Federally subsidized financial assistance is available to businesses of all sizes, private non-profit organizations, homeowners, and renters located in declared disaster areas. These loans offer low interest rates and long-term repayment options to help rebuild after physical damage or economic injury caused by qualifying disasters. For instance, a restaurant forced to close for several months due to a hurricane could utilize such assistance to cover operating expenses while unable to generate revenue.

This type of assistance is vital for community recovery following catastrophic events. It bridges the gap between immediate needs and long-term rebuilding, enabling businesses to reopen, homeowners to repair their properties, and renters to secure stable housing. Historically, such programs have played a crucial role in revitalizing impacted areas following natural disasters and other qualifying events, fostering economic resilience and mitigating the long-term consequences of such incidents. These programs have evolved over time to address the changing needs of communities and to encompass a wider range of eligible disasters.

The following sections will delve into eligibility requirements, application procedures, loan terms, and other essential aspects of navigating the complexities of post-disaster financial recovery. Understanding these elements is critical for those seeking to rebuild and restore their livelihoods after experiencing the devastating effects of a disaster.

Tips for Disaster Loan Applications

Careful preparation and a thorough understanding of the process are critical for successful disaster loan applications. The following tips provide valuable guidance for navigating this often complex procedure.

Tip 1: Document Everything. Meticulous record-keeping is essential. Maintain comprehensive records of all damages and losses. Detailed photographs, videos, and receipts are invaluable for substantiating the extent of the impact.

Tip 2: Apply Promptly. Timely application submission is crucial. Deadlines are strictly enforced, and delays can jeopardize eligibility. Begin the application process as soon as possible following the disaster declaration.

Tip 3: Understand Eligibility Requirements. Specific criteria determine eligibility. Review these requirements carefully to ensure compliance before investing time in the application process.

Tip 4: Gather Necessary Financial Information. Prepare all required financial documentation in advance. This may include tax returns, income statements, and other relevant financial records. Organized documentation expedites the application review.

Tip 5: Develop a Clear Recovery Plan. Articulate a well-defined plan for utilizing the loan proceeds. This demonstrates a clear understanding of recovery needs and enhances the application’s credibility.

Tip 6: Seek Professional Assistance. Consider consulting with financial advisors or disaster recovery specialists. Expert guidance can prove invaluable in navigating the application process and maximizing the chances of approval.

Tip 7: Maintain Communication. Remain in contact with the relevant agency throughout the application process. Promptly respond to any requests for additional information or clarification.

By adhering to these guidelines, applicants can significantly improve their chances of securing necessary financial assistance and facilitate a smoother recovery process following a disaster.

Careful planning and diligent execution of these recommendations can pave the way for a more efficient and successful recovery journey.

1. Eligibility Requirements

Access to disaster loan assistance hinges on meeting specific eligibility requirements. These criteria ensure that funds are distributed to those truly impacted by declared disasters and are used for legitimate recovery purposes. Understanding these requirements is paramount before initiating the application process.

- Physical Damage or Economic Injury:

Applicants must demonstrate tangible physical damage to property or verifiable economic injury resulting from a declared disaster. Physical damage could include structural damage to a business premises due to flooding. Economic injury might involve significant revenue loss for a tourism-dependent business due to a wildfire that deterred visitors. Providing substantial evidence of these impacts is essential for qualification.

- Creditworthiness:

Demonstrated ability to repay the loan is a key determinant of eligibility. Credit history, including past loan performance and current debt obligations, is carefully evaluated. While the program aims to assist those in dire need, a reasonable expectation of repayment capacity is essential for loan approval.

- Location in a Declared Disaster Area:

The business or property must be located within a designated disaster area officially declared by the appropriate governing authority. These declarations delineate the geographical boundaries of federal disaster assistance. Confirmation of location within a declared disaster area is a fundamental requirement.

- Legal and Regulatory Compliance:

Applicants must be in compliance with all applicable legal and regulatory requirements. This includes maintaining appropriate business licenses and adhering to relevant industry regulations. Demonstrating legal standing and operational compliance is a prerequisite for consideration.

Meeting these eligibility requirements is fundamental to accessing disaster loan assistance. Failure to satisfy any of these criteria may result in application denial. Careful review and thorough preparation of supporting documentation are vital for a successful application. Understanding and complying with these stipulations ensures that the program’s resources are directed to those genuinely in need, facilitating efficient and equitable disaster recovery.

2. Loan Types

The Small Business Administration (SBA) Disaster Loan Program offers various loan products tailored to address the diverse needs of disaster-affected entities. Selecting the appropriate loan type is crucial for effective recovery, as each product caters to specific circumstances and purposes. Understanding the nuances of each offering is essential for maximizing the program’s benefits.

- Business Physical Disaster Loans:

These loans provide financial assistance to businesses of all sizes, including private non-profit organizations, to repair or replace disaster-damaged property. Eligible property includes real estate, machinery, equipment, and inventory. For example, a manufacturer could use this loan to replace damaged machinery after a flood. These loans are essential for restoring operational capacity and resuming business activities following a disaster.

- Economic Injury Disaster Loans (EIDL):

EIDLs offer working capital to small businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private non-profit organizations of all sizes to alleviate economic injury caused by a declared disaster. This assistance helps businesses meet ordinary and necessary financial obligations that could have been met had the disaster not occurred. For instance, a retail store experiencing a significant decline in customers following a hurricane could use an EIDL to cover rent and payroll. This loan type bridges the gap during periods of reduced revenue and helps maintain business continuity.

- Home Disaster Loans:

These loans assist homeowners in repairing or replacing disaster-damaged primary residences. Funds can be used to address structural damage, as well as to replace essential personal property. A homeowner whose house suffered roof damage from a tornado could utilize this loan for repairs. These loans are critical for ensuring safe and stable housing following a disaster.

- Mitigation Assistance:

Mitigation assistance can be added to any of the above loan types, allowing borrowers to implement measures that reduce the risk of future disaster-related damage. Examples include elevating structures in flood-prone areas or installing storm shutters in hurricane-prone regions. Investing in mitigation measures contributes to long-term resilience and reduces the likelihood of repeated losses from future disasters.

Careful consideration of the specific needs and circumstances of the affected entity is paramount when selecting a loan type. Choosing the correct loan product ensures access to the appropriate level and type of assistance, facilitating a more efficient and effective recovery process. Understanding the distinctions between these offerings and their respective purposes allows applicants to leverage the full potential of the SBA Disaster Loan Program and rebuild their lives and businesses after a disaster.

3. Interest Rates

Interest rates within the Small Business Administration (SBA) Disaster Loan Program are a critical factor influencing the overall cost of borrowing and the long-term financial impact on borrowers. These rates are determined by statutory limitations and reflect the program’s objective of providing affordable financial assistance to disaster-affected individuals and entities. Understanding the factors influencing these rates and their implications is essential for making informed borrowing decisions.

- Statutory Limits and Caps:

Interest rates for disaster loans are subject to statutory limitations established by Congress. These limitations serve to ensure affordability and protect borrowers from excessive interest burdens during times of vulnerability. The caps may vary based on the applicant type (business, homeowner, etc.) and the size of the loan. Adherence to these legal limits is a cornerstone of the program’s commitment to providing reasonable financing options for disaster recovery.

- Relationship to Market Rates:

While disaster loan interest rates are regulated, they are often influenced by prevailing market interest rates. The SBA considers market conditions when setting rates within the statutory boundaries. However, disaster loan rates are typically lower than commercial loan rates, reflecting the program’s subsidized nature and its focus on supporting recovery efforts. This difference in rates provides a significant financial advantage to borrowers struggling to rebuild after a disaster.

- Fixed vs. Variable Rates:

Disaster loans generally feature fixed interest rates, providing borrowers with predictable monthly payments over the life of the loan. This stability is crucial for budgeting and long-term financial planning, especially during the uncertain recovery period. The fixed-rate structure shields borrowers from potential interest rate fluctuations, offering a degree of financial certainty in a challenging environment.

- Impact on Loan Affordability:

The interest rate directly impacts the overall affordability of the loan. Lower interest rates result in lower monthly payments and a reduced total cost of borrowing. This affordability is paramount for individuals and businesses facing significant financial strain following a disaster. The program’s emphasis on lower interest rates contributes significantly to its effectiveness in facilitating recovery and rebuilding efforts.

Careful consideration of the interest rate, along with other loan terms, is essential for borrowers evaluating the long-term financial implications of a disaster loan. The interplay between statutory limitations, market conditions, and the program’s focus on affordability creates a borrowing environment designed to support recovery and resilience following a disaster. Understanding these dynamics is crucial for making informed decisions and maximizing the benefits of the SBA Disaster Loan Program.

4. Repayment Terms

Repayment terms are a crucial aspect of the Small Business Administration (SBA) Disaster Loan Program, significantly impacting long-term financial recovery for borrowers. Understanding these terms is essential for responsible borrowing and successful rebuilding following a disaster. These terms are designed to provide flexibility and affordability while ensuring the program’s long-term sustainability.

- Loan Maturity:

Loan maturity, or the length of time allotted for full repayment, varies depending on the loan type and the borrower’s capacity to repay. Maturities can extend up to 30 years, offering borrowers manageable monthly payments. A longer maturity reduces the financial burden during the initial recovery phase but may result in higher overall interest costs over the life of the loan. For example, a business with substantial damage might opt for a longer maturity to minimize monthly payments while rebuilding its operations.

- Deferred Payments:

The SBA offers options for deferring initial loan payments, providing borrowers with immediate financial relief after a disaster. Deferment periods can vary depending on the specific circumstances of the disaster and the borrower’s needs. A business severely impacted by a hurricane might request a deferment to allow time to restore operations and generate revenue before commencing loan payments. This flexibility is crucial for enabling recovery and preventing further financial hardship.

- Prepayment Penalties:

The SBA Disaster Loan Program typically does not impose prepayment penalties, allowing borrowers to make additional payments or repay the loan in full at any time without incurring extra charges. This feature offers financial flexibility and allows borrowers to accelerate their recovery by reducing the overall loan cost. A business experiencing rapid post-disaster growth could utilize this option to expedite debt reduction and reinvest profits into further expansion.

- Fixed Interest Rates:

Disaster loans generally feature fixed interest rates, ensuring predictable monthly payments throughout the loan term. This stability is invaluable for budgeting and long-term financial planning during uncertain times. Fixed rates protect borrowers from potential interest rate increases, providing a degree of financial security during the recovery process. This predictability empowers borrowers to focus on rebuilding their lives and businesses without the added concern of fluctuating interest expenses.

Careful evaluation of repayment terms alongside other loan aspects, such as interest rates and loan amounts, is essential for making informed borrowing decisions. The SBA Disaster Loan Program strives to balance affordability and responsible lending practices, providing flexible repayment options that support long-term recovery and community resilience following a disaster. Understanding these terms empowers borrowers to leverage the program effectively and navigate the path to financial recovery with greater confidence and clarity.

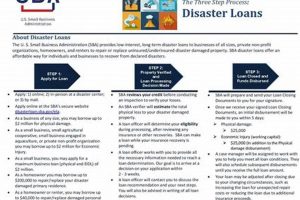

5. Application Process

Navigating the application process for disaster loan assistance requires careful attention to detail and a thorough understanding of the required steps. A well-prepared application significantly increases the likelihood of timely and favorable consideration. This process is designed to ensure equitable distribution of resources while verifying eligibility and assessing the legitimate needs of applicants seeking assistance through the Small Business Administration (SBA) Disaster Loan Program.

- Gathering Required Documentation:

Compilation of necessary documentation is paramount for a complete and accurate application. Required documents may include tax returns, financial statements, proof of property ownership, and documentation of damages or economic injury. For instance, businesses applying for Economic Injury Disaster Loans (EIDL) will need to provide profit and loss statements. Homeowners seeking assistance might need to submit insurance claim information and property appraisals. Adequate documentation substantiates the applicant’s claims and expedites the review process.

- Completing the Application Form:

Accurate and comprehensive completion of the loan application form is crucial. The form requests detailed information regarding the applicant, the nature of the disaster-related damage or economic injury, and the intended use of loan proceeds. Providing clear and concise responses ensures efficient processing and minimizes the need for follow-up inquiries. A business applying for a physical damage loan must accurately describe the extent of damage to its property and equipment. A homeowner needs to specify the repairs required for their primary residence. Accurate completion minimizes processing delays and potential misunderstandings.

- Submitting the Application:

Applications can be submitted online, via mail, or in person at designated disaster recovery centers. Choosing the most appropriate submission method depends on individual circumstances and accessibility. Online submission offers convenience and faster processing times. Mail or in-person submissions may be preferred by those lacking reliable internet access. Selecting the optimal method ensures timely delivery and initiation of the review process.

- Post-Submission Follow-up:

After submission, applicants should monitor the status of their application and respond promptly to any requests for additional information. Maintaining proactive communication with the SBA facilitates efficient processing and prevents unnecessary delays. Applicants should retain copies of all submitted materials and correspondence. Timely responses to inquiries and provision of requested documentation demonstrate diligence and facilitate a smoother application process.

Successful navigation of the application process is essential for accessing disaster loan assistance through the SBA. A well-prepared application, supported by accurate documentation and timely follow-up, maximizes the likelihood of a positive outcome. By understanding and adhering to these procedures, applicants can effectively leverage the program’s resources to rebuild their lives and businesses after a disaster.

6. Required Documentation

Comprehensive and accurate documentation is fundamental to the Small Business Administration (SBA) disaster loan application process. The required documentation serves as verifiable evidence of disaster-related damages, economic injury, and the applicant’s ability to repay the loan. This information enables the SBA to assess eligibility, determine appropriate loan amounts, and ensure responsible allocation of resources. The specific documentation required varies depending on the loan type and the applicant’s individual circumstances. For example, businesses applying for Business Physical Disaster Loans must provide documentation of physical damage to their property, such as photographs, insurance reports, and contractor estimates. Applicants seeking Economic Injury Disaster Loans (EIDL) must submit financial records demonstrating the economic impact of the disaster, including profit and loss statements and tax returns. Homeowners applying for assistance need to provide proof of ownership, insurance information, and documentation of damage to their primary residence.

This required documentation plays several critical roles. It substantiates the applicant’s claims of loss, enabling the SBA to verify the extent and nature of the disaster’s impact. It provides a basis for calculating appropriate loan amounts, ensuring that disbursed funds align with actual needs. Financial documentation allows the SBA to assess the applicant’s creditworthiness and ability to repay the loan, a key factor in loan approval. For instance, a business applying for an EIDL might need to demonstrate a decline in revenue following a hurricane by providing sales records and bank statements. A homeowner seeking assistance to repair flood damage might need to submit a contractor’s estimate for the necessary repairs. The absence of proper documentation can significantly hinder the application process, leading to delays or even denial of assistance.

A thorough understanding of documentation requirements is crucial for successful navigation of the disaster loan application process. Careful preparation and organization of necessary documents streamline the review process and increase the likelihood of timely loan approval. This understanding underscores the importance of meticulous record-keeping, particularly for businesses, as readily available financial records are essential in demonstrating economic injury. Ultimately, comprehensive documentation benefits both the applicant and the SBA by facilitating efficient and equitable distribution of disaster relief funds while ensuring responsible lending practices. The ability to provide verifiable evidence of loss and repayment capacity is paramount for obtaining much-needed financial assistance in the aftermath of a disaster.

7. Use of Funds

Regulations govern the permissible uses of funds obtained through the Small Business Administration (SBA) disaster loan program. Adherence to these stipulations is critical for maintaining compliance and ensuring the funds serve their intended purpose: facilitating recovery from declared disasters. Misuse of funds can lead to severe consequences, including loan default and potential legal repercussions. Permitted uses generally include repairing or replacing damaged real estate, equipment, inventory, and other business assets. Funds can also cover operating expenses during periods of reduced revenue due to a disaster. For instance, a restaurant could use loan proceeds to repair a fire-damaged kitchen or cover employee salaries while rebuilding its customer base. Conversely, using disaster loan funds for purposes unrelated to disaster recovery, such as business expansion or personal expenses, constitutes a violation of loan terms. Understanding these restrictions is crucial for responsible utilization of disaster relief funds.

The SBA meticulously monitors the use of disbursed funds. Borrowers are required to maintain detailed records of all expenditures and provide supporting documentation upon request. This oversight ensures transparency and accountability in the use of taxpayer-funded disaster assistance. Furthermore, the specific permitted uses may vary depending on the type of loan received. Business Physical Disaster Loans are specifically designated for repairing or replacing physical assets, whereas Economic Injury Disaster Loans (EIDL) address working capital needs. A manufacturer might use a Business Physical Disaster Loan to replace damaged machinery, while a retailer could utilize an EIDL to cover rent and utilities during a period of reduced customer traffic following a flood. This distinction ensures that each loan product addresses specific recovery needs effectively. Proper adherence to these guidelines ensures the program’s integrity and maximizes its impact on community recovery.

Compliance with use-of-funds stipulations is essential for both individual borrowers and the overall effectiveness of the disaster loan program. Responsible use of funds enables businesses and homeowners to rebuild and recover, fostering economic resilience within affected communities. Conversely, misuse undermines the program’s integrity and jeopardizes the availability of future assistance. Therefore, understanding and adhering to these regulations is a shared responsibility that benefits both individual recipients and the broader disaster recovery effort. By adhering to the prescribed use of funds, borrowers contribute to the long-term success of the program and demonstrate responsible stewardship of valuable disaster relief resources.

Frequently Asked Questions

This section addresses common inquiries regarding disaster loan assistance, providing concise and informative responses to facilitate understanding and aid in the application process.

Question 1: What types of disasters qualify for assistance?

Qualifying disasters typically include natural disasters such as hurricanes, floods, tornadoes, earthquakes, wildfires, and declared public health emergencies. Specific eligibility criteria may vary depending on the nature and extent of the declared disaster.

Question 2: How does one apply for a disaster loan?

Applications can be submitted online through the dedicated government website, via mail, or in person at designated disaster recovery centers. Guidance and support are available through various channels, including online resources, helplines, and in-person assistance.

Question 3: How long does the application process typically take?

Processing times vary based on application volume and the complexity of individual cases. While some decisions may be rendered within weeks, others may require a more extended timeframe. Applicants are encouraged to monitor application status and respond promptly to any requests for additional information.

Question 4: What are the typical loan terms and interest rates?

Loan terms, including interest rates and repayment periods, vary based on the specific loan product, the applicant’s qualifications, and prevailing statutory limits. Information regarding current interest rates and loan terms can be found on the official program website.

Question 5: What can disaster loan funds be used for?

Loan proceeds can be used for a range of recovery-related expenses, including repairing or replacing damaged property, covering operating expenses during periods of reduced revenue, and implementing mitigation measures to reduce future disaster risks. Specific permitted uses may vary depending on the loan type.

Question 6: What if my application is denied?

Applicants have the right to appeal a denial. Information regarding the appeals process, including required procedures and timelines, is provided in the loan application decision notification. Applicants are encouraged to seek guidance and support throughout the appeals process if needed.

Understanding these key aspects of disaster loan assistance is crucial for successful navigation of the application process and effective utilization of available resources. Diligent preparation and timely follow-up are essential for maximizing the program’s benefits.

Further information and resources regarding eligibility requirements, application procedures, loan terms, and other essential aspects of disaster loan assistance can be found in the subsequent sections of this guide.

Conclusion

Access to capital following a catastrophic event is often the deciding factor between recovery and ruin. The Small Business Administration Disaster Loan Program provides a crucial lifeline to businesses, homeowners, and renters grappling with the devastating impacts of natural disasters and other declared emergencies. This exploration has outlined the program’s core components, including eligibility criteria, loan types, interest rates, repayment terms, application procedures, required documentation, and permitted uses of funds. Understanding these elements is essential for navigating the complexities of post-disaster financial recovery and effectively leveraging the program’s resources.

Rebuilding after a disaster requires resilience, resourcefulness, and access to appropriate financial tools. The Small Business Administration Disaster Loan Program represents a vital component of the nation’s disaster recovery infrastructure, offering critical support to those striving to rebuild their lives and communities. Thorough preparation, informed decision-making, and responsible utilization of these resources are essential for maximizing the program’s impact and fostering a more resilient future in the face of inevitable future challenges.