicated funds, overtime pay structures, or other incentives. A hospital, for instance, might have a policy for distributing hazard pay to staff working during a pandemic. This demonstrates organizational commitment to supporting essential personnel and acknowledges the increased burdens they face.

- Contingency Funds:

Specific contingency funds can be established at various governmental levels to address unforeseen emergency needs. These funds offer a flexible resource for covering unexpected personnel costs associated with large-scale events. For example, a state might maintain a disaster relief fund that can be accessed to supplement pay for firefighters battling wildfires. This flexibility ensures rapid response and resource allocation during evolving crises.

- Charitable Donations and Grants:

While not a primary funding source, charitable donations and grants from philanthropic organizations can play a supplementary role in supporting essential workers during emergencies. These contributions might fund specific initiatives, provide direct financial assistance to individuals, or support community recovery efforts. For example, a foundation might provide grants to organizations offering mental health services to first responders following a traumatic event. This illustrates the role of community support in bolstering the overall response effort.

The interplay of these funding mechanisms shapes the landscape of disaster pay, determining the financial resources available to support essential workers during crises. A balanced and diversified approach, combining government funding, employer initiatives, and community support, enhances the resilience and responsiveness of essential services in the face of emergencies.

3. Disbursement Processes

Efficient and equitable disbursement processes are crucial for ensuring that disaster pay reaches eligible essential workers promptly and without undue burden. These processes represent the critical link between allocated funds and the individuals who rely on them during and after emergencies. A well-designed system minimizes delays, reduces administrative overhead, and fosters trust in the compensation system. Conversely, flawed processes can lead to frustration, financial hardship, and decreased morale among essential personnel, potentially impacting their ability to perform critical duties effectively. For instance, streamlined electronic transfers directly to workers’ bank accounts can accelerate access to funds, while cumbersome manual processes requiring extensive paperwork can create significant delays, particularly in chaotic post-disaster environments. This difference underscores the practical significance of efficient disbursement mechanisms.

Several factors influence the effectiveness of disbursement processes. Clear communication regarding eligibility criteria, application procedures, and payment timelines is paramount. Accessibility of information and application channels is equally crucial, particularly for individuals in remote areas or with limited technological access. Furthermore, robust verification mechanisms are necessary to prevent fraud and ensure that funds are directed to eligible recipients. For example, utilizing existing payroll systems or partnering with financial institutions can expedite payments and reduce administrative complexity. Conversely, requiring individuals to submit extensive documentation or travel long distances to apply for compensation can create barriers, especially for those already dealing with the aftermath of a disaster. This illustrates the importance of considering contextual factors when designing disbursement procedures.

Effective disbursement processes are therefore integral to the overall success of disaster pay initiatives. They contribute significantly to the financial well-being of essential workers, recognizing their sacrifices and supporting their continued service during challenging times. Streamlined, transparent, and accessible procedures not only ensure timely access to funds but also reinforce the value placed on the contributions of these individuals. Challenges such as limited technological infrastructure, data security concerns, and the need for interagency coordination must be addressed to optimize disbursement effectiveness and maintain public trust. These considerations underscore the ongoing need for evaluation and refinement of disbursement processes to ensure they remain responsive to the evolving needs of essential workers in disaster contexts.

4. Legislative Frameworks

Legislative frameworks provide the crucial foundation upon which disaster pay systems are built, defining eligibility, funding mechanisms, and implementation procedures. These legal structures ensure consistent application of policies, protect worker rights, and facilitate efficient resource allocation during emergencies. Examining these frameworks is essential to understanding how disaster pay functions and its impact on essential workers.

- Federal Laws:

Federal laws, such as the Stafford Act, establish national guidelines for disaster response and recovery, including provisions for federal assistance to state and local governments. These laws may also indirectly influence disaster pay by setting standards for hazard pay for federal employees deployed to disaster zones. For example, the Stafford Act authorizes FEMA to provide funding for emergency work, which can encompass supplemental compensation for essential workers. This federal oversight ensures a baseline level of support across different jurisdictions.

- State Regulations:

State regulations often build upon federal frameworks, tailoring disaster pay provisions to specific regional contexts and needs. These regulations may define eligible occupations, establish payment rates, and outline application procedures. For instance, a state might have specific legislation mandating hazard pay for healthcare workers during public health emergencies. This state-level control allows for nuanced responses to diverse emergency scenarios.

- Local Ordinances:

Local ordinances further refine disaster pay policies at the municipal level, addressing specific community needs and resource availability. These ordinances might specify eligibility criteria for local government employees or establish partnerships with community organizations to support essential workers. A city, for example, might have a local ordinance providing additional compensation to sanitation workers during extreme weather events. This localized approach allows for targeted support tailored to specific community circumstances.

- Collective Bargaining Agreements:

For unionized workers, collective bargaining agreements play a significant role in shaping disaster pay provisions. These agreements often include clauses addressing hazard pay, overtime, and other forms of compensation during emergencies. For example, a nurses’ union might negotiate a contract that guarantees a specific percentage increase in hourly wages for work performed during declared pandemics. This collective bargaining process ensures that worker voices are represented in the development of compensation policies.

These interconnected legislative frameworks establish the legal and regulatory environment for disaster pay, impacting how essential workers are compensated during emergencies. The interplay between federal, state, and local laws, alongside collective bargaining agreements, creates a complex web of regulations that requires careful navigation to ensure effective implementation and equitable distribution of resources. Understanding these frameworks is critical for advocating for fair compensation and ensuring the sustainability of essential services during times of crisis.

5. Equity and Adequacy

Discussions surrounding disaster pay inevitably raise crucial questions of equity and adequacy. Ensuring fair compensation requires careful consideration of how resources are distributed among different groups of essential workers, accounting for varying levels of risk, responsibility, and pre-existing economic vulnerabilities. Adequacy addresses whether the compensation provided truly reflects the sacrifices made and the potential financial burdens incurred during emergencies. These considerations are fundamental to supporting the workforce that sustains critical services during times of crisis and mitigating potential disparities exacerbated by disaster events.

- Comparability Across Sectors:

Equity demands consideration of compensation levels across different essential sectors. A paramedic risking their life in a disaster zone should receive comparable compensation to a hospital physician working extended hours under similarly hazardous conditions. Disparities in pay can create resentment and undermine the collaborative spirit essential for effective disaster response. For example, discrepancies between hazard pay offered to hospital staff and that offered to emergency medical technicians raise concerns about equitable treatment for individuals performing equally critical roles. Analyzing these cross-sector comparisons helps identify and address potential inequities.

- Addressing Pre-existing Disparities:

Adequacy must account for pre-existing economic disparities among essential workers. Lower-wage workers, often disproportionately represented in essential roles like grocery store clerks and sanitation workers, may face greater financial strain during emergencies due to limited savings and reliance on hourly wages. Adequate disaster pay should mitigate these vulnerabilities, ensuring that essential workers are not further disadvantaged by the very crises they help manage. For instance, a grocery store worker facing lost income due to store closures during a hurricane experiences a more significant financial impact than a higher-paid healthcare administrator working remotely. Addressing such disparities requires tailored support mechanisms.

- Accounting for Varied Risks and Responsibilities:

Equity requires differentiating compensation based on the specific risks and responsibilities undertaken by various essential workers. Individuals directly exposed to hazardous materials or working in high-risk environments should receive higher compensation than those in less dangerous roles. This recognizes the varying degrees of sacrifice and potential long-term health consequences associated with different essential duties. For example, a firefighter entering a burning building faces greater immediate risks than a support staff member coordinating logistics from a safe location, justifying differentiated compensation. Clear criteria for assessing risk and responsibility are crucial for establishing equitable pay structures.

- Transparency and Accountability:

Transparency in compensation policies and accountability in disbursement processes are essential for ensuring both equity and adequacy. Clear guidelines regarding eligibility criteria, payment calculations, and grievance procedures build trust and allow for effective oversight. This transparency also facilitates public scrutiny and allows for ongoing evaluation of the effectiveness and fairness of disaster pay systems. For example, publicly accessible data on disaster pay distributions, broken down by sector and job category, can reveal potential disparities and inform policy adjustments. Promoting open access to information fosters accountability and strengthens public trust.

These considerations of equity and adequacy are integral to the broader discussion of disaster pay for essential workers. Striking a balance between fair compensation, efficient resource allocation, and recognition of the diverse contributions of essential personnel is crucial for building resilient communities capable of effectively responding to and recovering from emergencies. Failing to address these concerns can undermine the very systems designed to support essential workers and protect public well-being during times of crisis. Therefore, ongoing evaluation and refinement of disaster pay policies, informed by principles of equity and adequacy, are essential for strengthening the resilience of essential services and promoting a just and equitable recovery process.

Frequently Asked Questions about Supplemental Compensation for Essential Personnel During Emergencies

This section addresses common inquiries regarding supplemental compensation provided to essential personnel during emergencies. Clarity on these matters is crucial for both employers and employees navigating complex and often rapidly evolving situations.

Question 1: Which occupations typically qualify for supplemental compensation during emergencies?

Eligibility criteria vary based on jurisdiction and specific circumstances, but typically encompass roles critical to public safety, health, and infrastructure maintenance, including healthcare professionals, first responders, utility workers, and sanitation personnel.

Question 2: How are supplemental compensation rates determined?

Rates can be determined through a combination of pre-established policies, collective bargaining agreements, legislative mandates, and employer discretion, factoring in the nature of the emergency, the level of risk involved, and the duration of service.

Question 3: What documentation is typically required to substantiate a claim for supplemental compensation?

Required documentation can include timesheets, expense reports, deployment records, and incident reports, demonstrating service within a designated disaster area and the performance of duties directly related to the emergency response.

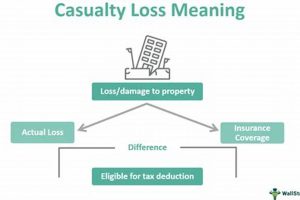

Question 4: Are there tax implications associated with supplemental compensation received during emergencies?

Supplemental compensation, like regular wages, is generally subject to applicable income taxes and other payroll deductions. Specific tax implications may vary depending on local regulations and the nature of the compensation received.

Question 5: What recourse is available if an employer denies a claim for supplemental compensation believed to be justified?

Individuals whose claims are denied should consult relevant employment contracts, collective bargaining agreements, and applicable regulations. Legal counsel specializing in labor law may be necessary to explore further options.

Question 6: How can one prepare in advance to navigate potential compensation issues during future emergencies?

Advance preparation involves understanding existing employer policies, maintaining accurate personal records, and familiarizing oneself with relevant local, state, and federal regulations pertaining to emergency compensation.

Understanding these key aspects of supplemental compensation empowers essential personnel and employers to navigate emergency situations effectively, ensuring fair treatment and timely access to earned funds. Open communication and proactive planning are crucial for addressing potential challenges and supporting the workforce that sustains critical services during times of crisis.

The following section will explore case studies illustrating the practical application of these principles in real-world emergency scenarios.

Disaster Pay for Essential Workers

This exploration of disaster pay for essential workers has highlighted its multifaceted nature, encompassing eligibility criteria, funding mechanisms, disbursement processes, legislative frameworks, and ongoing debates surrounding equity and adequacy. Understanding these interconnected components is crucial for ensuring fair compensation and recognizing the vital contributions of individuals who maintain essential services during emergencies. From clarifying who qualifies for such pay to examining how funds are allocated and distributed, this discussion has emphasized the importance of robust systems that support these critical personnel. Furthermore, the analysis of legislative frameworks and the ongoing dialogue regarding fair and sufficient compensation underscores the need for continuous evaluation and refinement of existing policies.

Adequate disaster pay is not merely a financial matter; it represents a societal commitment to valuing and supporting those who bear disproportionate burdens during times of crisis. Investing in robust, equitable, and transparent compensation systems strengthens community resilience, ensuring the continued functioning of essential services when they are most needed. Further research and policy development are crucial to address evolving challenges and ensure that disaster pay effectively supports the workforce that safeguards public well-being during emergencies. The long-term sustainability of essential services hinges on the ability to attract, retain, and adequately compensate the dedicated individuals who serve on the front lines of disaster response and recovery.